2020 and 2021 have been landmark years for AI led drug discovery, digital health initiatives and integrated drug-device offerings such as continuous glucose monitoring devices. Powered by funding fuel, regulatory impetus and progressive adoption by big pharma, both drug discovery and prescription digital therapeutics segments continue to march forward with the promise of greater value realization and emergence of tangible business models for value capture.

2020 and 2021 have been pivotal for artificial intelligence (AI) and machine learning (ML) applications in drug discovery. COVID-19 has been a stark reminder of the need to re-script pace of drug discovery and development process. It still takes about 10 to 12 years to discover and develop a new drug with an estimated total stacked cost of around $2billion. Technology led transformation in drug discovery is long overdue.

Potential for disruption is across the continuum of drug discovery including early screening, lead optimization and computational drug design as well as the capital intensive phases of preclinical and clinical validation. The pursuit of in-silico, computational, data-driven approaches is not a recent phenomenon. Over the last decade and a half, several ventures have expanded possibilities of leveraging data and computational science for screening for off-target indications, potential side-effects, repurposing molecules, and designing drug candidates for enhanced success at progressive stages of drug development. Despite in-silico approaches becoming an integral part of the drug discovery and development process, value realization by ventures in the space has largely been elusive. Ventures with in-silico platforms either pivoted into focusing on advancing lead candidates from their pipeline, perished, or survived on lean cashflows from the historical SaaS / fixed project revenue business model.

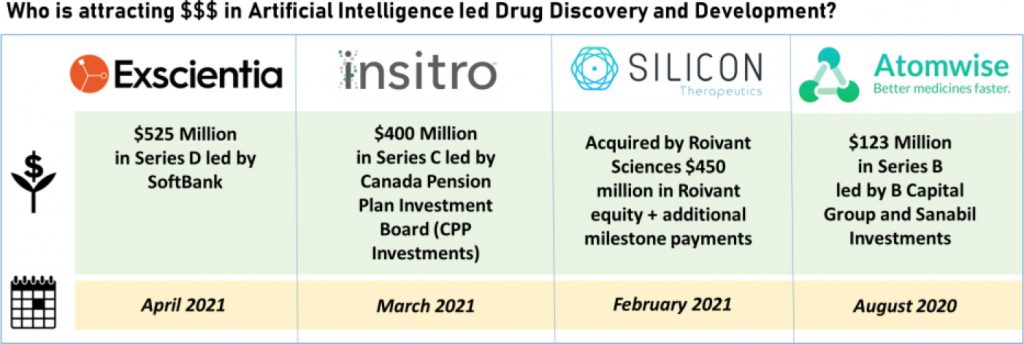

2020 and 2021 have been landmark years for value realization, emergence of tangible business models for value capture, and consequently, a renewed funding landscape. As the segment matures, there has been a shift in business model towards more co-development partnerships between young AI ventures and big pharma instead of earlier reliance on fee based SAAS. This is enabling capture of greater share of value created. VC investors have responded with expanded funding appetite. The funding fuel completes the full circle of an energized ecosystem with vibrant engagement in AI based drug discovery expanding across geographic borders. We have discussed below key funding milestones that emphasize this coming of age:

