The COVID-19 global crisis continues to loom large. With the new normal expected to last for an extended period, it is time industry moves on and embraces growth despite the challenges. We are encouraged by an active landscape in global biopharma for M&A, licensing and strategic partnerships and funding. This is especially excited considering the pervasive focus on cash conservation. Growth balanced with tight purse strings, the new mantra is here to stay in biopharma.

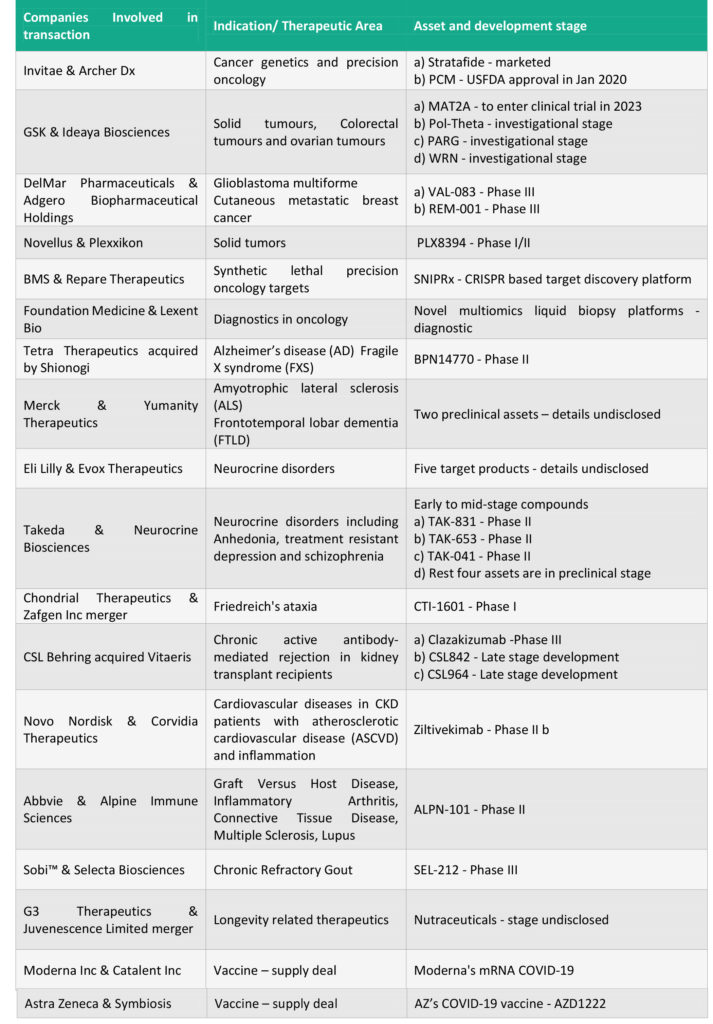

To celebrate this active momentum, this month we bring you a comprehensive round-up of the global deals (M&A, licensing and strategic partnerships) and corporate investments:

The investment momentum in next generation therapies doesn’t seem to have been muted despite the pandemic. In fact, the area is rife with partnerships, deals and investments with continued interest from mainstream biopharma companies. Particularly notable is depth of investment in vector engineering platforms and other enabling technologies for more sophisticated and efficient gene delivery platforms in addition to clinical stage therapeutic assets.

The largest announcement this month was from UniQure – CSL Behring. UniQure put speculations to rest with its recent sale of late-stage haemophilia B asset to CSL Behring with $450 million upfront and up to $1.6 billion in regulatory and commercial milestone payments. The sale leaves UniQure with a lean gene therapy portfolio centred on CNS disorders and arms CSL with another hemotalogy therapy, competing directly with Pfizer and Roche in the haemophilia B therapy space. The transaction comes at an opportune time with UniQure’s another lead candidate for Huntington’s disease entered clinical development in June.

