June has turned out to be an eventful month with the FDA approving or taking regulatory action for several critical drugs, particularly within the segments of central nervous system (CNS) and metabolic health. Within the CNS space, the progress with Alzheimer’s drugs has been touted as a remarkable progress for both science and the regulator with its accelerated approval pathway.

Attacking disease pathophysiology in Alzheimer’s

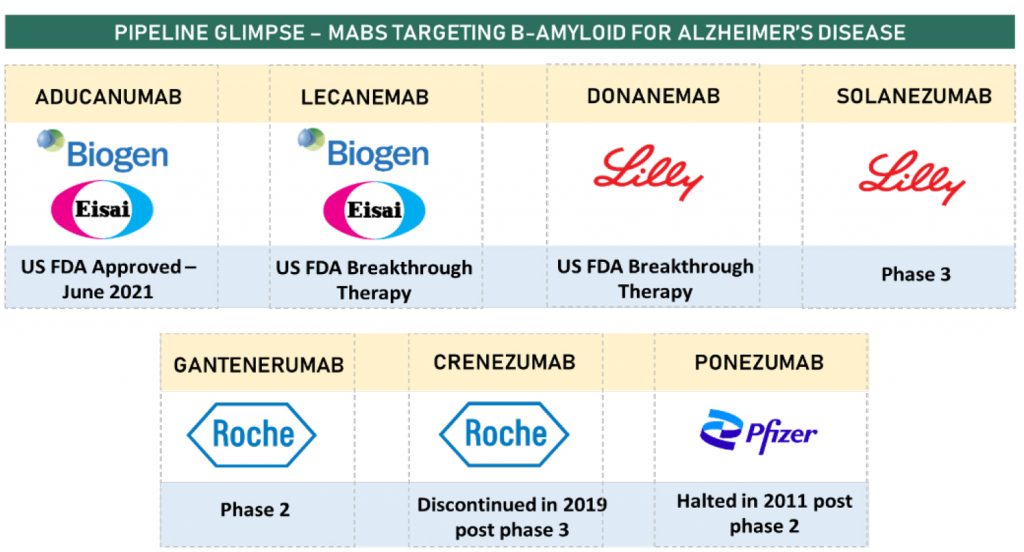

Majority of previously approved and marketed treatments for Alzheimer’s Disease were directed at symptomatic treatment of the disease with either cholinesterase inhibitors in mild to moderate stage of disease or with N-methyl-d-aspartate receptor antagonist (memantine) in the more severe stage. These oral drugs do not address the underlying neuropathology of the disease, and hence fail to slow down the progression of the disease. One of the popular hypothesis within the research circles is that of β-amyloid accumulation leading to neurodegeneration in Alzheimer’s. Biogen’s Aducanumab (AduhelmTM ) has been designed to target the same peptide and prevents plaque buildup, thereby slowing the course of the disease. The mAb is the first drug to treat the course of the disease and also the first Alzheimer’s drug to be approved in nearly two decades. The advantage of monoclonal antibody therapy over the pre-existing treatment paradigm is that of short-term drug administration addressing the underlying physiology of the disease.

The approval of Biogen’s drug has drawn criticism from researchers and drug developers alike over the use of the surrogate endpoint of plaque reduction as a proxy for final clinical endpoint. Earlier research conducted on mAbs targeting β-amyloid have been found to reduce plaque formation without any improvement in the symptoms of Alzheimer’s. In its own late-stage trial EMERGE, patients receiving Aducanumab experienced a 22% improvement in clinical dementia over placebo after 78 weeks of treatment, but the same patient group showed worse outcome than placebo in another ENGAGE study, posing much uncertainty about the real clinical benefit of the treatment. Under the accelerated approval pathway, Biogen will now conduct a phase-4 post-approval study to verify the treatment’s anticipated clinical benefit, failing which the drug will be withdrawn from the market. Another point of contention amongst lawmakers, regulators, and patient health advocates is the label expansion to include all Alzheimer’s patients vs those with an early-onset of disease, as studied in the clinical trials. Adding to the criticism is now an investigation that has been launched by The House Committee on Oversight and Reform to look into the reason for the FDA approval and seek evidence supporting health-economic benefit of the hefty price tag. The negative media publicity surrounding Aducanumab is likely to affect its adoption by physicians and the high price-tag may limit reimbursement since the evidence to support clinical benefit currently appears bleak. Biogen and its partner Eisai are working towards providing one-on-one support to Alzheimer’s Patients and are simultaneously running other initiatives to enable affordable access to the drug for all patients. More on the approval is available here in our PharmForward post.

