The global barrage of COVID-19 cases continues unabated. As on today, the 30th of September 2020, global death toll has breached 1 million and number of cases is nearing 34 million. While the US tops the table on recorded cases (7.2 million cases and about 200,000 deaths), three of the BRIC countries, India, Brazil and Russia, follow closely at the heel.

The pandemic has been a global equalizer with both high income and LMIC (low and middle income countries) countries caught at the midst of the storm. The COVID-19 vaccines is most promising solace for both public health and economic health. Per GAVI estimates, the pandemic is costing the global economy US$ 375 billion every month. Sustained immunity is important to turn the tide on incidence and equally importantly, empower countries to trigger economic activity with renewed momentum.

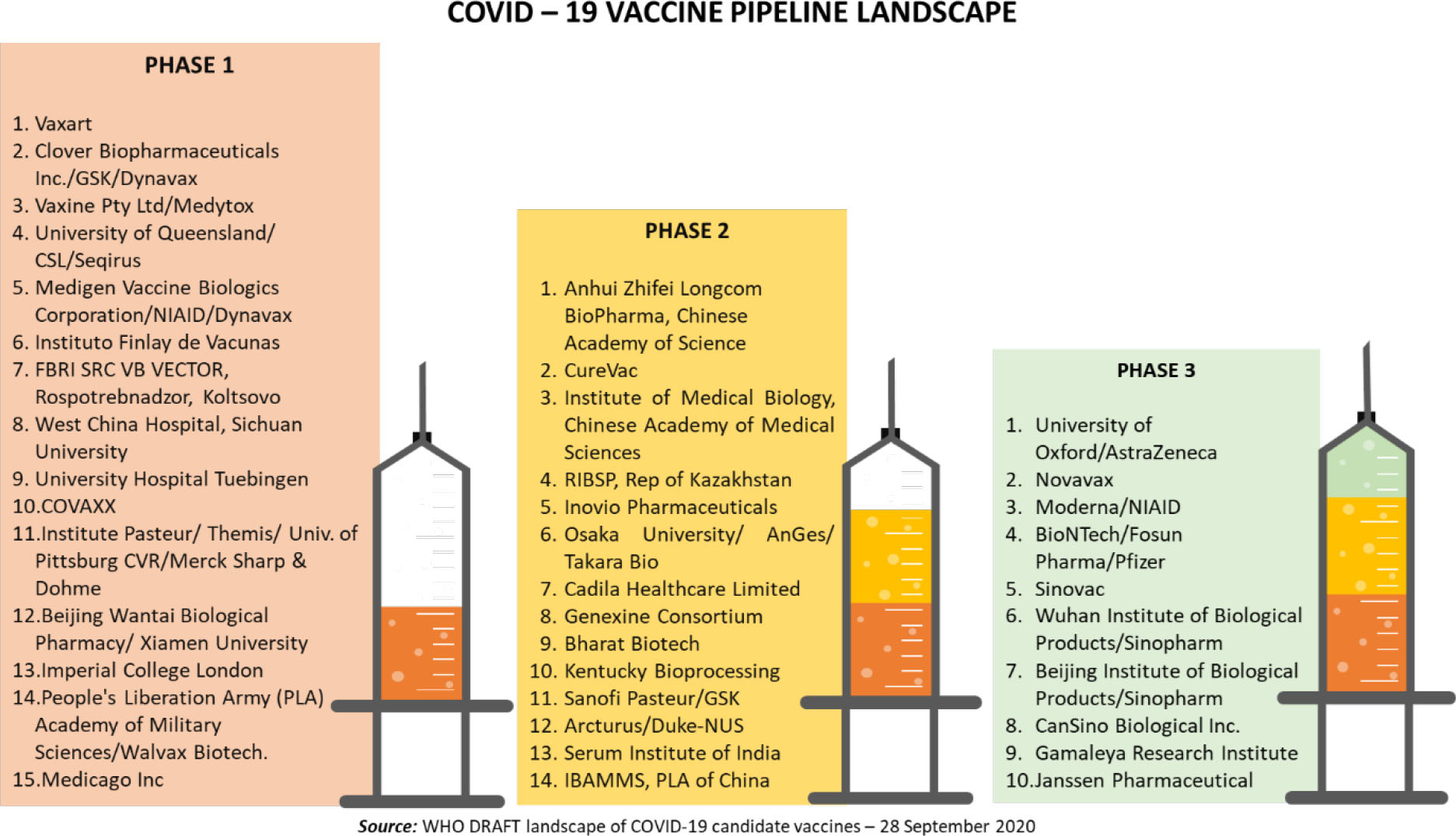

Development of the COVID-19 vaccine has advanced at unprecedented pace, and high level of global collaborative momentum. Normal vaccine development timelines of 8 to 10 years are being shrunk to 18 to 24 months. With commitment from all stakeholders, industry, research institutions, Government and philanthropic funders and regulators, globally, we have a formidable pipeline of over 190 vaccine candidates across different phases of development, including the pre-clinical stage. Per the WHO COVID19 vaccine tracker, this includes 151 candidates in pre-clinical stage, 15 in Phase I, 14 in Phase II and 10 in Phase III studies as illustrated below.

In the current roundup of global developments on the COVID-19 vaccine, we have discussed the exciting momentum created by several vaccine candidates advancing through milestones of clinical validation, continued frenzy in country specific procurement deals and the harbinger of hope for global equitable access, the WHO-GAVI-CEPI led COVAC facility.

As on date, there are 10 vaccines globally that are in the midst of the penultimate milestone, the Phase III trials. Vaccine candidates span range of platform technologies – inactivated protein /subunit vaccines, DNA and mRNA vaccines. This breadth provides comfort on technology de-risking, critical given the reality of historical success rates in experimental vaccines – 7% for pre-clinical stage candidates and 20% for clinical stage assets (source: GAVI estimates).