Partnership momentum extends beyond late stage clinical assets with low technology risk to upstream partnerships to shore up foundation of technology arsenal. Two-year young biotech Dyno Therapeutics, a spin-out from George Church’s lab at Harvard Medical School is a great example of having woven successful partnerships with both Novartis and Serepta Therapeutics and attracting upto $2Bn. Dyno uniquely harnesses the power of artificial intelligence to design superior novel Adeno-associated vectors that significantly improve upon the shortcomings of the current vectors used for gene therapy. Their proprietary technology CapsidMap applies machine learning algorithms, combined with high-throughput experiments to simultaneously generate and evaluate millions of AAV variants to identify and create superior synthetic AAV vectors. By deploying machine learning and artificial intelligence, Dyno can address and tweak multiple properties of gene therapy vectors – immunity, delivery, packaging size etc., which compared to the current approach offers far many parameters for vector optimization. Novartis will work with Dyno to leverage its CapsidMab technology to design vectors for ocular gene therapies while Sarepta’s area of interest is muscle diseases.

Sarepta Therapeutics, a rising gene therapy company with two known muscular dystrophy drugs EXONDYS 51 and VYONDYS 53 is keen to solve one of the biggest challenges of gene therapy developers: immune system reactions which limits multiple administration of the therapy once the antibodies are created against the virus. With the aim of addressing this limitation, it has partnered with two other biotech ventures, Selecta Biosciences and Codiac Biosciences. Selecta and Sarepta will together explore the formers ImmTOR, immune tolerate technology that can limit or prevent neutralizing antibodies from forming. Codiac, on the other hand is researching exosome based gene delivery that does not elicit an immune response. The deal with Selecta is focused mainly around Duchenne Muscular Dystrophy (DMD) and certain limb-girdle muscular dystrophies. With Codiac, Sarepta has the option to license up to 5 neuromuscular targets under which Codiac will receive initial $72.5 million upfront, near-term license and research funding, if the therapy moves to markets it could receive additional milestone payments.

Widespread momentum and deal motivation: In our previous newsletter we emphasized greater concentration of M&A and licensing momentum in niche segments. With COVID-19 related economic uncertainty looming large, it is very encouraging to note big pharma join younger biotech ventures in adding to the transaction activity. Growth has not been blindsided and there has been a clear appetite to close deals that are important for pipeline strengthening. In addition to shoring up drug pipeline, business organization and debt reduction were also prominent deal drivers. While deals announced this month weren’t necessarily driven by COVID-19 led pressures, we expect such re-organization deal momentum to continue as economic stress drives strategic pruning.

Oncology and CNS dominate the deal tables: Oncology continues to be the therapeutic area with highest investment appetite for pipeline assets. We expect this skewing of investment towards immuno-oncology and continuing unmet clinical needs across cancers to continue in the near term horizon. Recent transactions also emphasize the progressively expanding interest in neurological diseases. Late stage assets continued to gain favour.

Licensing and option agreements overshadow M&A: Despite active deal momentum, we believe that cash conservation leaning has impacted structure of deals with preference for licensing with staged payments as compared as compared to outright acquisition with completely top-loaded consideration. With strong focus on cash conservation in current economic landscape, we expect that outright exits will be harder to forge; and licensing/option transactions with stage-gated payments will continue to dominate this year’s deal tables.

Notable transactions: While the table below outlines the larger deal landscape, higher value transactions include:

AbbVie and Genmab: The USD 4 Billion deal covers joint development and commercialization of three cancer therapies developed by Genmab – Epcoritamab (DuoBody-CD3xCD20), DuoHexaBody-CD37 and DuoBody-CD3x5T4 and a discovery research collaboration for future differentiated antibody therapeutics. The lead asset Epcroitamab is a CD3 and CD20 targeting antibody focussed on B cell malignancies that is currently being evaluated in a Phase I/II trial for multiple hematological B cell malignancies. AbbVie will make an upfront payment of USD 750 Million and Genmab will be eligible to receive a further sum of up to USD 3.15 Billion in development, regulatory and sales milestones of three assets. Tiered royalties agreed are in the range of 22% and 26% on net sales for epcoritamab outside the U.S. and Japan. Genmab and AbbVie share development and commercialization responsibilities for US and Japan with 50:50 sharing of pre-tax profits. Genmab could also receive USD 2 Billion on option exercise and milestone payments as part of the discovery research collaboration.

