Lackluster year for biosimilars – marked by regulatory and development delays

While the COVID-19 vaccine itself has created new benchmarks for pace of biotech product development, the pandemic otherwise resulted in major setbacks for clinical trials across the world. Data reported from across countries pointed to clinical trial enrolments recovering the steep 70% drop in April and moderating to about a 30% drop by Q2 and Q3 2020. Invariably, this implied delays in intended product development plans. Regulatory activity was concentrated on COVID-19 related measures and operational challenges of a global pandemic resulted in  regulatory delays further affecting the biopharma industry. Restricted travels slowed down regulatory evaluations, manufacturing site inspections and thereby product approval decisions.

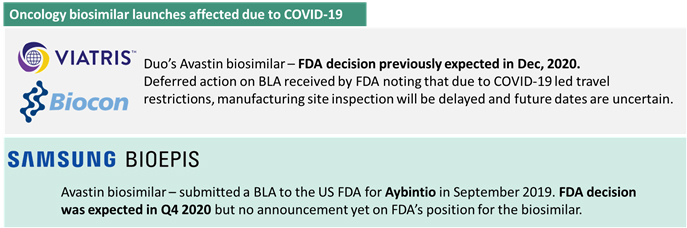

regulatory delays further affecting the biopharma industry. Restricted travels slowed down regulatory evaluations, manufacturing site inspections and thereby product approval decisions.

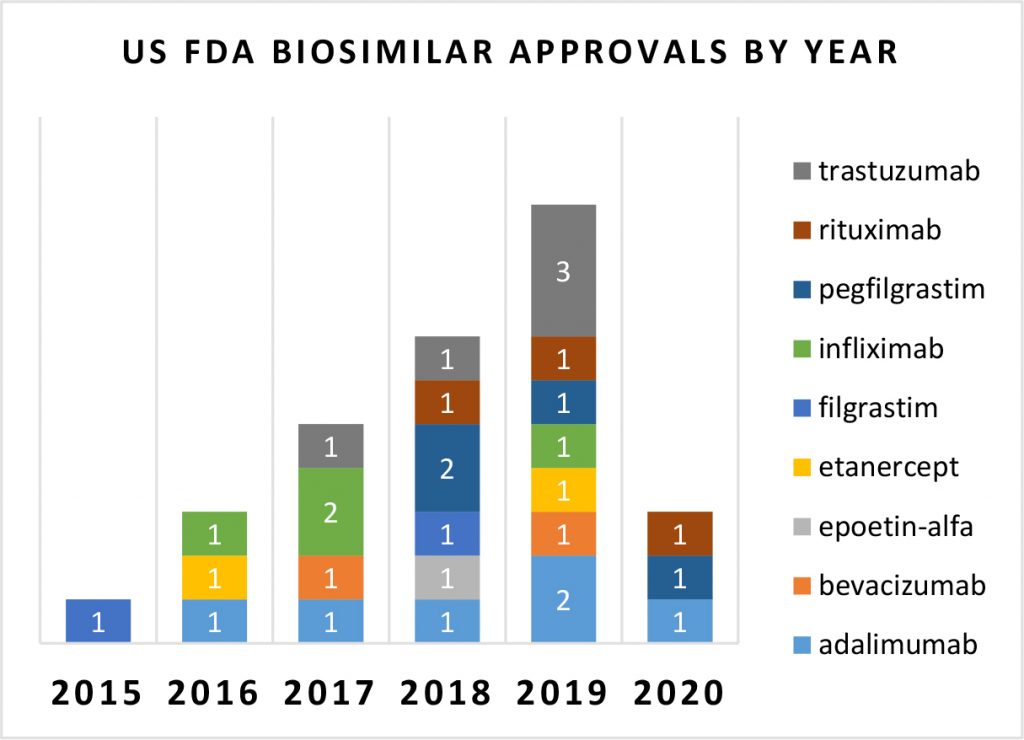

Biosimilars were no exception. The lack luster year was marked by delays, substantially fewer approvals and no major reason for cheer. New biosimilar approvals by the US FDA stooped to a low of 3 approvals during 2020 from the remarkable level of 10 approvals in 2019. The delay was caused by several factors – practical challenges of enrolling and running clinical trials in the new normal of 2020, regulatory actions hindered and some dampening of corporate investment appetite due to an overall focus on cash conservation.

While some bevacizumab biosimilars faced hurdles due to regulatory delays, Centus Biotherapeutics faced a setback due to the lawsuit filed by Genentech alleging patent infringement on the molecule. While the primary patents on the originator reference molecule bevacizumab have expired in 2019, multiple secondary patents active in USA continue to guard the formulation and manufacturing process and platform. The biosimilar is still under review by the FDA and any patent litigation would substantially delay the launch of the biosimilar. We have covered this news in detail in our November Newsletter. Genentech witnessed a sales erosion of approximately USD 900 million in the first nine months of 2020 and two marketed biosimilars currently – Mvasi and Zirabev have acquired a 40% share in the US market. On account of this, Avastin’s parent continues to stall future biosimilar competition and sales erosion through the infamous legal route.

While some bevacizumab biosimilars faced hurdles due to regulatory delays, Centus Biotherapeutics faced a setback due to the lawsuit filed by Genentech alleging patent infringement on the molecule. While the primary patents on the originator reference molecule bevacizumab have expired in 2019, multiple secondary patents active in USA continue to guard the formulation and manufacturing process and platform. The biosimilar is still under review by the FDA and any patent litigation would substantially delay the launch of the biosimilar. We have covered this news in detail in our November Newsletter. Genentech witnessed a sales erosion of approximately USD 900 million in the first nine months of 2020 and two marketed biosimilars currently – Mvasi and Zirabev have acquired a 40% share in the US market. On account of this, Avastin’s parent continues to stall future biosimilar competition and sales erosion through the infamous legal route.

The overall setback in the biosimilars segment is a cause of concern. This could impact anticipated timeline of launches and affordable access to critical biological drugs. We embark on 2021 with hope that catchup efforts will propel the pipeline forward and 2021 will be significant for industry, patients and healthcare systems across the world.

Grow Beyond

Grow Beyond