A. Inactivated vaccines:- Sinovac vaccine, Wuhan Institute of Biological Products/Sinopharm vaccine and Beijing Institute of Biological Products/Sinopharm vaccine: Three inactivated vaccines developed by Chinese companies/ institutes have now advanced to Phase III in China as well as several international locations. The candidate with widest footprint of international validation is the Sinovac vaccine. Armed with strong partnerships, Sinovac has expanded validation sites beyond China to include Brazil, Indonesia, Turkey and Philippines. With about 8,800 individuals expected to be enrolled in Brazil alone, the overall global enrolment will be north of 14,500 individuals. The clinical trials in Brazil are being pursued in partnership with the Butantan Institute that has extensive experience in large scale vaccine validation. Results from Phase I/II trial on 421 healthy volunteers aged 18 to 59 years showed positive results with medium dose indicating 98% seroconversion rate in elderly volunteers and 97.4% in healthy adults. The medium dose vaccine candidate has entered Phase III trial. Wuhan Institute of Biological Products/Sinopharm vaccine has expanded Phase III trials to Abu Dhabi, UAE, Bahrain and Jordan. Beijing Institute of Biological Products/Sinopharm vaccine has expanded Phase III trials to Argentina and Dubai. No efficacy data or Phase II outcome has been published for both these candidates.

- Oxford University/Astra Zeneca vaccine: Funded by US Biomedical Advanced Research and Development Authority (BARDA) and the National Institute of Allergy and Infectious Diseases (NIAID). Phase III trials are currently being conducted across various centres in US, recruiting up to 50,000 adults aged 18 years and above, including those living with HIV. Apart from these trial centres also include sites in UK, Peru, Brazil, India, Japan, Russia, South Africa and Chile.