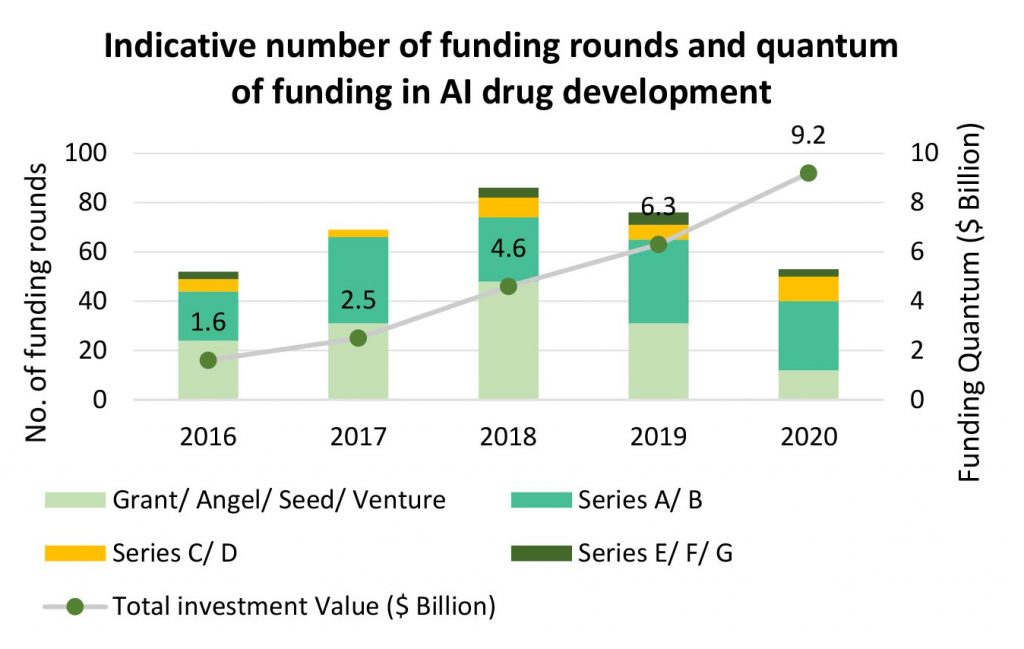

Record VC funding of $2.9 billion in 2020 symbolizing tectonic shift in AI in drug discovery

With brewing appetite gaining investor validation, 2020 set a record with VC funding in AI in drug discovery scaling USD 2.9 billion. Multiple announcements on funding and value shared partnerships progressively expanded segment momentum throughout the year.

Insitro has been one of the preferred choice for the VC ecosystem, raising consecutive funding rounds. In 2020, Insitro successfully raised USD 143 million in a Series B financing round and also received milestone payment as it hit the first operational milestone from Gilead as part of the three-year long strategic partnership to discover and develop drug targets for non-alcoholic steatohepatitis (NASH). Consecutively, in March 2021, it raised another USD 400 million in a Series C financing round. The Series C financing, alongside Insitro’s Series B Financing, has further armed Insitro with substantial resources from some of the best long-term investors in biotech. We have covered the development in detail here in our PharmForward article.

In October 2020, Insitro also announced a five–year discovery and development collaboration with Bristol Myers Squibb for Amyotrophic Lateral Sclerosis and Frontotemporal Dementia.

Another recent partnership announcement comes from InveniAI and Shionogi who have entered into a multi-year drug discovery collaboration to utilize InveniAI’s platform AlphaMeld® to research and validate drug targets, followed by Shionogi synthesizing the drugs of interest and taking them through clinical development and regulatory filing. InveniAI® is eligible to receive up to USD 200 million per program for a combination of upfront payments, development and commercial milestones, and royalties. InveniAI shares its DNA with BioXcel Therapeutics, launched in 2017, an AI-driven company that is deploying its AI-ML based expertise to re-innovate existing drugs to discover new therapeutic indices for nervous system and immuno-oncology disorders. It recently received FDA breakthrough therapy designation for BXCL501, an investigational, proprietary, orally dissolving thin film formulation of dexmedetomidine, a selective alpha-2a receptor agonist for the treatment of dementia related agitation.

The growth of AI-based drug discovery is also being iterated in a series of firsts for the sector –In April 2021, Oxford-based AI drug discovery firm Exscientia announced that it is preparing for the phase 1 clinical trial of the first immune-oncology drug molecule that was designed using AI. The molecule is a result of a joint venture between Evotech and Exscientia that led to co-invention and development of an A2a receptor antagonist for adult patients with advanced solid tumours by applying Exscientia’s proprietary platform Centaur Chemist. The novel molecule was discovered in a record timeline of eight-months. Last year, in January 2020, Exscientia met another milestone, a first both for the company and the world, when it initiated the phase 1 trial of its drug compound DSP-1181, developed in collaboration with Japan’s Sumitomo Dainippon Pharma for the treatment of obsessive-compulsive disorder. The molecule was discovered and validated in-silico in under 12 months, another record timeline in its development. It was, reportedly, also the first novel drug to be discovered using an AI platform and enter clinical development. Very recently, the company brought in USD 525 million in a Series D funding round led by SoftBank, with participation from existing investors, more about this deal is available in our PharmForward article. The key feature setting Exscientia aside from its peers is it utilization of its proprietary platform for discovery of new molecules rather than screening existing compounds for re-purposing, the most common strategy across several AI startups.

