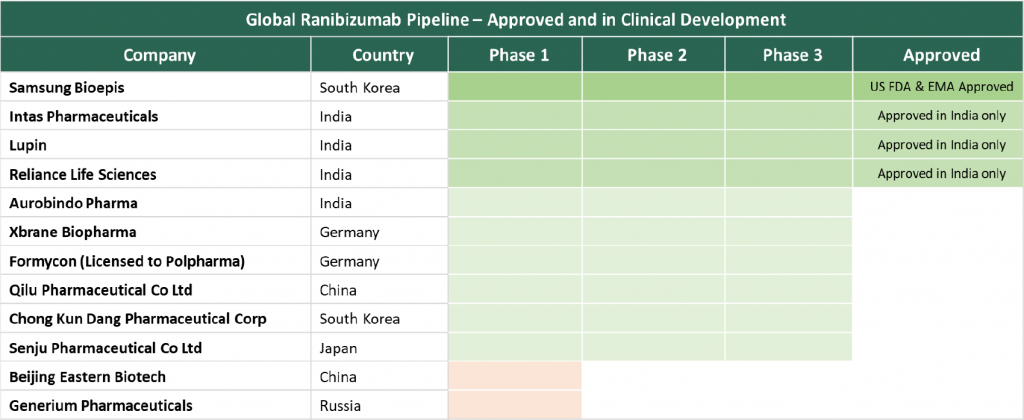

After a brief lull in the biosimilars space with respect to approvals and launch of new biosimilars, the third wave of biosimilars is now making a buzz with emerging market players taking the lead in development, regulatory filings/ approvals and launch. The first wave biosimilar products were mostly versions of cytokines, growth factors and hormones already off patent, for example filgrastim and epoetin alfa; the second wave biosimilars were mainly monoclonal antibodies (MAbs) that come off patent before 2020 – trastuzumab, rituximab, bevacizumab et al and now post-2021 biosimilar pipeline is the third wave comprising of more complex MAbs that are set to lose exclusivity and patent protection over the next few years – ranibizumab, denosumab et al. Large biopharma companies such as Sandoz, Pfizer, Amgen took emerged forerunners in the development and launch of the first and second wave of biosimilars, especially in regulated markets. However, more players from emerging markets such as South Korea, China, Taiwan and India have taken a lead in development of the next wave of biosimilars whose markets open post-2021. This has largely been catalyzed by technological sophistication supporting development of high-quality biosimilars, evolution of biosimilar regulations in these countries to be more aligned with the norms of regulated markets US and EU, and overall regulatory comfort on biosimilars originating from emerging markets.

Samsung Bioepis is one such company that has been able to nurture a rich pipeline of biosimilars and put emerging market players on the world map of biosimilar developers next to traditional biopharma stalwarts. It became the first company to get US FDA and EMA approval for a ranibizumab biosimilar referencing Lucentis®. Branded Byooviz, it is also the first biosimilar to be approved for ophthalmology indications – neovascular (wet) age-related macular degeneration (AMD), macular edema, retinal vein occlusion, and myopic choroidal neovascularization. Based on the existing agreement between the innovator Genentech and Samsung Bioepis, the drug will not be launched in the market before June 2022. Lucentis® is one of the blockbuster drugs in the ophthalmology segment and in 2020 clocked in $1.93 billion in global sales. Although bevacizumab is also used for certain ophthalmology indications, the use was off-label and regulatory approval for the same has not been obtained. With the availability of an approved ranibizumab biosimilar that can result in price rationalization, off-label use of bevacizumab could progressively reduce. More on the update and other ranibizumab biosimilar candidates can be found here in our PharmForward post.

Other than South Korean players Samsung Bioepis and Celltrion, China-based biosimilar makers also made news in 2020 and 2021 with their launches in the regulated markets. Henlius received the EMA approval for trastuzumab biosimilar in August 2020 and marked the foray of Chinese biosimilar companies in the regulated market. Indian pharmaceutical industry is recognized globally for its strong foot-hold in the generics and vaccines business and now Indian biopharma players have been actively participating and making news in the regulated market. Biocon and Mylan co-developed biosimilar insulin glargine became the first interchangeable biosimilar in the US and marked a significant milestone in improving patient affordability and access to low-cost insulin biosimilar alternatives. Indian manufacturers have also taken a lead in the development of the next wave of biosimilars such as ranibizumab, Intas, Lupin and Reliance Life Sciences have an approved biosimilar in India and Aurobindo Pharma’s candidate is in phase 3 development, overall the Indian biosimilar players are ripe with momentum to participate in the next global wave.