- Cansino Biological Inc. / Beijing Institute of Biotechnology: In addition to China, Cansino is conducting Phase III trials across various sites in Pakistan, Russian Federation (in partnership with Petrovax) and Saudi Arabia. Over 40,000 subjects are estimated in the enrolment for trial in Pakistan and around 500 in Russia. The Phase II trial results shared by company demonstrated seroconversion rate of 97% on day 28, post vaccination, in 508 eligible candidates.

- Gamaleya Research Institute: While having the distinction of being granted Emergency Use Authorization in Russia, Gamaleya’s candidate is currently undergoing Phase III trials with over enrolment size of over 40,000. Currently the trials are conducted in Moscow, in collaboration with the Government of Moscow City and across various centres in Belarus. The vaccine consists of two components, administered 21 days apart: Component 1 consists of a recombinant adenovirus vector based on the human adenovirus type 26, containing the SARS-CoV-2 S protein gene. Component 2 consists of a vector based on the human adenovirus type 5, containing the SARS-CoV-2 S protein gene.

- Janssen Pharmaceutical Companies: Janssen’s vaccine candidate will enrol over 60,000 subjects of age 18 years and above, to be tested for its efficacy and safety across 291 sites in US, Argentina, Brazil, Chile, Colombia, Mexico, Peru, Philippines, South Africa and Ukraine.

- Novavax vaccine: is a stable, full length perfusion recombinant SARS-COV2 glycoprotein nanoparticle vaccine with Matrix M adjuvant. Phase III trial has been commenced in UK with target enrolment of about 10,000 healthy individuals in UK aged 18 to 64 years. It is a placebo-controlled study to evaluate the efficacy, safety of the vaccine wherein half the participants will receive two intramuscular injections of vaccine comprising 5 µg of protein antigen with 50 µg Matrix‑M adjuvant, administered 21 days apart, while half of the trial participants will receive placebo. The US trials are expected to follow soon.

- Moderna/NIAID: 2 dose vaccine and the Phase III trial is a stratified placebo controlled study designed to evaluate the efficacy, safety and immunogenicity for up to 2 years after the second dose of vaccine. With an estimated sample size of 30,000 healthy participants, aged 18 years and above, the trial will be conducted across several sites in US.

- BioNTech/Fosun Pharma/Pfizer vaccine: Phase III commenced with target enrolment of ~44,400 individuals for the 2 dose vaccine with triple blinded, placebo controlled, dose finding, efficacy study to be tested in patients aged 16 and above (stratified as ≤55 or >55 years of age). The trial is being conducted across 166 study sites in US, Argentina, Brazil, South Africa and Turkey.

| VACCINE DEVELOPER | PLATFROM TECHNOLOGY & TRIAL DETAILS |

| Sinovac | Inactivated vaccine Trial No: NCT04456595 669/UN6.KEP/EC/2020 |

| Wuhan Institute of Biological Products/Sinopharm | Inactivated vaccine Trial No: ChiCTR2000034780 |

| Beijing Institute of Biological Products/Sinopharm | Inactivated vaccine Trial No: NCT04560881 |

| University of Oxford/AstraZeneca | Non-Replicating Viral Vector Trial No: ISRCTN89951424 NCT04540393 NCT04516746 CTRI/2020/08/027 |

| CanSino Biological Inc./Beijing Institute of Biotechnology | Non-Replicating Viral Vector Trial No: NCT04526990 NCT04540419 |

| Gamaleya Research Institute | Non-Replicating Viral Vector Trial No: NCT04564716 NCT04530396 |

| Janssen Pharmaceutical Companies | Non-Replicating Viral Vector Trial No: NCT04505722 |

| Novavax | Protein Subunit vaccine candidate Trial No: 2020-004123-16 |

| Moderna/NIAID | RNA vaccine candidate Trial No: NCT04470427 |

| BioNTech/Fosun Pharma/Pfizer | RNA vaccine candidate Trial No: NCT04368728 |

In addition to the ten Phase III candidates, there is also substantial hope for 2020 licensure for several of the 14 candidates in Phase II clinical validation. Many of the Phase II candidates are close to initiating Phase III trials with interim safety and immunogenicity data having been submitted to respective national regulatory authorities.