Beyond VC funding, few companies like Roivant Sciences have gone down the acquisition route to build computational drug discovery and development capabilities.In February 2021, Roivant Sciences announced the acquisition of Silicon Therapeutics, a drug discovery company deploying computational physics approach to discover small-molecule compounds for previously intractable protein targets. Roivant plans to integrate Silicon’s platform and capabilities with its own targeted protein degradation (TPD) platform that is powered by VantAI’s advanced machine learning models. Earlier, in November 2020, Silicon Therapeutics announced initiation of the phase 1 clinical trial for SNX281 for the treatment of Advanced Solid Tumors or Lymphoma. SNX281 is a novel small-molecule agonist of Stimulator of Interferon Genes (STING) and the company’s first molecule to enter the clinic. Synergistic combination of computational physics and machine learning-based drug discovery approach will power Roivant with distinctive platform capability to hunt down complex drug targets and novel molecules.

The subsequent success of the novel targets entering clinical development will determine how successful AI platforms are in validating and predicting the safety profile of novel molecules. In the formative years of the segment, the VC sentiment in the sector has been rather bullish, there had been continuous YoY increase in the number of funding rounds up until 2018. Post 2018, while the quantum of funding has increased, the number of funding rounds have decreased.

The peaked momentum in AI in drug discovery heralds transformational potential across cost of drug development and agility of the overall drug development process. Light at the end of the tunnel lies in next round of value realization where current VC investments translates to commercial value. We look forward to this decade being symbolic for rescripting sustainable opportunity for ventures that can disrupt drug discovery and development with the power of technology.

Healthcare technologies have been prominent enablers of healthcare delivery under COVID-19 created newfound constraints. While the growth has been obvious in provider-patient connecting remote care apps, there has also been significant progress in a new but expanding domain of possibilities, prescription based digital therapeutics. As highlighted below, in addition to slew of FDA approvals and a forthcoming regulatory environment, the segment has benefited from expanding payor support and big pharma’s appetite to participate in the opportunity. At the end, we are highly encouraged by the foundational momentum and the possibility of a new integrative care paradigm that seamless combines traditional drugs with these emerging technology led possibilities.

Significant approvals herald in wider innovation momentum:

In 2020, COVID-19 presented an urgent need to limit patient-physician in-person interaction and increase the adoption and dependence on digital therapeutics to continue patient access to healthcare. Taking cognizance of the same, in April 2020, FDA relaxed some of the regulatory requirements for the distribution and marketing of digital therapeutics for psychiatric disorders. The agency waived off the requirement to submit a 510(k) pre-market notification for low-risk computerized behavioural therapy devices and other digital therapeutics for psychiatric disorders for the duration of the pandemic. This enabled an early release by Pear Therapeutics of its digital therapeutic for schizophrenia management, Pear-004.

Consecutively, FDA launched the Digital Health Center of Excellence in September 2020 to further its goals of advancing digital health technologies, software as medical devices, prescription digital therapeutics etc. The centre will undertake steps to modernize the digital health ecosystem through policies and a structured regulatory framework, while also providing developers access to specialized expertise, knowledge, and tools to accelerate development and access to digital health technologies.

The impetus on part of the regulators was also supplemented with multiple first-time approvals for prescription digital therapeutics. In June 2020, FDA  cleared marketing authorization of the first game-based digital therapeutic device, EndeavorRx, to improve attention function in children with Attention Deficit Hyperactivity Disorder (ADHD) developed by Akili Interactive. A feat in itself, this journey embodies the pioneering effort of advancing what would seem like a fun concept to a clinically studied therapeutic modality for ADHD that activates the neural systems playing a key role in attention.

cleared marketing authorization of the first game-based digital therapeutic device, EndeavorRx, to improve attention function in children with Attention Deficit Hyperactivity Disorder (ADHD) developed by Akili Interactive. A feat in itself, this journey embodies the pioneering effort of advancing what would seem like a fun concept to a clinically studied therapeutic modality for ADHD that activates the neural systems playing a key role in attention.

In November 2020, FDA permitted marketing of NightWare, an Apple  Watch and Apple iPhone based digital therapeutic designed to reduce sleep disturbance related to nightmares in adults with post-traumatic stress disorder (PTSD). The platform deploys artificial intelligence to monitor biometric pattern of an individual’s sleep cycle to identify elevated heart rate and body movement associated with nightmares and is then able to interrupt the nightmare by a gentle vibration through the watch. The feedback mechanism helps in decreasing the frequency and intensity of nightmares. The platform is available through prescription only and the device is to be used in conjunction with other medications for PTSD and recommended therapies for nightmare disorder.