Gilead and Arcus Biosciences: At the heel of ASCO’s virtual annual meeting, Gilead and Arcus announced this $2 Billion long term partnership to collectively develop and commercialise next-generation cancer immunotherapies. The $2 Billion deal includes an upfront payment USD 175 Million, equity investment of USD 200 Million and the remaining in potential research and development funding, opt-in and milestone payments. The deal includes immediate rights to zimberelimab and opt-in rights to all other clinical candidates (AB154, AB928 and AB680) and opt-in rights to all programs that emerge from Arcus’s research portfolio over the next 10 years. Ongoing Phase 2 clinical evaluation includes combinations of the following three candidates study in first-line non-small cell lung cancer: AB154, an anti-TIGIT monoclonal antibody; AB928, an A2aR/A2bR antagonist; and zimberelimab (AB122), an anti-PD-1 monoclonal antibody.

Astra Zeneca and Accent Therapeutics partner in a $1.1 Billion deal to develop RNA-modifying proteins (RMPs) to treat acute myeloid leukaemia (AML) and solid tumours. The deal strengthens Astra Zeneca’s commitment to epigenetics; and covers a nominated preclinical asset where Accent will lead development until Phase I and Astra Zeneca thereafter (with Accent having the option of joint development) and exclusive option to license worldwide rights to two other preclinical discovery programs. Astra Zenca will pay an upfront consideration of $55 million and upto $1.1 billion in option fees, milestone payments, and mid-single digit to low-double digits tiered royalties on net sales.

Gilead Sciences announced a purchase of 49.9% stake in Pionyr Immunotherapeutics strengthening its oncology portfolio by gaining access to two promising drugs PY314 and PY159. The drugs are based on Pionyr’s tech, myeloid tuning that rebalance the tumor micro-environment and enhance anti-tumor activity of the immune cells. The 49.9% equity stake comes at a cost of $275 million to Gilead and gives it an exclusive option to buy the remainder of Pionyr for $315 million. In addition to the stake sale, Gilead will fund Pionyr’s ongoing clinical programs and may exercise the buy-out option upon completion of phase 1b studies for either candidate or at an earlier time. Pionyr’s shareholders may receive up to $1.47 billion in option exercise fees and future milestone payments linked to regulatory and commercial developments.

When we sift through the global noise, we are highly encouraged by the mark that emerging market companies have made in the recent past in their quest to participate in specialty pharma. This is true of companies traditionally in generics now nurturing specialty pharma portfolios in regulated/global markets, and lastly, the expanding breed of Asian ventures advancing noel therapeutics with a focus on Asian markets.

Generic companies nurturing specialty pharma portfolios (branded drugs) in global markets:

Indian and South Korean pharma companies lead the pack in this trend that is backed by strong balance sheets and a keen aspiration to go beyond generics. Earlier in May, Dr Reddys announced FDA approval for its migraine drug Elyxyb (celecoxib oral solution). More recently, in June two emerging market companies with strong foothold in US generics Sun Pharma and Hikma combined forces to expand the specialty pharma franchise. Hikma is exclusively licensing ILUMYA™ (tildrakizumab) from Sun Pharma for the Middle East and North Africa region. USFDA approved ILUMYA in March 2018, EMA in September 2018 and the Japanese MHLW approved it two days ago (end June 2020) for the treatment of plaque psoriasis in adult patients. ILUMYA is a humanized lgG1/k monoclonal antibody that selectively binds to the p19 subunit of IL-23 and inhibits its interaction with the IL-23 receptor, thus inhibiting release of proinflammatory cytokines and chemokines. Under terms of the Sun Pharma – Hikma agreement that includes undisclosed upfront and milestone payments, Hikma will be responsible for registration and commercialization in all MENA markets while Sun Pharma will be responsible for product supply. Other Indian companies such as Aurobindo, Glenmark, Cipla and Alembic have also been actively shaping their specialty pharma strategy. More east, South Korean companies such as SK Biopharma are setting new benchmarks for sustained focus and execution in specialty pharma foray.