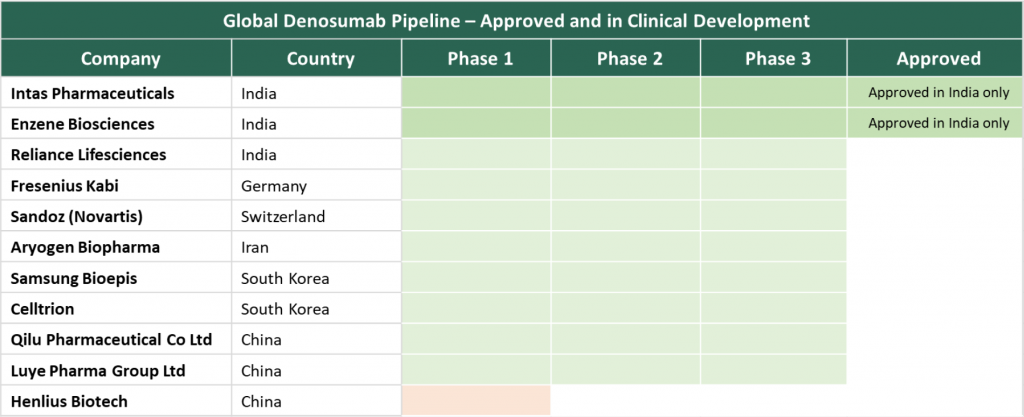

India one of the first to have approved Denosumab biosimilars: India is one of the first countries globally to have approved denosumab biosimilars – Intas and Enzene Biosciences now hold the approval for denosumab biosimilars in India and are possibly the only approved biosimilars globally for denosumab. A relatively younger venture, Enzene Biosciences, a subsidiary of India-based Alkem Laboratories has been growing its biosimilar pipeline at a quick pace – February 2021, it received the Drugs Controller General of India (DCGI) approval for its first biosimilar, teriparatide and DCGI approval for its romiplostim and denosumab biosimilars followed soon after in August 2021. Enzene has articulated aspirations to launch the denosumab biosimilar in EU and US markets. In June 2021, Enzene entered into a license agreement with London-based Theramex for registration and commercialization of the biosimilar in Europe, the UK, Switzerland, and Australia. Theramex has a specialty portfolio targeting women’s health segment such as contraception, fertility, Menopause and Osteoporosis and carries synergy with one of the target indications of denosumab in prevention of osteoporosis in post-menopausal women. Enzene is also aiming to commercialize the biosimilar in the US market through Alkem’s US subsidiary Ascend Laboratories LLC.

Global sales for Prolia® were $749 in 2020 and most other denosumab biosimilar candidates are in late-stage clinical development and have originated from players based out of Asia.

We remain optimistic about the growing participation of emerging market players in the global biosimilars arena and anticipate more strategic partnerships for biosimilar commercialization in different geographies. Price rationalization threshold achieved through biosimilars is not currently comparable to erstwhile benchmarks established by small-molecule generic substitutes. However, the expanding footprint of emerging market manufacturers from India, South Korea and China carry the promise of expanding level of price rationalization and potentially market expansion for biological drugs in both regulated and non-regulated RoW markets. Companies having an early lead on development and launch are more likely to reap higher returns on their pipeline investments and timing will continue to remain of essence in the biosimilars industry as price erosion with each subsequent launched biosimilar becomes steeper and market share becomes smaller.

We remain optimistic about the growing participation of emerging market players in the global biosimilars arena and anticipate more strategic partnerships for biosimilar commercialization in different geographies. Price rationalization threshold achieved through biosimilars is not currently comparable to erstwhile benchmarks established by small-molecule generic substitutes. However, the expanding footprint of emerging market manufacturers from India, South Korea and China carry the promise of expanding level of price rationalization and potentially market expansion for biological drugs in both regulated and non-regulated RoW markets. Companies having an early lead on development and launch are more likely to reap higher returns on their pipeline investments and timing will continue to remain of essence in the biosimilars industry as price erosion with each subsequent launched biosimilar becomes steeper and market share becomes smaller.

In our 2020 deep-dive, we covered the robust deal making that happened in 2020 across segments – immunotherapy, cell and gene therapy. The dominant theme that emerged was that while in monoclonal antibody therapeutics late-stage asset-focused licensing or strategic partnerships were preferred, in the cell and gene therapy space, early-stage partnerships were more commonplace. A number of research collaborations unfolded in late-August and September that build on the trend of big-pharma tapping into early-stage pipeline of young biotechs.