The accelerated approval of Aducanumab has also opened doors to other drug developers seeking similar pathway for their own drugs. Eli Lilly’s donanemab received FDA Breakthrough therapy Designation few weeks after Biogen’s approval. The mAb targets a modified form of β-amyloid called N3pG and the Breakthrough designation is based on the positive clinical evidence from the TRAILBLAZER-ALZ study which showed consistent slowing down of cognitive and functional decline in the treatment group when compared to placebo. Eli Lilly lintends to submit a BLA for donanemab under the accelerated approval pathway later in the year while it continues to run its phase 3 trial in parallel.

The debate stirred by Aducanumab’s approval shines the spotlight on the critical aspect of scientific integrity and patient safety. As it further evolves, we hope the controversy will only result in more intent focus on these aspects as part of bringing new drugs to the market. CNS diseases such as Alzheimer’s and Parkinson’s have always had a dearth of treatment options and drugs addressing the underlying physiology of the disease will be a remarkable feat for the biopharma community. It is pertinent that the introduction of new drugs is done with due consideration to patient safety, health-economics outcomes and patient access.

Beyond Alzheimer’s, Biohaven’s Nurtec® ODT (rimegepant) received an FDA approval to expand its label indication to include preventive treatment of migraine. The drug was approved last year for acute treatment of migraine and now it has become the only drug approved for both treatment of acute migraine attacks and preventing future attacks. An oral CGRP antagonist, the drug is available in the form of a quick-dissolving tablet formulation and attacks the root cause of migraine. Preventive migraine treatment will be a better treatment option for patients suffering from frequent migraine attacks and would have a positive impact on the their lifestyles.

Chronic to Lifestyle switch – Diabetes drug repurposed to treat obesity

Novo Nordisk has actively pursuing expanded positioning of semaglutide as a versatile active ingredient for a range of cardio-metabolic conditions. There’s a close association between cardio-metabolic diseases such as obesity, type 2 diabetes, kidney diseases, non-alcoholic steatohepatitis (NASH), cardiovascular diseases et al. and the company strongly believes in shedding the siloed approach of symptomatic treatment of each disease and is purposing the GLP-1 peptitde semaglutide to target various therapeutic areas. In June, Novo Nordisk received US FDA approval for once-weekly semaglutide as a treatment of obesity. Obesity affects almost 70% of American adults and is a gateway for other chronic conditions too. The subcutaneous injectable drug will be marketed as Wegovy®. The approval was based on positive phase 3 data demonstrating that one-third patients lost 20% of their body weight over the 68-week trial period when supplemented with diet and exercise.

The approval is a big win for Novo Nordisk whose diabetes portfolio is now riding on GLP-1 molecules. Three currently marketed products – Victoza® (liraglutide), Ozempic® (injectable semaglutide) and Rybelsus® (oral semaglutide) helped off-set the decline in sales in the insulin portfolio on account of lower realized prices in the US market following higher patient rebates. Novo Nordisk is further expanding the semaglutide therapy portfolio, planning on a phase 3 trial for an oral semaglutide for obesity treatment, and also running a phase 2 trial for semaglutide therapy in NASH. Results from the phase 2 trial in NASH showed significant resolution in symptoms and decline in disease progression. Semaglutide’s indication expansion into obesity grains greater prominence in the light of impending generic competition for liraglutide across geographic markets. Globally, there is a robust pipeline of generics under way with liraglutide flagging off a new turf of opportunity in high volume peptides for generic companies.