SK Biopharma’s big IPO this week is an important milestone. The stock listed at a soaring 159% over offer price in Seoul, taking its market capitalization to $8.2 billion. The company is the first South Korean company to obtain USFDA approval for an independently developed novel drug for XCOPRI (cenobamate) for treatment of partial-onset seizures in adults. The company has to its credit discovery and development of another novel drug: solriamfetol to improve wakefulness in adult patients with excessive daytime sleepiness associated with narcolepsy or obstructive sleep apnea. The drug was later out-licenced to Jazz Pharmaceuticals for global development and commercialization, retaining rights to certain jurisdictions in Asia. The drug Sunosi™ received FDA approval in March 2019, marking the approval of the first dopamine and norepinephrine reuptake inhibitor targeting the said condition. SK Bio dons an innovative pipeline of drugs in phase 1/ 2 clinical stages targeting CNS indications like ADHD, Schizophrenia, Bipolar Disorder etc., another epilepsy drug targeting Primary Generalized Tonic-Clonic Seizure is currently in phase 3 development. SK’s journey over the last decade is a telling example of an emerging market generic company emerging as a strong contender in US CNS space with a diligently executed long haul.

Emerging market CDMOs expanding presence in US and Europe:

Piramal Pharma Solutions (PPS) acquired G&W Laboratories’ oral solids manufacturing facility in the US for USD 17.5 Million for expanding its reach in global markets. The USFDA and EMA approved facility is located in Sellerville and marks PPS’s first plant in North America. This strategic acquisition comes despite simultaneous effort from the Piramal group to pare down debt – a recent deal announced where Piramal Pharma Limited (PPL) has sold 20% of its stakes to Carlyle Group, a global private equity company for USD 490 million. This acquisition will add breadth of solid oral dosage form capabilities (tablets and capsules including immediate release, modified release, chewable & sublingual solid oral dosage forms, solutions and suspensions in liquids) in North America. We believe timing is opportune with greater localization of pharma production preferred in the post COVID era where health system resilience will receive focus in most countries.

Asian ventures developing novel therapeutics for Asian markets:

Finally, the emerging market footprint is also evident in the expanding engagement of Asian ventures in novel therapeutics developed with the objective of serving Asian markets. These include VC funded ventures as well as ones fuelled more recently by capital access for pre-revenue companies made a reality on the Hong Kong stock exchange. While this is currently a China centred trend, we expect that Indian and South Korean ventures will soon add to this momentum. Notable transactions this month include:

Roche and Innovent Biologics: Focussed on developing therapies to treat solid and blood cancers, the USD 2 Billion deal encompasses Innovent paying upfront, development and commercial milestone payments along with royalties to earn non-exclusive access to certain technologies from Roche that will enable the discovery and development of specific 2:1 T-cell bispecific antibodies (TCB) and the universal CAR-T platform. While Innovent will develop, manufacture and commercialize the products, Roche will retain an optional right to license each product for ex-China development and commercialization. If Roche chooses to exercise all of its licensing options, it will pay $ 140 million as option exercise payment, along with milestone payments upto 1.96 billion. Additionally, Innovent will also be eligible to double-digit percentage royalties on each product. Innovent’s US$485 Million IPO on the Hong Kong stock exchange was one of the initial listings to infuse confidence in the industry on depth that can be nurtured in the Asian funding hub.