Watch and Apple iPhone based digital therapeutic designed to reduce sleep disturbance related to nightmares in adults with post-traumatic stress disorder (PTSD). The platform deploys artificial intelligence to monitor biometric pattern of an individual’s sleep cycle to identify elevated heart rate and body movement associated with nightmares and is then able to interrupt the nightmare by a gentle vibration through the watch. The feedback mechanism helps in decreasing the frequency and intensity of nightmares. The platform is available through prescription only and the device is to be used in conjunction with other medications for PTSD and recommended therapies for nightmare disorder.

Pear Therapeutics also received US FDA marketing authorization for SomrystTM , first prescription digital  therapeutic for use in adults with chronic insomnia. SomrystTM addresses the underlying issues of insomnia through cognitive behavioral therapy over a period of 9-weeks, delivered through a mobile device.

therapeutic for use in adults with chronic insomnia. SomrystTM addresses the underlying issues of insomnia through cognitive behavioral therapy over a period of 9-weeks, delivered through a mobile device.

![]() Recently, in March 2021, Wise Therapeutics announced its plans to pursue FDA clearance of its attention bias modification (ABM) platform across three target indications; alcohol use disorder, multiple sclerosis-related anxiety, and perinatal anxiety. Wise therapeutics is well-known for its stress and anxiety reduction app platform, Personal Zen, a gamified micro-intervention developed and clinically validated to relieve symptoms of stress and anxiety.

Recently, in March 2021, Wise Therapeutics announced its plans to pursue FDA clearance of its attention bias modification (ABM) platform across three target indications; alcohol use disorder, multiple sclerosis-related anxiety, and perinatal anxiety. Wise therapeutics is well-known for its stress and anxiety reduction app platform, Personal Zen, a gamified micro-intervention developed and clinically validated to relieve symptoms of stress and anxiety.

The approvals serve as an incentive for innovation by other developers by creating greater clarity on pathway for validation and approval and accelerating the journey of provider adoption and payer support.

Big Pharma warms up to “digital” as an evolving and integral new normal

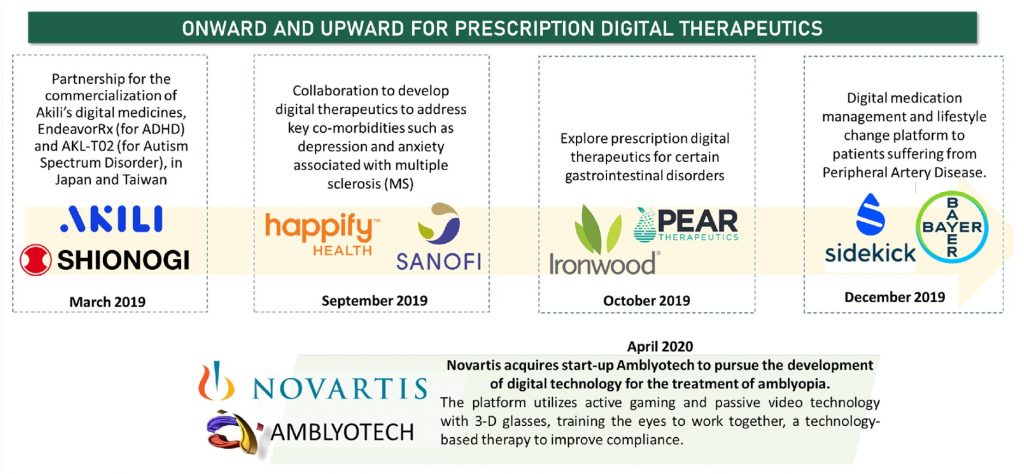

Digital therapeutic solutions and companies got their moment in the sun in 2018, beginning with a series of partnerships with big pharma to co-develop and commercialize digital interventions. Multiple partnerships ensued in 2019, and the momentum continues to spill over into 2020 and 2021. Novartis –Amblyotech acquisition is a pertinent one to note and is representative of the growing confidence and interest from big pharma to dive to digital therapeutics and embracing the co-existing space of pharmacological and digital interventions.