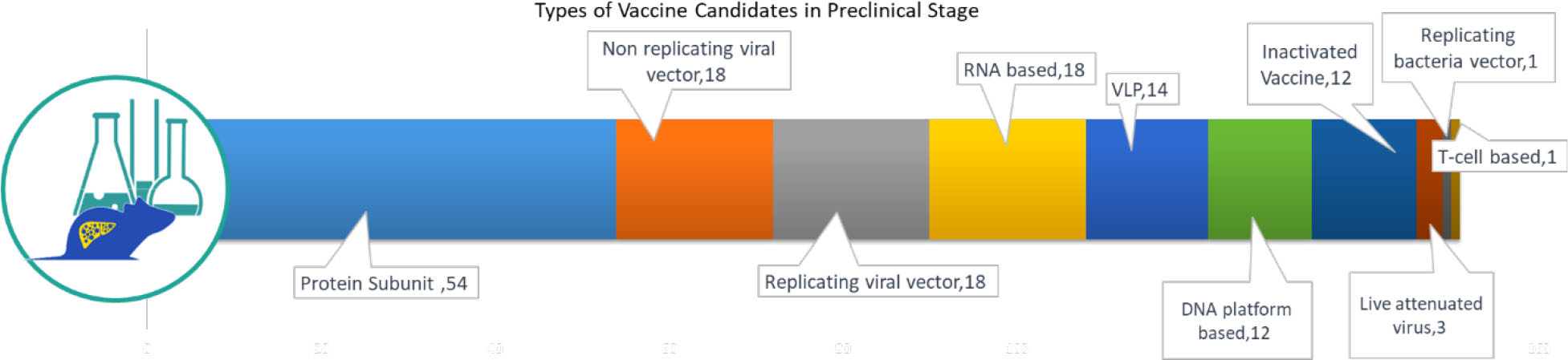

The 151 candidates in pre-clinical evaluation are also important for delivering the vaccine at the scale needed to address global demand. While the pre-clinical stage candidates are expected to gain approval by June to September 2021, this second wave will be important to meet the global scale-up demand. Again, we are encouraged by the diversity of technology platforms in the preclinical pipeline:

Volume demand for the COVID-19 is unprecedented given the global onslaught of the virus. Majority of the world’s 7.8 billion people are exposed to the infection. With two doses being the most common dosing schedule being pursued globally, aggregate global demand is north of 10 billion doses. And, to add to the challenge of dearth in large scale manufacturing capacity, several vaccines being pursued need to be manufactured at BSL II level of biosafety compliance. The robust clinical development pipeline of 40 candidates will translate to widespread vaccine availability only when they can be commercially delivered at scale right after product licensure. None of the 40 clinical candidate developers individually have current in-house capacity to deliver the product at this needed scale. This has understandably led to a flurry of partnerships and acquisitions to gain access to manufacturing capacity, often in a distributed global manner. These partnerships cover both drug substance manufacturing as well as fill-finish capability.

Some notable developments of such acquisitions and partnerships include BioNTech’s acquisition of two manufacturing facilities of Novartis in Germany which have GMP authorization. This will enable commercial production to begin in first half of 2021 immediately after product approval. Novavax too acquired the vaccine production facility of Praha Vaccines in Czech Republic while Astra Zeneca has signed an agreement with Catalent Cell & Gene therapy to produce their vaccine drug substance in their facility at Harmans, Maryland. This agreement is similar to a previous arrangement by the duo in June for usage of Anagni, Italy facility for large scale vial filling and packaging. Recently Johnson & Johnson (J&J) has also signed partnership with Grand River Aseptic Manufacturing (GRAM), a CDMO in Michigan for fill and finish manufacture of J ohnson & Johnson’s SARS-CoV-2 vaccine candidate. In India, Biological E, has acquired Akorn India Ltd, a subsidiary of Akorn Inc. to boost manufacturing production of two COVID vaccine candidates including the J&J vaccine where Biological E has forged a manufacturing partnership. Production volume anticipated based on capacity creation announcements and partnerships forged are tabulated below: To date, several manufacturers have announced capacity expansion plans to about 2 billion doses by the end of 2020 and 8 to 9 billion doses by the end of 2021. However, with the trend of several bilateral procurement deals that have been catalytic for such capacity creation, the threat of negligible to limited supply to LMIC countries looms large.