Together Ozempic® and Rybelsus® (oral semaglutide) brought in $3,703 million in sales in 2020 and Novo Nordisk’s other obesity drug Saxenda raked in $900 million in sales last year. An established foothold in the obesity segment gives Novo Nordisk some headway in introducing the drug. Reimbursement of weight loss drugs has been a pain point for drug pricing and access and the company is also working on enabling better access to patients such as launching a copay card for patients whose insurance already covers anti-obesity medications. The company is also leading efforts to raise obesity’s profile as a chronic disease rather than a mere lifestyle condition.

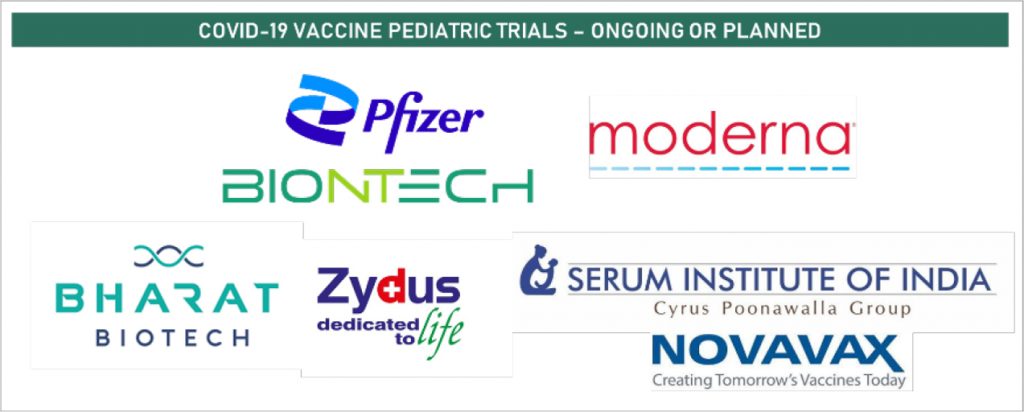

Globally, 23.1% of the world population has received at least one dose of a COVID-19 vaccine and 3.0 billion vaccine doses have been administered globally. Most vaccine candidates have been able to prove their safety and immunogenicity in the adult populations and countries continue to ramp-up vaccination drives for adults. In parallel, multiple vaccine candidates have initiated pediatric vaccine trials to generate safety and immunogenicity data in children. Children of all age groups remain susceptible to COVID-19 infection, although COVID manifestation in children has largely been asymptomatic to mild  infection. However, in a multicenter study in Europe, a small proportion of children have been found to develop severe symptoms requiring prolonged ventilation and ICU admission. There is also concern in the scientific and physician community of the likelihood of third COVID wave affecting children more severely, however there is limited data to back this hypothesis. Nevertheless, long-term effects of COVID-19 are unknown and vaccination of children will be crucial to protect them from both direct health impact and indirect social impact of COVID-19 infection.

infection. However, in a multicenter study in Europe, a small proportion of children have been found to develop severe symptoms requiring prolonged ventilation and ICU admission. There is also concern in the scientific and physician community of the likelihood of third COVID wave affecting children more severely, however there is limited data to back this hypothesis. Nevertheless, long-term effects of COVID-19 are unknown and vaccination of children will be crucial to protect them from both direct health impact and indirect social impact of COVID-19 infection.

Pfizer and Moderna launch late-stage pediatric vaccine: In June, Pfizer and BioNTech announced that their vaccine BNT162b2 will begin phase 2/3 trial (NCT04816643) in children under 12 years of age. The duo plan to enroll about 4,500 participants across 98 locations in US, Poland, Spain, Finland et al. The vaccine will be evaluated in the pediatric pool on a two-dose schedule, 21 days apart, in three different age groups: children 6 months to 2 years, 2 years to 5 years and 5 to 11 years. Preliminary data from the pool of 2 years to 12 years is expected to be ready by October or November. Vaccine dose in children has been selected lower to what is being used in adults, since children’s robust immune system are able to kick start an immune response at a lower antigen dose.