Continuing the momentum into 2021, is a significant milestone in Otsuka Pharmaceutical’s partnership with Click Therapeutics announced in February 2021. Otsuka and Click now advance their partnership into a critical validation milestone with a remote clinical trial to evaluate the effectiveness of digital therapeutics in patients taking anti-depressants. The two companies began collaborating in 2018 to develop and commercialize an app for the treatment of major depressive disorder.

Digital therapeutics can deeply impact psychological and behavioural outcomes, and there exists a concentrated interest in neurological conditions but there are other emerging niche applications in other therapeutic areas that can benefit from behavioural interventions such as diabetes, cardiovascular diseases et al.

Since digital therapeutics are an uncharted territory for pharma companies, partnerships with start-ups in the segment is the most sought-after strategy to explore and develop either stand-alone digital therapeutic interventions or ones in combination with drugs, to better monitor and manage clinical outcomes. Overall, the evolving ecosystem emphasizes pharma embracing a future where traditional therapeutics co-exist in an integrated manner with a new world of digital interventions. Investments and partnerships signal keenness to participate and shape this new paradigm.

Supportive regulatory ecosystem, COVID-19 led acceleration and broadening payor support

Regulatory approval milestones are paving a way for more such therapeutics to enter into clinic and in the market. As previously discussed, to address the increase in demand of digital invertventions for psychiatric disorders, FDA waived off regulatory requirements for the launch of several computerized behavioural therapy devices and other digital therapeutics for psychiatric disorders for the duration of the pandemic. However, realizing the impact of and facilitating access of such digital therapeutics will hinge largely on providers embracing and payors supporting their expanded use. There’s substantial ground to be covered in the development of payment and reimbursement models for prescription digital therapeutics. Currently there’s a heterogeneous landscape but we are encouraged by the initiatives by some forerunners:

Express Scripts’ formulary: Pharmacy benefit manager Express Scripts, now owned by Cigna, launched the industry’s first digital health formulary in May 2019. The digital health formulary is a curated list of technology- and software-enabled applications and devices that help patients prevent, manage or treat medical conditions. Inclusion of a digital therapeutic on the formulary depends on demonstrated therapeutic value, clinical outcomes, therapeutic benefit data, platform usability, security and privacy standards.

German public reimbursement: In a step towards ensuring broad public health access to digital interventions, Germany has taken a leading role by setting up a process for developers to submit digital therapeutics for reimbursement through the statutory public health insurance system, which covers over 90% of the German population. 10 such devices and prescription based digital therapeutics have now been cleared for reimbursement, for use in a wide range of conditions such as insomnia, anxiety, pain, obesity, migraine, and multiple sclerosis. Since reimbursement and insurance coverage systems are specific to each country, digital therapeutic developers have to take into account contextual challenges and differences across geographies to tailor their strategy for market launch and scalability of their solutions.

While the payors and companies navigate the complex payment and reimbursement models, it is welcoming to see more digitally powered therapeutic solutions get regulatory clearance and enter the market. We look forward to a new normal where digital and traditional therapeutics are used in an integrated manner in the future. This will substantially expand and simplify access to care, introduce greater efficiency in care delivery and leverage the power of technology. While we anticipate neurological conditions to attract the lion’s share of investments and innovation engagement, other areas such as ophthalmology, reproductive and womens health, GI et al are all also likely to gain attention. We also expect greater geographic expansion across borders at both ends – source of innovation as well as target markets.

Insulin continues to be at the heart of diabetes care. The global insulin market has always been known as one dominated by the big three producers of insulin – Eli Lilly, Novo Nordisk and Sanofi Aventis. The insulin drug market itself is at a critical cross-section – biosimilar competition is rapidly catching up with the big three across global markets and next generation analogs are unlikely to protect the franchise. However, the bigger threat to the big three insulin makers are not the biosimiilars. It doesn’t come from any drug company but rather from device makers, both large and small. The disruption is driven by dual forces from two innovations that have gained progressively expanding levels of adoption over the last decade – Insulin pumps and Continuous Glucose Monitor (CGM).