Allogenic cell therapies rule recent collaborations: Reflecting expanding interest in off-the-shelf allogenic cell therapies, a number of early-stage research collaborations took shape last month. Currently approved and commercially available cell therapy products are all autologous and carry operational limitations with respect to logistical bottlenecks, lengthy turn-around time, complex and high-cost of manufacturing. Allogenic cell therapies can address some of these logistical and supply chain bottlenecks and hence also promise scalability and a relatively lower manufacturing cost. The next phase of innovation in cell therapies is riding on the development of allogenic cell therapies and a number of candidates have already entered the clinic.

Allogenic cell therapies rule recent collaborations: Reflecting expanding interest in off-the-shelf allogenic cell therapies, a number of early-stage research collaborations took shape last month. Currently approved and commercially available cell therapy products are all autologous and carry operational limitations with respect to logistical bottlenecks, lengthy turn-around time, complex and high-cost of manufacturing. Allogenic cell therapies can address some of these logistical and supply chain bottlenecks and hence also promise scalability and a relatively lower manufacturing cost. The next phase of innovation in cell therapies is riding on the development of allogenic cell therapies and a number of candidates have already entered the clinic.

In August 2021, Kite Pharmaceuticals, a subsidiary of Gilead, announced collaboration with Appia Bio to research and develop chimeric antigen receptor (CAR)-engineered natural killer T (CAR-iNKT) cells using Appia Bio’s ACUA (Appia Cells Utilized for Allogenic) technology platform for allogeneic cell therapy. Appia Bio, founded in 2020, is an early-stage company that leverages its ACUA Technology platform to generate CAR-iNKT cells from allogenic donor-derived hematopoetic stem cells (HSCs). The platform enables streamlined manufacturing and scalability of manufacturing off-the-shelf CAR-iNKT cell therapies. Under the terms of the agreement, Appia Bio will be responsible for preclinical and early clinical research of two HSC-derived CAR-iNKT cell therapy product candidates whose targets will be provided by Kite. Kite will be responsible for the development, manufacturing, and commercialization of the product candidates identified through the collaboration. Appia Bio is eligible to receive an upfront payment, an equity investment, and additional milestone payments for a total value of up to $875 million as well as tiered royalties. Gilead’s portfolio already includes approved autologous CAR-T cell therapies and allogenic cell therapy is a synergistic extension with next-generation off-the-shelf therapies.

In September 2021, Adaptimmune Therapeutics entered into a strategic collaboration and license agreement with Genentech (Roche Group) to develop and commercialize allogenic cell therapies targeting up to 5 oncology indications. The partnership aims to harness the scientific expertise of both the companies by combining Adaptimmune’s allogenic cell therapy manufacturing platform with Genetech’s expertise in developing personalized cell therapies. Adaptimmune will develop T-cells using its induced pluripotent stem cell (iPSC) allogenic platform and Genetech will be responsible for providing the input T-cell receptors. A second part of the agreement also covers development of personalized T-cell therapy wherein Adaptimmune will generate the T-cells using T-cell receptors isolated from patients. Genetech will undertake the subsequent clinical development and commercialization. Adaptimmune will receive an upfront payment of $150 million and additional payments of $150 million over five years, and may also receive additional research, development, regulatory and commercial milestones payments potentially exceeding $3 billion in aggregate value.

Beyond oncology, Vertex Pharmaceuticals and Arbor Biotechnologies entered into a research and development collaboration for ex vivo CRISPR – engineered cell therapies to generate allogenic differentiated, insulin-producing hypoimmune islet cells for the treatment of type 1 diabetes, for treatment of sickle cell disease, beta thalassemia, and other undisclosed diseases. The two have partnered to develop therapies for up to seven potential programs and Arbor will receive an undisclosed upfront cash payment and up to $1.2 billion in potential milestone payments linked to research, development, regulatory and commercial milestones. Vertex started with small-molecule gene-targeting therapeutics and has established itself as one of the market leaders in the treatment of cystic fibrosis by targeting genetic mutations responsible for the disease. It is now building up its capabilities in cell and gene therapy through multiple acquisitions (Exonics Therapeutics & Semma Therapeutics) and research collaborations such as the recent one with Arbor.