| DEVELOPERS AND MANUFACTURERS PARTNERSHIPS | EXPECTED DOSE PRODUCTION IN 2020 AND 2021 |

| University of Oxford/AstraZeneca Serum Institute of India, Oxford Biomedica, Emergent Biosolutions | 0.7 Bn in 2020 2.0 Bn in 2021 |

| Moderna, Catalent, Lonza and ROVI | 1.0 Bn in 2021 |

| Merck, Themis Bioscience | 1.0 Bn in 2021 |

| Johnson & Johnson, Catalent, Emergent Biosolutions | 1.0 Bn in 2021 |

| Novavax, Praha Vaccines | 1.0 Bn in 2021 |

| Sanofi Pasteur | 1.0 Bn in 2021 |

| BioNTech/Pfizer | 1.3 Bn in 2021 |

| Sinovac Biotech | 0.3 Bn in 2021 |

| Sinopharm | 0.1 Bn in 2021 |

| ImmunityBio | 0.2 Bn in 2021 |

| INOVIO Pharmaceuticals, Richter-Helm Biologics | <0.1 Bn in 2021 |

Source: Press release by companies

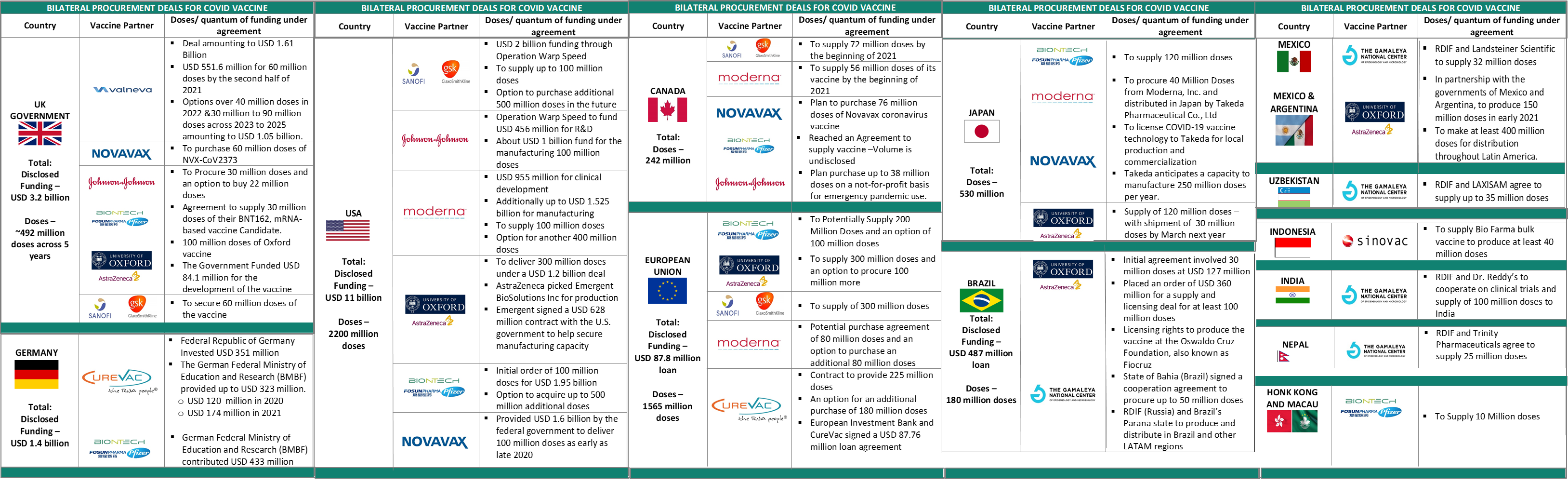

All countries, developed and developing alike, are grappling with the long-term effects of the pandemic on the economy. In order to get communities back on their feet, national governments are pushing hard to make purchase commitment for the vaccine ahead of their licensure. As more candidates progress to Phase II and III clinical trials, more countries have come forward to fund vaccine candidates in return for supply commitment for a specific volume of vaccine doses. In the quest for national supply security, few high income countries have funded multiple vaccine candidates considering the intrinsic risk associated with vaccine development and uncertainty in development timelines. The table below highlights some important bilateral procurement deals forged by country governments.

Early purchase commitments have given manufacturers the incentive to invest in creation of manufacturing capacity, far ahead of clinical data proving its safety, efficacy and eventual licensure. In order to spread out the risk associated with their investments, developed countries like USA and UK have made agreements to procure billions of vaccine doses that exceed the number of doses required for their population. While the catalytic impact of such partnerships has been highly impactful in rapidly catalyzing capacity creation, equitable access to LMIC countries that haven’t pledged this quantum of funding is a grave global challenge. In this context, a structure like the COVAX Facility is thus, paramount to ensure that COVID vaccine doesn’t remain the privilege of countries that can pay the most.

The world’s population has its eyes set on a COVID-19 vaccine and putting an end to this global pandemic not only requires a safe and effective vaccine, but also ensuring that everyone has access to the vaccine. Pockets of population that remain unvaccinated would continue to spread the virus and continued global economic slowdown is imminent. With bilateral deals obtaining commitment to substantial doses of vaccine pre-licensure, equitable access appears a distant reality. The threat gets more grave in the context of most LMIC countries having near zero local vaccine manufacturing capability. Commitment of all global stakeholders will be essential to ensure that the scramble for a vaccine by the high income countries doesn’t leave the entire LMIC group in the lurch.