We have discussed below defining trends in the global landscape of insulin pumps and CGMs – and the expanding reality of automated insulin delivery:

Current landscape: Medtronic and Abbaott jostle alongside Dexcom, Insulet and Tandem in an expanding market for continuous glucose monitoring and automated insulin delivery

Insulet and Tandem have been primary innovators and market developers in insulin pumps.  Parked in the middle, Medtronic has been pursuing presence across both the insulin pump and CGM markets. In addition to Medtronic, Abbott’s Freesyle Libre system has been a competitor to the global leader, Dexcom. Having breached $1 billion revenues in 2018, Dexcom reported 2020 revenues of $1.9 billion and is 20% growth in 2021 with the G7 expected to get regulatory approval in second half of 2021. While trailing behind Dexcom, Abbott has benefited from competitive pricing, the Freestyle Libre 2 system gaining FDA clearance in September 2020 and initial data pointing to encouraging market uptake by high volume prescribers and paediatric endocrinologists. Abbott reported 43% growth of sales year over year for FreeStyle Libre system.

Parked in the middle, Medtronic has been pursuing presence across both the insulin pump and CGM markets. In addition to Medtronic, Abbott’s Freesyle Libre system has been a competitor to the global leader, Dexcom. Having breached $1 billion revenues in 2018, Dexcom reported 2020 revenues of $1.9 billion and is 20% growth in 2021 with the G7 expected to get regulatory approval in second half of 2021. While trailing behind Dexcom, Abbott has benefited from competitive pricing, the Freestyle Libre 2 system gaining FDA clearance in September 2020 and initial data pointing to encouraging market uptake by high volume prescribers and paediatric endocrinologists. Abbott reported 43% growth of sales year over year for FreeStyle Libre system.

The expanding partnership paradigm – CGM makers with Insulin Pump Developers

While both CGMs and insulin pump markets have been favoured by similar demand drivers and market shaping forces, corporate champions until now have been largely independent. However, with the active pursuit of partnerships between CGM and insulin pump companies now gaining heightened momentum, we perceive accelerated progress towards more seamless approach to automated insulin delivery, the ultimate goal. With Abott, Dexcom and Medtronic pursuing multiple partnerships, interoperability may not be a concern in the near term:

Abbott forged partnerships with both Insulet and Tandem, integrating it’s FreeStyle Libre CGM with their proprietary pumps, Insulet’s Omnipod and with Tandem’s t:slim X2. The partnerships target development of interoperable and closed loop systems for automated insulin delivery. In addition to FDA clearance for the FreeStyle Libre 2 system, last year Abbott had also received CE mark for FreeStyle Libre 3 system that is 70% smaller in size as compared to previous editions. Abbott claims this product to be the smallest in CGM category, delivering information every 60 seconds. FreeStyle Libre 3 and a speciality product for Athletes were launched in Europe last year. The sports biosensor will help athletes with utility beyond diabetes. To expand the market reach for sports biosensor, Abbott had entered a non-exclusive partnership with Supersapiens, a sports performance technology company.

Dexcom too forged partnerships with both Insulet and Tandem to gain from momentum for integrated products.

While Medtronic has the advantage of a portfolio combining CGM with insulin pumps, it has forged ahead by receiving CE mark for its MiniMed 780G CGM for type 1 diabetes, developed based on its proprietary algorithm to automate insulin delivery system with correction boluses being administered every five minutes. Armed with Blackstone’s financial backing of USD 337 million, Medtronic has also been making progressive efforts to provide more entrenched and comprehensive diabetes management solutions. These include more recent acquisition of Companion Medical, developer of the first smart insulin pen and earlier acquisitions of nutrition analytics firm Nutrino and Klue.

Partnerships have expanded into other digital health platforms as well. Teladoc and Welldoc, both digital health platforms with diabetes management digital solutions have partnered with insulin pump and CGM developers, connecting real-time data for recommendations, providing better patient care and management of condition. Dexcom’s CGM under pilot programs will be integrated in both Teladoc and Welldoc, whereas Eli Lilly partnered with Welldoc to connect the latter’s BlueStar® platform with their own upcoming digital insulin pen. Welldoc’s BlueStar app is a digital health solution cleared by the U.S. Food and Drug Administration (FDA) for use by adults with type 1 or type 2 diabetes for both prescription and non-prescription usage such as insulin titration support, a bolus calculator, personalized health coaching etc. The app will provide a comprehensive set of offerings, aggregating various dimensions of personalized data and connecting with healthcare providers to deliver actionable insights and provide new opportunities to optimize diabetes care with great level of patient-friendliness and convenience.