Platform technology partnerships enabling drug development: Platform technologies enabling drug development for targeted clinical indications have rapidly gained traction and emerged as an important enabler of novel drug development for the big pharma. Preferred partnership structure revolves around exclusivity for specific target indications and upfront, milestone payments and royalties on the commercialized products. Platform technology companies have supported the externalization of research for the big pharma wherein both partners leverage their core competencies to develop and commercialize the drug.

Takeda announced a global collaboration and license agreement with Genevant Sciences to develop and commercialize novel non-viral gene therapies targeting two undisclosed rare liver diseases. This collaboration follows soon after an earlier 2021 agreement to develop nucleic acid therapeutics treat liver fibrosis. Under the agreement, Takeda has exclusive rights to use the platform for two liver disease targets and Genevant is eligible to receive up to $303 million in upfront and potential milestone payments, plus royalties on future product sales. Genevant is one of the global pioneers in lipid nanoparticle (LNP) based gene delivery technology. The platform is well-validated through various partner clinical programs and offers great degree of versatility in nucleic acid payload and pharmacological properties.

Eli Lilly and ProQR Therapeutics announced a global licensing and research collaboration agreement to develop editing oligonucleotides directed to up to five targets using ProQR’s proprietary Axiomer® RNA editing platform. The platform enables the editing of specific single nucleotides in mRNA to reverse or edit mutations associated with certain diseases by inducing the editing of adenosine to inosine on RNA at specific sites. Inosine is later translated into guanosine to correct specific point mutations. Eli Lilly is the first partner for ProQR’s Axiomer® platform and serves as a strong validation for the potential of the platform. ProQR also has a novel pipeline targeting retinal diseases through RNA therapy, however, those do not utilize the Axiomer® platform and instead are based on antisense oligonucleotides delivered intra-vitreally into the eye. Under the terms of the agreement, ProQR will an upfront payment of $20 million, as well as an equity investment in its ordinary shares of $30 million. It is also eligible to receive up to approximately $1.25 billion for development, regulatory and commercialization milestones, as well as tiered royalties of up to mid-single digit percentage on product sales.

Eli Lilly and ProQR Therapeutics announced a global licensing and research collaboration agreement to develop editing oligonucleotides directed to up to five targets using ProQR’s proprietary Axiomer® RNA editing platform. The platform enables the editing of specific single nucleotides in mRNA to reverse or edit mutations associated with certain diseases by inducing the editing of adenosine to inosine on RNA at specific sites. Inosine is later translated into guanosine to correct specific point mutations. Eli Lilly is the first partner for ProQR’s Axiomer® platform and serves as a strong validation for the potential of the platform. ProQR also has a novel pipeline targeting retinal diseases through RNA therapy, however, those do not utilize the Axiomer® platform and instead are based on antisense oligonucleotides delivered intra-vitreally into the eye. Under the terms of the agreement, ProQR will an upfront payment of $20 million, as well as an equity investment in its ordinary shares of $30 million. It is also eligible to receive up to approximately $1.25 billion for development, regulatory and commercialization milestones, as well as tiered royalties of up to mid-single digit percentage on product sales.

Shape Therapeutics announced a multi-target strategic collaboration and license agreement with Roche for the development of gene therapy for certain targets in the areas of Alzheimer’s disease, Parkinson’s disease, and rare diseases. Shape will utilize its proprietary RNA editing platform RNAfix™ and potentially leverage its AAVid™ technology platform for generation of tissue-specific adeno-associated viruses (AAVs) to deliver RNA payload. The platform utilizes a mechanism that is similar to ProQR’s Axiomer® technology: point corrections of adenosine to guanosine. The partnership is one of the firsts for Shape Therapeutics as it continues to expand its RNA editing technology platforms. As part of the deal, Shape Therapeutics will be responsible for preclinical research and Roche will undertake the clinical development and commercialization. Under the terms of the agreement, Shape Therapeutics is eligible to receive up to $3 billion in aggregate value through upfront payment, development, regulatory and sales milestone payments.

The trend of medical devices company forging acquisition deals continued into September. Thematically, diagnostics stands out as a segment with high traction with companies forging deals to enter and expand capabilities in molecular diagnostics segment. At the other end, real time surgical visualization continues to attract attention of both financial and strategic investors and the high deal values reflect optimism on expanding scope in the product category.