In March, Moderna announced initiation of phase 2/3 trial, named KidCove (NCT04796896) to study the mRNA vaccine mRNA-1273 in children 6 months to 12 years of age. The study is being conducted in collaboration with NIAID, NIH and BARDA. The trial will enroll up to 6,750 children across US and Canada. The vaccine will be administered in 2-doses, 28 days apart. The trial has two parts, in part-1 children will receive one dose from three different doses: 25μg, 50μg and 100μg. Based on the interim analysis on part 1 of the trial, a single dose will be selected and administered in placebo-controlled part 2 of the trial.

Both the trials are critical from the point of view of both COVID-19 infection and the broader stance of the scientific community and regulators on mRNA vaccines. Both BNT162b2 and mRNA-1273 will be the first vaccines mRNA vaccines to be tested in children at a large scale and potentially to be approved for use in children. It’s an enabling development for other mRNA vaccines for diseases such as Zika, Malaria, Dengue which continue to have a huge unmet need in endemic regions, particularly in children and adolescent pool and vaccine candidates haven’t been able to make significant progress.

Indian companies begin trial in children and adolescents: India’s homegrown COVID-19 vaccine, Bharat Biotech’s COVAXIN has initiated phase 2/3 trial in children of ages 2 years to 18 years of age. The trial will enroll up to 525 children across different states in India, and has already been kick started at AIIMS New Delhi and AIIMS Patna for the age group of 12 years to 18 years. The trial will progressively be expanded to younger age groups with tiered risk de-escalation.

Another Indian vaccine manufacturer, Serum Institute of India is due to start the pediatric trials for Novavax’s COVID-19 vaccine, Covovax in July. Zydus Cadila’s vaccine ZyCoV-D recently announced that the vaccine is nearing the completion of its trial for vaccine in the adolescent age group, 12 years to 18 years and the vaccine may be available for administration in this age group by August end, conditional upon government approvals.

Sinovac vaccine receives emergency approval for use in children: CoronaVac vaccine developed by China-based Sinovac received emergency approval in China for administration in children between the ages 3 years to 17 years. The emergency approval is based on the preliminary results from phase 1 and phase 2 trials which demonstrated safety and immunogenicity in the above age group.

We remain optimistic about the pace of vaccine development and administration globally. Concerted efforts by the global biopharma fraternity, scientists and regulators have been able to bring to fruition multiple vaccine candidates that can together help address the global demand for vaccine needed to avert further health, social and economic damage from the pandemic.

Remote monitoring devices have been gaining regulatory support in the past few months. US FDA granted clearance to multiple such devices, which can support the medical staff without having to come in close proximity. Oxehealth, a UK based firm, received de novo clearance for a camera based vital sign monitor. Oxevision, overhead camera based device with optical sensors, is capable of recording accurate pulse and breathing rate, gauging chest movements of the patient. The device has received green light from Europe regulatory authorities 2 years ago and post that was studied under a pilot project, conducted with University of Oxford and National Health Services at UK. We perceive wide potential for application across hospitals as well other care provider settings.

Xandar Kardian is second one to gain a spot on the recent UD FDA clearance list.  The company received clearance for radar powered, contactless patient monitoring device. The device captures a person’s vital signs, without having to use any kind of wearables. XK300, non-contact monitoring device, automatically alerts physicians in case aberrations are detected in vital signs. Again, the device holds substantial potential for use across both hospital and at-home monitoring contexts.

The company received clearance for radar powered, contactless patient monitoring device. The device captures a person’s vital signs, without having to use any kind of wearables. XK300, non-contact monitoring device, automatically alerts physicians in case aberrations are detected in vital signs. Again, the device holds substantial potential for use across both hospital and at-home monitoring contexts.

Devices to help reduce hospital visits have gained great traction during the on-going pandemic. One such device in the women’s health arena gained expanded approvals for remote monitoring of uterine activity. Nuvo Group announced having received 510(k) clearance from US FDA for expanded clinical utility of INVU, device for monitoring fetal heart rates, maternal heart rate and uterine activity, hence making it possible to conduct non-stress tests remotely. Regulatory nod for monitoring maternal and fetal heart rates were granted last year. More recently, in May 2021, this was followed by expanded clearance for uterine activity monitoring. The INVU sensor band provides mothers and care providers with real-time readings, which can further assist in better patient management during virtual visits.