Type 2 Diabetes emerges market driver: Continued growth despite pandemic:

Earlier considered the bastion of Type 1 diabetes, current growth for insulin pumps leans heavily on adoption in Type 2 diabetes. Leerink’s 2021 survey indicated ~ 17% current adoption in the US Type 2 market and substantial potential for year on year market expansion until adoption peaks at about 29%. While this expected peak adoption is substantially lower the 60% + in Type 1 patients in US, this is expected to still contribute to overall market size of over $ 2 billion. Continued growth forecast for 2021 is based on geographic expansion (Abbott’s Libre 2 system was also approved in Canada in 2020), expanding coverage with payors embracing CGMs and insulin pumps and the opening of type 2 diabetes market.

Looking ahead: Big Pharma steps into the ring, Medtronic crosses over the pen and new product launches:

Big pharma steps in to participate in the automated delivery opportunity: The big three pharma companies in insulin, Novo Nordisk, Sanofi Aventis and Eli Lilly have been dealing with two significant tectonic shifts in the insulin market – the progressively expanding adoption of automated delivery of insulin and the emergence of biosimilars on the global stage. While Novo Nordisk has responding by expanding investments in obesity and NASH, Eli Lilly has time and again acknowledged the shift and the criticality of participating in automated insulin delivery to retain its share of the insulin market.

Co-incidentally Medtronic and Eli Lilly had announced a partnership more than a decade ago for better diabetes care but no synergy has been explored through the years. Eli Lilly, on its part, commenced with its own internal development at newly created innovation center in Boston. In 2018, Lilly unveiled its closed loop hybrid system integrated with the Dexcom G6 CGM. While the in-house developed device was expected to launch soon, Lilly’s big November 2020 announcement heralds an opportunistic partnership that enables it deeper deeper into automated insulin delivery. Lilly announced its exclusive US market partnership with Switzerland based Ypsomed, a first of its kind where a insulin maker has joined forced with an established developer of insulin pumps. The Ypsomed partnership gives Lilly’s exclusive commercialization rights in US for YpsoPump after the latest model is cleared by USFDA. The YpsoPump is available in more than 20 countries and was launched in 2016. The development is significant and is reflective of the broader trend of device strategy emerging as a survival requirement in several pharma product categories.

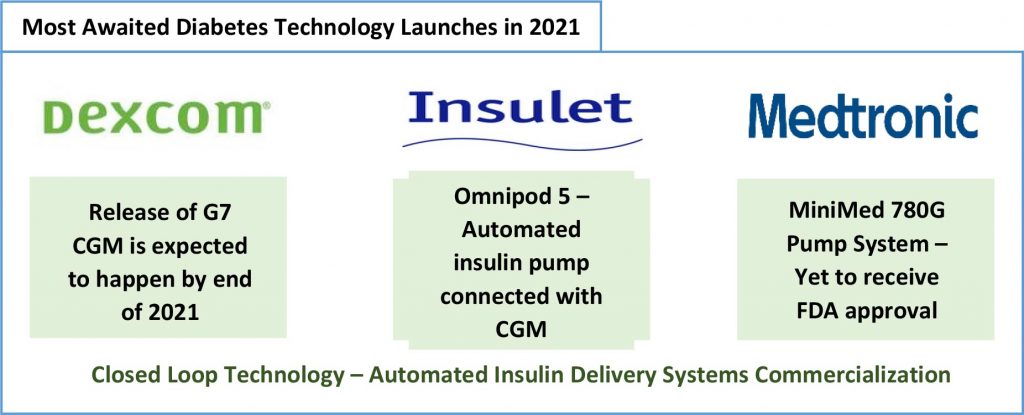

In addition to the Lilly and Ypsomed offering, the following product launches are also anticipated in 2021:

Dexcom’s G7 CGM’s launch, that was pushed forward from 2020, could further strengthen Dexcom’s position in the global landscape. The new CGM will be competing with Abbott’s FreeStyle Libre 3, with respect to size and effectiveness of algorithm. Tandem Control IQ technology was the first algorithm to automate the insulin delivery systems and following it Insulet has developed an algorithm to be integrated with its Omnipod 5, which awaits regulatory approval and post which commercial launch. Having received CE mark for MiniMed 780G, the CGM has been launched by Medtronic in Europe but approval from USFDA is still in progress along with which launch of product in US.

Grow Beyond

Grow Beyond