Molecular Diagnostics: Molecular diagnostics segment rides high on the recent boost from COVID-19 led commercial momentum and awareness. Corporate investment interest is at its peak and PCR based tests are in focus given the fillip from COVID led demand. There has been high level of appetite for both acquisitions and strategic partnerships. Notable transactions include:

Molecular Diagnostics: Molecular diagnostics segment rides high on the recent boost from COVID-19 led commercial momentum and awareness. Corporate investment interest is at its peak and PCR based tests are in focus given the fillip from COVID led demand. There has been high level of appetite for both acquisitions and strategic partnerships. Notable transactions include:

Roche penned a deal to acquire its partner of two decades, TIB Molbiol Group, for undisclosed amount to gain ultra-rapid assay development capability for infectious diseases. The transaction emphasizes the COVID triggered interest in molecular testing at large and PCR-based diagnostics specifically. The current deal is a step towards expanding Roche’s portfolio of CE-IVD assays and adding research use assay on LightCycler PCR instruments. TIB Molbiol Group has developed an extensive portfolio of infectious diseases CE-IVD assays, including SARS-CoV-2 variants. Roche will be leaning on the acquisition to expand its infectious diseases offerings with 45 additional assays. The transaction builds on a history of partnership between both the companies covering several products including SARS, anthrax, avian influenza, MERS, novel influenza H1N1 swine, Ebola virus, Zika virus and SARS-CoV-2 virus variants.

Mesa Laboratories Inc. acquired Agena Bioscience Inc. for $300 million. Mesa, a manufacturer of quality care solutions for pharmaceutical, healthcare and medical devices industry will be entering molecular diagnostic segment by acquiring Agena. The transaction is expected to add to Mesa Labs’s revenue by $63 to 67 million in 12 months, excluding COVID-19 related impact. Agena Bioscience has developed MassArray, a platform for clinical genomics, which can be integrated with mass spectroscopy and multiplex PCR. MassArray platform assists in pharmacogenetics, liquid biopsy, tumor profiling, SARS-CoV-2, hereditary genetics and blood typing.

Real time monitoring and surgical visualization: With expanding global pipeline of innovations and increasing level of clinical adoption, this product category has also been very deal active. In the month of September, Stryker acquired Gauss Surgical, developer of Triton, artificial intelligence based platform for monitoring blood loss during surgery. The device has demonstrated clinical value in maternal and surgical care by identifying early signs of hemorrhage for timely intervention. Ultrasound based real time visualization for surgical applications has also gained traction due to progressively expanding evidence of clinical benefit and commercial merit. GE Healthcare’s acquisition of BK Medical, a surgical visualization company funded by Altaris Capital Partners, for $1.45 billion emphatically demonstrates segment potential. BK Medical is an innovator of intraoperative imaging and surgical navigation solutions used in clinics during minimally invasive and robotic surgeries. BK Medical’s solution enables use of ultrasound for real time visualization of deep tissues during neuro and abdominal surgery. The solution offers additional segment competitiveness for GE, a company that already enjoys a significant market share in ultrasound systems. Acquisition interest from medtech majors and deal valuation trends signal expanding market opportunity and business potential for such real time images solutions for intraoperative use.

Other high value medtech transactions: In addition to the two lager themes of molecular diagnostics and real imaging solutions for intraoperative applications, the following larger transactions added to the med-tech M&A momentum in September:

Baxter acquired Hillrom for a total value of $10.5 billion: The deal is driven by commercial opportunity perceived for Hillrom’s innovative portfolio of connected care solutions. Baxter portfolio includes products catering to renal care, medication delivery, pharmaceuticals, clinical nutrition, advanced surgery, acute therapies, biopharma solutions etc. When combined with Hillrom’s connected care solutions, the combined portfolio can potentially cater to patients at hospitals, at home and in other sites of care. The acquisition is a strategic step to engage across the continuum of care including settings outside the hospital, a trend that has accelerated due to COVID-19 pandemic.

Zoll Medical acquired Itamar Medical in a $538 million deal. Itamar is a developer of non-invasive devices for diagnosis of respiratory sleep disorders. The company has developed FDA approved WatchPAT, home sleep apnea device for diagnosis of sleep for patients and healthcare professionals at home settings. The device is worn around the wrist and fingers, measuring movement, snoring, heart rate and blood oxygen levels while the patient sleeps.

Boston Scientific continued the deal spree, acquires Devoro Medical for $269 million. Devovo has developed the WOLF Thrombectomy platform capable of breaking down blood clots. Boston Scientific has been an investor in the company since 2019, holding 16% stake that has expanded to complete ownership with the current transaction.

Grow Beyond

Grow Beyond