Agenus Inc. and Betta Pharmaceuticals collaborated for the development and commercialization of balstilimab and zalifrelimab in Greater China, including Mainland China, Hong Kong, Macau and Taiwan. Currently, Agenus’ balstilimab is being advanced in trials and slated for BLA filing this year as a monotherapy and in combination with zalifrelimab (anti-CTLA-4) for the treatment of refractory or metastatic cervical cancer. Under the terms of the agreement, Agenus will receive USD USD 15 Million in upfront cash and USD 20 million as equity investment. The agreement also includes USD 100 million in potential milestones plus royalties on net sales. Betta receives exclusive rights for the development and commercialization of balstilimab and zalifrelimab to either as monotherapies or combination therapies, excluding intravesical delivery in greater China. Betta is a VC funded company backed in its Series B funding round by Sequoia and Lilly Asia Ventures.

The aspiration and hunger to grow beyond the traditional generics base is strong across several emerging market companies. Journeys such as SK’s provide much needed confidence in the industry that this transition to an integrated and discovery led pharma company can be successfully accomplished. We expect this deal momentum to continue; and are highly enthused by the possibility of more distributed biotech innovation engine emerging in the future.

-

- Sathguru’s Grow Beyond Webinar – discussed insights from some of the leaders in the Indian healthcare delivery ecosystem on healthcare delivery, rebound expected, how care delivery will evolve and financial/business implications for the segment in its entirety.

- Pushpa Vijayaraghavan, Director and Healthcare Practice Lead elucidates on India’s agile and steadfast response to COVID-19 crisis.

- Sathguru proud and humbled to be certified as Great Place to Work, fourth time in a row.

Connect with Authors at: E-mail healthcare@sathguru.com

[/su_spoiler]

Capacity expansions in June re-affirmed the expanding affinity for cell and gene therapies that was evident in the deal table. This further builds on the momentum created by MilliPoreSigma’s $100 Million investment in a viral vector facility that we discussed in our last month’s newsletter.

The first major announcement was Thermo Fischer’s with $180 million investment in a new commercial manufacturing site in Plainville, Massachusetts for viral vector development and manufacturing. The project is expected to be completed in 2022. The project will double the commercial capacity; and emphasizes Thermo Fischer’s commitment to end to end development and manufacturing service for viral vector production for cell and gene therapies.

Emergent BioSolutions also announced an expansion of its CDMO capability into with a $75 million investment in its Canton, Massachusetts facility for viral vectors and gene therapy. The site will be focused on development and manufacturing of drug substance for live viral vaccines, including the company’s smallpox vaccine. The new capacity includes multi-suite operation up to 1000L and creates cross-platform strength for Emergent across mammalian, microbial, live viral, advanced therapy, and plasma.

In early June Sarepta also announced a USD 30 Million expansion of its Gene Therapy Centre of Excellence in Columbus, Ohio; the investment will be directed mainly towards research and development and capacity building.

Investments in facilities for traditional biologicals (antibodies, vaccines et al) were dominated by Fujifilm and Sanofi:

Fujifilm’s USD 928 Million investment at its Denmark site will expand current manufacturing and fill/finish capabilities along with assembling services. With ambitious targets for its Biologics Contract Development and Manufacturing (CDMO) business, Fujifilm aims to achieve over USD 1 Billion sales by FY 2022.

