Key insights: Indian Healthcare Delivery & Diagnostics – Webinar on Impact of COVID-19

On June 16th, we held our Grow Beyond Webinar, “Conversations with the Captains of the Indian Healthcare and Diagnostics Industry”, to discuss impact of COVID-19 on healthcare delivery, rebound expected, how care delivery will evolve and financial/business implications for the segment in its entirety. The panel was moderated by our Healthcare practice lead Pushpa Vijayaraghavan and included a holistic round-up clinical, management and investor perspective:

Dr. Pramod Gaddam: CEO of Fernandez Foundation that is nationally recognized for setting benchmarks in compassion led Ob/Gyn care. Dr Pramod has led introduction of kangaroo medical care, the breast milk banking operations and more recently establishment of the Fernandez Child Development Centre, which cares for children with special needs.

Dr. Gurava Reddy: Founder, Chairman & Managing Director of Sunshine Group of Hospitals, 350+ beds tertiary care multi-specialty hospital with PE investment. Has led Sunshine to be recognized as second largest joint replacement center in South & South East Asia with 4,000+ procedures each year. Active faculty member at Royal College of Surgeons, Edinburgh, UK.

Sunil Thakur: Managing Director at Quadria Capital, Asia’s leading healthcare PE fund with AUM of US$ 1.6Bn. Quadria’s investments have included AIG & KIMS in Hyderabad, HCG in Bangalore & Medica in Kolkata.

Sanjeev Vashishta: Co-promoter of PathKind Diagnostics Pvt Limited, a Company funded by the promoters of Mankind Pharma. Before starting PathKind in January 2017, Mr. Vashishta spearheaded SRL Diagnostics as the CEO. With 340 Labs and 7400 Collection Points, SRL became the Largest Diagnostics Company in India in terms of revenue, number of tests and network.

We present here summary of key insights from the webinar:

Continued delivery of clinical services during times of COVID

Leading healthcare providers in India have been quick to adapt to the new normal presented by COVID-19. Both hosptials represented on the panel, Fernandez Hospital and Sunshine Hospital have set up formal SOPs for the hospital staff and the patients to reduce the risk of contagion and enhance measures for infection control. Key measures followed by most hospitals was to switch to lean staffing, adopt tele-consultation, discontinue or limit the out-patient department at their hospitals and work from home for employees or departments wherever feasible.

In the current ‘Unlock 1.0’ phase, hospitals have gradually begun to resume out-patient (OP) services, taking prudent measures to limit in-person consultation as much as possible with proper guidelines in place for the patients to follow social distancing. For example, multi-specialty Sunshine Hospital introduced a blanket restriction on the number of OPs run per day and requires prior appointment before seeking the doctor to reduce the patient load and wait time at the hospital. Fernandes Hospital, a leading obstetrics care provider, has introduced a system of conducting an online consultation first before having an in-person consultation with the doctor. In addition to this, they have reduced the number of times a pregnant woman visits to the hospital in person, switching to an optimized combination of tele-consultation and in-person care for the same.

On the diagnostics front, there was an active effort from the private sector to support capacity expansion in the country. The panellists applauded the efforts of the National Accreditation Board for Testing and Calibration Laboratories (NABL) for their speedy accreditation of diagnostic laboratories through digital means. Although initial deployment of COVID-19 diagnostics was challenging, the diagnostic labs have rapidly ramped up supply and are now conducting up to 150,000 tests a day.

Impact on caseloads and rebound expected

Hospitals and diagnostic service providers faced the brunt of COVID-19 alike. Major hospitals observed a decline in trauma and chronic care with patients delaying seeking medical intervention during the lockdown. Both single and multispecialty hospitals now have a backlog of medical procedures that they expect to clear gradually.