Pervasive global trend of digital transformation of care

The trend of overdue digital transformation across the healthcare continuum has been global and pervasive. Our White Paper on the Digital Transformation of Healthcare in India emphasized the clinicians survey pointing to behavioral change during the pandemic. The behavioral change is further providing impetus to strong pipeline of digital innovation including wide spectrum of patient monitoring solutions for at home and in-hospital use in LMIC countries.

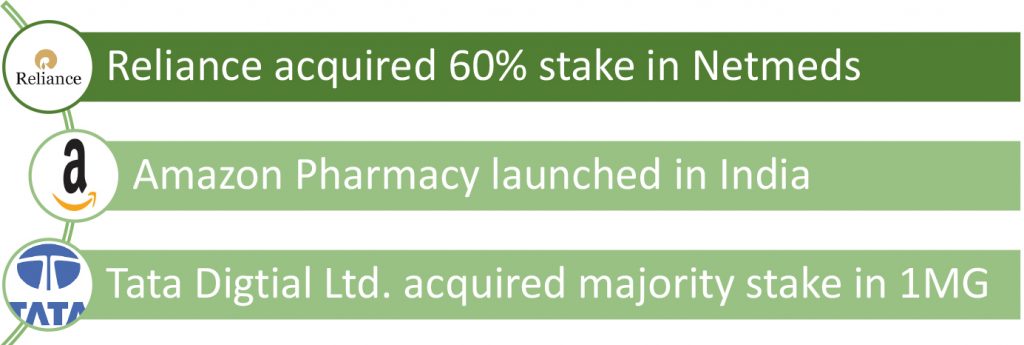

The most emphatic illustration of surge in digital solution adoption is the loosening of purse strings by leading Indian conglomerates to participate in the evolving opportunity and expanding venture capital appetite.

India’s leading conglomerate, Reliance, expanded its healthcare portfolio by acquiring 60% stake in the epharmacy Netmeds for INR 620 crore. This followed at the heel of smaller historic transactions such as subsuming KareXpert for INR 10 crore and acquiring 82% stake of C-square. KareXpert was a health-tech app connecting healthcare providers and patients. C-square provided the company with software solutions focal towards pharma market, covering distribution, retail and e-commerce.

Another giant player in ecommerce sector, Amazon launched, Amazon Pharmacy in India. Another large Indian corporate group, the Tata group has been forging string of investments across the continuum of digital health solutions. Tata Digital Limited acquired majority stake in another e-pharmacy, 1MG Technologies Private Ltd for an undisclosed amount. 1MG, established in 2015, has established robust supply chain including 20,000 pin codes, offering diagnostic services and is also engaged in B2B distribution of medicines. Several Indian pharma companies are also pursuing opportunities to expand participation in healthcare solutions beyond traditional pharmaceutical value chain. As a reflecting of such an expanding interest, leading Indian pharma company Lupin announced a new subsidiary, Lupin Digital Health.

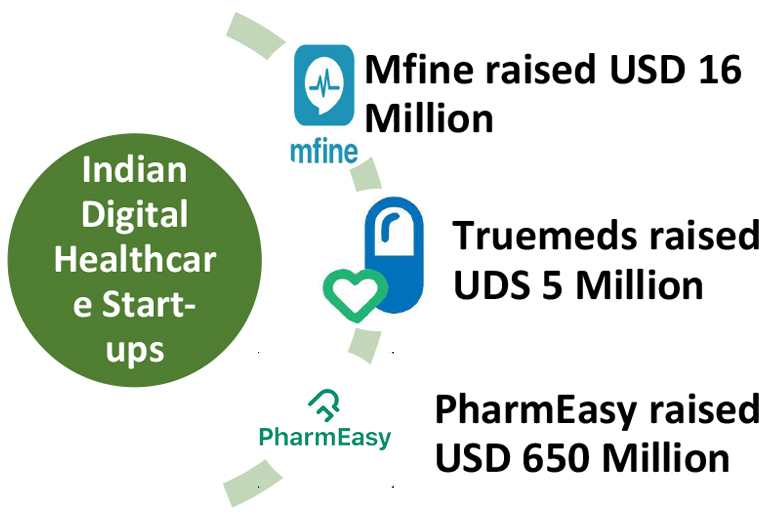

The strong strategic investment momentum is complimented by expanding activity amongst ventures and VC investor appetite.