Sanofi also announced investment in a new vaccine research and production center in Neuville sur Saône, France. The move reflects the realization in countries today that nurturing domestic strengths and capabilities for vaccine R&D and manufacturing is important for developing resilient health systems that don’t bow down to future pandemics. Sanofi’s announcement alludes to support from the French authorities and the strategic choice being exerted to create this facility in France, where “Sanofi’s heart beats”. Global quest and advance booking of vaccine and therapeutic doses by national Governments (including the latest news on US booking remdesivir supplies) has laid bare this criticality in a glaring manner. Sanofi’s belief in the need for local capacity creation was alluded to by Gary Nabel, Sanofi’s CSO who has stressed on the need for a “global biosecurity network” for future pandemics. Sanofi’s investment of USD 418 Million over five years will be directed to translating to reality an envisioned center of excellence for vaccine R&D and production in France that will be a new global benchmark. The Evolutive Vaccine Facility (EVF) will have a unique design of a “central unit housing several fully digital production modules that make it possible to produce three to four vaccines simultaneously”. This modularity will make it pandemic ready with the possibility of prioritizing needed vaccines for response measures either simultaneously with other products or on a dedicated basis. One of the few collateral benefits of the highly damaging COVID-19 pandemic is this realization across countries and companies. Hopefully, we will all together nurture health systems that are more resilient and responsive; future ready to handle pandemics of this magnitude or more.

When we sift through the global noise, we are highly encouraged by the mark that emerging market companies have made in the recent past in their quest to participate in specialty pharma. This is true of companies traditionally in generics now nurturing specialty pharma portfolios in regulated/global markets, and lastly, the expanding breed of Asian ventures advancing noel therapeutics with a focus on Asian markets.

Generic companies nurturing specialty pharma portfolios (branded drugs) in global markets:

Indian and South Korean pharma companies lead the pack in this trend that is backed by strong balance sheets and a keen aspiration to go beyond generics. Earlier in May, Dr Reddys announced FDA approval for its migraine drug Elyxyb (celecoxib oral solution). More recently, in June two emerging market companies with strong foothold in US generics Sun Pharma and Hikma combined forces to expand the specialty pharma franchise. Hikma is exclusively licensing ILUMYA™ (tildrakizumab) from Sun Pharma for the Middle East and North Africa region. USFDA approved ILUMYA in March 2018, EMA in September 2018 and the Japanese MHLW approved it two days ago (end June 2020) for the treatment of plaque psoriasis in adult patients. ILUMYA is a humanized lgG1/k monoclonal antibody that selectively binds to the p19 subunit of IL-23 and inhibits its interaction with the IL-23 receptor, thus inhibiting release of proinflammatory cytokines and chemokines. Under terms of the Sun Pharma – Hikma agreement that includes undisclosed upfront and milestone payments, Hikma will be responsible for registration and commercialization in all MENA markets while Sun Pharma will be responsible for product supply. Other Indian companies such as Aurobindo, Glenmark, Cipla and Alembic have also been actively shaping their specialty pharma strategy. More east, South Korean companies such as SK Biopharma are setting new benchmarks for sustained focus and execution in specialty pharma foray.

SK Biopharma’s big IPO this week is an important milestone. The stock listed at a soaring 159% over offer price in Seoul, taking its market capitalization to $8.2 billion. The company is the first South Korean company to obtain USFDA approval for an independently developed novel drug for XCOPRI (cenobamate) for treatment of partial-onset seizures in adults. The company has to its credit discovery and development of another novel drug: solriamfetol to improve wakefulness in adult patients with excessive daytime sleepiness associated with narcolepsy or obstructive sleep apnea. The drug was later out-licenced to Jazz Pharmaceuticals for global development and commercialization, retaining rights to certain jurisdictions in Asia. The drug Sunosi™ received FDA approval in March 2019, marking the approval of the first dopamine and norepinephrine reuptake inhibitor targeting the said condition. SK Bio dons an innovative pipeline of drugs in phase 1/ 2 clinical stages targeting CNS indications like ADHD, Schizophrenia, Bipolar Disorder etc., another epilepsy drug targeting Primary Generalized Tonic-Clonic Seizure is currently in phase 3 development. SK’s journey over the last decade is a telling example of an emerging market generic company emerging as a strong contender in US CNS space with a diligently executed long haul.