With the goal of equitable access to the vaccine, WHO launched the Access to COVID-19 Tools (ACT) Accelerator in April and the COVAX pillar of the Accelerator is focused on expediting the development and providing equitable access to the vaccine. COVAX is jointly facilitated by GAVI, the Vaccine Alliance, Coalition of Epidemic Preparedness (CEPI) and WHO to support the research and development, manufacturing, distribution and negotiation of prices for multiple vaccine candidates. With the level of uncertainty surrounding the fate of the pandemic and success of the vaccines in development, it is crucial to ensure that the most promising candidates are supported simultaneously to make them available as soon as they are licensed. According to WHO estimates, vaccines at a preclinical stage have a 7% chance of succeeding, and the candidates in clinical development have about 20% chances. Need for de-risking of vaccine candidates appears more apparent in light of the recent interruptions on two vaccine candidates, the AstraZeneca’s phase III trial was put on hold after an incident of unexpected adverse event and it continues to be hold in USA (while it is resumed in the UK); Inovio’s Phase II/III trial being put on hold by the US FDA to address certain questions related to the delivery device being used with the vaccine. Funding multiple candidates distributes the risk associated with clinical failure proportionately across candidates and helps in supporting the most suitable candidates based on scientific merit and scalability.

COVAX Facility – maximizing quick and fair access to vaccineCOVAX Facility is a GAVI-coordinated pooled procurement mechanism for vaccines to ensure fair and equitable access for each participating country using an allocation framework developed by the WHO. COVAX Facility has curated an actively managed portfolio of nine vaccine candidates, continuously working with the manufacturers and incentivizing capacity expansion ahead of licensure. The Facility intends to do so by pooling the purchasing power of the many participating countries towards funding of development and manufacturing of vaccines and will also use the pooled demand to negotiate competitive pricing from the manufacturers. The Facility aims to make cumulative USD 5.7 billion of investment into acceleration of vaccine candidates to secure up to 2 billion doses of the vaccine.