MFine, AI driven healthcare platform founded in 2017, raised USD 16 million, led by Heritas Capital and new and existing investors earlier in 2021. The new funding round was joined by Singapore based Y’S Investment Pte Ltd and included participation from SBI Investment, SBI Ven Capital, BEENEXT and Alteria Capital, the existing MFine investors. Japan based SBI Investment led the prior round of investment for MFine, raising USD 17.2 million in series B, in 2019. The company announced having achieved 10x growth in 2020, leveraging steep adoption pattern of telemedicine and digital health solutions. The platform now includes over 4000 doctors and covering 35 specialties.

Truemeds, founded in 2018 raised capital of USD 5 million in a Series A finding round,  led by their existing investor InfoEdge Ventures and other investors including Asha Impact and Indian Angel Network, followed by seed funding in 2020. The company provides value alternative brands to chronic patients, hence offering cheaper alternatives along with free delivery of certain suggested brands. It observed 40 times increase in monthly orders since launch in 2019. The company offers services in 16,000 pin codes. Similar to MFine, the company intends on building a subscription model for chronic patients.

led by their existing investor InfoEdge Ventures and other investors including Asha Impact and Indian Angel Network, followed by seed funding in 2020. The company provides value alternative brands to chronic patients, hence offering cheaper alternatives along with free delivery of certain suggested brands. It observed 40 times increase in monthly orders since launch in 2019. The company offers services in 16,000 pin codes. Similar to MFine, the company intends on building a subscription model for chronic patients.

PharmEasy entered the unicorn club recently in April 2021, with a USD 1.5 billion valuation, raising USD 350 million in series E round. The funding round was led by Prosus Ventures and TPG Growth. The digital healthcare platform, claims to digitize entire medicine supply chain, easing the process to access products for pharmacies, connecting over 60,000 brick and mortar pharmacies and over 4000 doctors in 22,000 pin code areas. A SaaS solution offered by the company for pharmacies, provides delivery and logistic assistance along with credit solutions to buy medicines from multiple manufacturers. Followed by the investment round in April, the company announced merger with Medlife, claiming the new entity to be the largest online healthcare delivery platform. API Holdings, parent company of PharmEasy acquired 100% stake in Medlife. Actions to establish themselves in the digital health space haven’t stopped yet, on June 26, 2021, the company announced acquisition of 66.1% stake in Thyrocare for INR 4,546 crore. Acquisition of an entrenched and largest B2B diagnostic chain, with pan-India presence, will enable PharmEasy to offer and scale up their expanded diagnostics services. In order to fund the acquisition, PharmEasy had raised additional USD 300 million from its exiting investors, summing up to USD 650 million raised since April 2021. The company aims to provide all out-patient healthcare products and services to customers in timespan of less than a day.

It is even more optimistic to have seen government interventions to have observed significant adoption in a short span of time. eSanjeevani developed by the Centre for Development of Advanced Computing (C-DAC), a free video-based tele-consultation application, connecting patients with doctors speaking local languages, empaneled in each state. 60 lakh consultations were completed on June 10, 2021. Over 40,000 patients utilizing the application for remote health services. Andhra Pradesh, Tamil Nadu, Karnataka and Uttar Pradesh led the pack in terms of adoption of the platform. In order to further penetrate the rural population, Common Services Center’s (CSCs) and Ministry of Health and Family Welfare have joined forces to increase OPD consultations in rural and remote areas. Pervasive digitization of healthcare is here to stay, and is possibly one of the only silver linings of the COVID-19 ravaged year gone by.

Grow Beyond

Grow Beyond