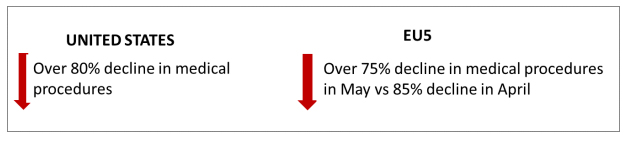

An IQVIA survey of over 1000 physicians from USA and EU5 (UK, Spain, Italy, Germany and France) revealed the following statistics on medical procedures:

Illustratively, a procedure like robotic hysterectomy saw a decline of over 80% in April in both USA and EU5, in May the number picked up in EU5 and was around 79% of the pre-COVID numbers. The experience of Indian multispecialty hospitals mirrors this global trend.

With a renewed clinical delivery paradigm that includes more integrated use of virtual and tele-consultations, the country is gradually settling with the ‘COVID-19 way of life’. Experts on the panel admitted that elective care cannot be deferred for too long and that could have unintended clinical consequences. With comfort provided by hospitals on nature of infection control measures, patients are gradually showing willingnes to undergo surgical procedures that had been delayed. Hospitals have begun to clear the backlogs in interventions and are following up with patients upfront who had been waiting to get these procedures. However, hospitals expect that backlogs

would take time to be cleared due to capacity constraints. Physicians from USA and EU expect the backlog to be cleared in 6 to 8 months. While intensity of backlog is comparable in India, time taken to address backlog will depend on volumes at which hospitals are able to operate and continued impact of COVID spread on a regional level. It is highly encouraging to note that for certain elective procedures, hospitals have begun to see a rebound rate of 70% of pre-COVID-19 levels in May.

| UNITED STATES | EU5 |

| 8.4 months to reach pre-COVID procedure rates 5.6 months to clear backlog of procedures | 9 months to pre-COVID procedure rates 8 months to perform backlog procedures |

Volume decline in diagnostic labs has already also reflected the same trend, especially in the number of routine tests, which make about 70% of their revenue streams. COVID-19 testing has helped partially offset impact on revenues, but profitability remains subdued given the thin margins on the public health oriented COVID testing exercise and high cost structure per test delivered.

Digitization and Transformational trends

Despite the challenges presented by this unprecedented global pandemic, COVID-19 could be the unanticipated driver of transformational change. Hospitals that had traditionally shied away from adopting digital tech, have now rapidly deployed it as part of their routine patient management. Fernandes Hospital has made tele-consultation mandatory before an in-person consultation, the management undertook upskilling of the staff engaged in tele-consultation to drive a smooth transition and experience for both the staff and the patients. Sunshine Hospital had adopted tele-consultation platform M-fine prior to COVID-19 and under the current circumstance, was expanded its use in its daily services. Unanimous opinions of the panellists confirms that one of the most notable impacts of care delivery under the current constraints has been acceleration of digitization and automation. While done due to compulsion, this trend is likely to drive behavioural change and practice changes that are expected to be an integral part of care delivery in the future. Consequently, there is high VC investor appetite for health-tech and digitization solutions for Indian healthcare delivery and an upbeat outlook for ventures in this segment.

Behavioral change driven by COVID-19 is expected to extend beyond adoption of digital platforms in healthcare. Patients have now realized the importance of health and immunity. This awareness could lead to greater focus on diagnostic testing. The population has now become familiar with molecular diagnostics and RT-PCR testing; and greater receptiveness is thus anticipated for more sensitive molecular tests in other disease areas as well.

Finally, another mid to long term benefit from the current crisis could be structural re-engineering of cost structures in hospitals. A relatively lower EBITDA operations (normally between 10% to 15%), hospitals have hitherto paid negligible focus to optimizing operations. The current cash flow stress could result in a demand driven focus on operations optimization and elimination of inefficiencies much needed for improving overall financial health and sustainable cost structure of these healthcare delivery institutions.

Overall, while caseloads in April and May have reflected crisis similar to global landscape and the cashflow stress continues, the perspectives on rebound, operational efficiencies and digitization shine hope in a sector that has finally gained the prominence it deserves from all stakeholders.

Grow Beyond

Grow Beyond