Self-financing countries participating in the Facility will make payments towards doses sufficient to vaccinate 10-50% of their populations. Some of these countries already have bilateral deals with manufacturers such as UK and Japan, and the Facility serves as an insurance policy to get access to the vaccine in case the bilateral deal fails. The Facility has structured two mechanisms for self-financing countries to participate:

- Committed Purchase Agreement – Countries to make committed guarantees to procure an agreed volume of doses at a lower upfront payment USD 1.60 per dose, or 15% of the total cost per dose.

- Optional Purchase Agreement – Attractive for countries with existing bilateral deals – participants can opt out from the purchase agreement. The upfront payment is higher USD 3.10 per dose and a risk-sharing guarantee of USD 0.40 per dose in case the purchase agreement is called off after the Facility has contracted with a manufacturer.

Presently, 64 high-income countries have formally joined the Facility in the first call, including 35 self-financing countries and the European Commission, representing 27 member states plus Norway and Iceland. Further 38 economies are expected to sign up in the coming few days. Participating countries are expected to make an upfront payment into the Facility by October 9.

GAVI COVAX Advance Market Commitment – Vaccine access to LMICsIn order to support vaccine access to the 92 middle and lower-income countries, GAVI COVAX AMC arrangement has been setup which will be funded through the Official Development Assistance (ODA) funds and through philanthropic and private contributions. These countries together make up almost half of the world’s population and ensuring vaccine access to this half of the population is critical to put a timely end to the pandemic. AMC requires a seed capital of USD 2 billion which will be sufficient to immunize health-care workers and high-risk individuals in GAVI-supported countries. As of now, it has raised USD 600 million towards the initial target. The COVAX AMC has taken its inspiration from the highly successful AMC structure for pneumococcal vaccines.

Under the allocation framework designed by the WHO, vaccines will be allocated to all participating countries in a two-phased structure – in the first phase, initial allocation will be done in a way that all countries have sufficient doses to vaccine 20% of their population. In the second phase, coverage will be expanded to other populations and in the event of supply constraints, weighted allocation would be done taking into account country’s COVID threat and vulnerability of the population.

The pooled demand and purchase commitment from both COVAX Facility and AMC will be leveraged to fund volume guarantees to specific manufacturers, commit to and purchase the doses once the vaccines are licensed and WHO prequalified. Collective global effort towards ensuring safe and equitable access to vaccine is the only solution to mitigate the economic and health toll of the pandemic and the unprecedented efforts of global economies as part of the COVAX bring hope that there is light at the end of the tunnel, and that is a vaccine.

Whitepaper on ‘Digital Transformation of Indian Healthcare‘ released at SmarTec India 2020 Conference organized by ASSOCHAM. Click here to view Key Takeaways: -Indian healthcare startup ecosystem rightly positioned to transform clinical delivery – Leveraging technology to address long-standing challenges in Indian context and leapfrogging to contemporary practices – COVID-19 led transformation of a reticent industry – regulatory thrust to digital initiatives – Catapulting innovation pipeline to realize value and create global impact Out-licensing opportunities: 1. Transdermal tizanidine patch for spasticity – USFDA Phase II ready 2. Novel small-molecule oral treatment for N-AMD – adjuvant for anti-VEGF therapy 3. High-throughput screening antibody-based COVID-19 diagnostic kit 4. Contact lens based drug delivery for post-surgical anti-infectives 5. Novel device to measure visual field defects in neonates with built-in objective assessment software

Announcing the beta launch of

We promise to deliver timely & critical insights across the spectrum of pharma & biotech. Signup for updates

We promise to deliver timely & critical insights across the spectrum of pharma & biotech. Signup for updates

Connect with Authors at: E-mail healthcare@sathguru.com

Grow Beyond

Grow Beyond