Emerging market CDMOs expanding presence in US and Europe:

Piramal Pharma Solutions (PPS) acquired G&W Laboratories’ oral solids manufacturing facility in the US for USD 17.5 Million for expanding its reach in global markets. The USFDA and EMA approved facility is located in Sellerville and marks PPS’s first plant in North America. This strategic acquisition comes despite simultaneous effort from the Piramal group to pare down debt – a recent deal announced where Piramal Pharma Limited (PPL) has sold 20% of its stakes to Carlyle Group, a global private equity company for USD 490 million. This acquisition will add breadth of solid oral dosage form capabilities (tablets and capsules including immediate release, modified release, chewable & sublingual solid oral dosage forms, solutions and suspensions in liquids) in North America. We believe timing is opportune with greater localization of pharma production preferred in the post COVID era where health system resilience will receive focus in most countries.

Asian ventures developing novel therapeutics for Asian markets:

Finally, the emerging market footprint is also evident in the expanding engagement of Asian ventures in novel therapeutics developed with the objective of serving Asian markets. These include VC funded ventures as well as ones fuelled more recently by capital access for pre-revenue companies made a reality on the Hong Kong stock exchange. While this is currently a China centred trend, we expect that Indian and South Korean ventures will soon add to this momentum. Notable transactions this month include:

Roche and Innovent Biologics: Focussed on developing therapies to treat solid and blood cancers, the USD 2 Billion deal encompasses Innovent paying upfront, development and commercial milestone payments along with royalties to earn non-exclusive access to certain technologies from Roche that will enable the discovery and development of specific 2:1 T-cell bispecific antibodies (TCB) and the universal CAR-T platform. While Innovent will develop, manufacture and commercialize the products, Roche will retain an optional right to license each product for ex-China development and commercialization. If Roche chooses to exercise all of its licensing options, it will pay $ 140 million as option exercise payment, along with milestone payments upto 1.96 billion. Additionally, Innovent will also be eligible to double-digit percentage royalties on each product. Innovent’s US$485 Million IPO on the Hong Kong stock exchange was one of the initial listings to infuse confidence in the industry on depth that can be nurtured in the Asian funding hub.

Agenus Inc. and Betta Pharmaceuticals collaborated for the development and commercialization of balstilimab and zalifrelimab in Greater China, including Mainland China, Hong Kong, Macau and Taiwan. Currently, Agenus’ balstilimab is being advanced in trials and slated for BLA filing this year as a monotherapy and in combination with zalifrelimab (anti-CTLA-4) for the treatment of refractory or metastatic cervical cancer. Under the terms of the agreement, Agenus will receive USD USD 15 Million in upfront cash and USD 20 million as equity investment. The agreement also includes USD 100 million in potential milestones plus royalties on net sales. Betta receives exclusive rights for the development and commercialization of balstilimab and zalifrelimab to either as monotherapies or combination therapies, excluding intravesical delivery in greater China. Betta is a VC funded company backed in its Series B funding round by Sequoia and Lilly Asia Ventures.

The aspiration and hunger to grow beyond the traditional generics base is strong across several emerging market companies. Journeys such as SK’s provide much needed confidence in the industry that this transition to an integrated and discovery led pharma company can be successfully accomplished. We expect this deal momentum to continue; and are highly enthused by the possibility of more distributed biotech innovation engine emerging in the future.

-

- Sathguru’s Grow Beyond Webinar – discussed insights from some of the leaders in the Indian healthcare delivery ecosystem on healthcare delivery, rebound expected, how care delivery will evolve and financial/business implications for the segment in its entirety.

- Pushpa Vijayaraghavan, Director and Healthcare Practice Lead elucidates on India’s agile and steadfast response to COVID-19 crisis.

- Sathguru proud and humbled to be certified as Great Place to Work, fourth time in a row.

Connect with Authors at: E-mail healthcare@sathguru.com

Grow Beyond

Grow Beyond