Generics: Unconventional investment fillip and continued PE interest

“While the threat of price erosion continues to loom large on US generics, the entry of an unexpected investor Mark Cuban draws attention to the unique cost-plus pricing model proposed. The promise of price disruption in generics is intriguing, with viability hinging on hard to achieve threshold of scale in each product and size of the overall portfolio. Across the continent, PE funds continue to keep afloat investment momentum in complex generics.”

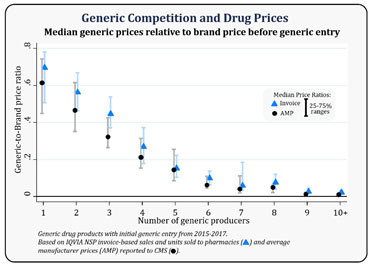

The global generics market has been through a sustained phase of pricing pressures that continue to loom large. In the US generic market, pricing pressure attributed to higher competition has been true since the introduction of GDUFA. While approval timelines have shrunk from the pre-GDUFA average of 36 months to about ten months in the last few years, the intensity of competition has increased multifold. It is emphatic in the common phenomenon of shared Para IV exclusivity amongst more than five companies. The FDA has also acknowledged this correlation between generic competition and drug prices in a December 2019 publication pointing to historical evidence of a 95% reduction in Average Manufacturer Price (AMP) of generics compared to brand prices when there is six or more generic competitors’ vs. 31% reduction with a single generic competitor. While the level of the year on year price decline has cooled off from the peak in CY 2017 and 2018 (of about 15%), the threat of price erosion continues to cause business stress with no sign of competitive intensity wearing out anytime soon.

The FDA has also acknowledged this correlation between generic competition and drug prices in a December 2019 publication pointing to historical evidence of a 95% reduction in Average Manufacturer Price (AMP) of generics compared to brand prices when there is six or more generic competitors’ vs. 31% reduction with a single generic competitor. While the level of the year on year price decline has cooled off from the peak in CY 2017 and 2018 (of about 15%), the threat of price erosion continues to cause business stress with no sign of competitive intensity wearing out anytime soon.

Mark Cuban enters with a promise to disrupt price in a market reeling under pricing pressure.

January 2021 formally marks the foray into pharma generics of a much unexpected investor, the Shark Tank star Mark Cuban. He has launched a new company Mark Cuban Cost Plus Drug Company that will produce low-cost versions of generics that continue to carry a high price tag. The company’s first drug is Albendazole, an antiparasitic included in the WHO list of essential medicines. The complaints plan to price its Albendazole generic at USD 20 per tablet MSRP vs. the current threshold of the average cash price of USD 225 per tablet. The company aims to produce over 100 generic drugs by the end of 2021 and has already shared the intent to set up a pharmaceutical manufacturing facility in Dallas by 2022.

The promise of price disruption for generics is backed by the intent to use a unique cost-plus pricing model – pegging the wholesale price at the cost of manufacturing and distribution plus a 15% profit margin. The model proposed is intriguing in the current competitive landscape. Post-GDUFA, companies have struggled to maintain market shares in a highly competitive landscape. A cost plus 15% profit margin model would imply that scale becomes pertinent to viability. Survival will hinge on the plate for each product launched at thin margins, as well as the possibility of expanding the business model to larger generic opportunities (that are likely to be more intensely competitive). While we stay enthused by Mark Cuban’s liking for the pharmaceutical industry, we tread cautiously on assessing potential impact given the criticality for rapid and sustained scale for this business model to succeed. The steep challenge of price competition from existing and larger generic companies with the pre-existing advantage of manufacturing scale and product development agility is also steep.

The development comes at the heel of an unusual year with disrupted supply chains and a focus on domestic manufacturing resilience across countries. In our December 2020 roundup, we discussed non-dilutive grant support from the US Government (Kodak and Paratek) to catalyze domestic production of pharmaceutical API and formulations. While Mr. Mark Cuban generic experiment plays out, we simultaneously expect continued emphasis from governments worldwide on enhancing the level of domestic production.

Private Equity funds continue to warm up to generics.

While 2020 saw a leaner appetite for strategic investments in pharma generics, Private Equity stepped in to bridge the appetite. Our August 2020 newsletter had discussed the high level of emerging market activity with PE firm KKR acquiring JB Chemicals for USD 400 million and Advent International acquiring a controlling stake in RA Chem. January 2021 alludes to interest across borders with PE funds steering continued operations and growth of London based Advanz Pharma (earlier traded on NASDAQ as Concordia).

Advanz Pharma, a specialty pharmaceutical company, announced accepting the acquisition offer from Nordic Capital, a private equity investor focusing on North European markets. Nordic Capital will acquire the entire company for an equity value of around USD 846 million that is purposed to translate to an enterprise value of approximately USD 2 billion, including debt.

Formed in 2015 due to Concordia Healthcare and AMCO’s merger, Advanz is present in multiple therapeutic areas, including endocrinology, urology, pain management, and cardiology. The specialty generics company focuses on complex medicines and has nurtured a direct sales presence across Europe. The company was trading on NASDAQ as Concordia until 2018, when it was delisted as part of a debt restructuring deal and christened Advanz Pharma. We anticipate greater deal momentum in generics across geographic borders. Private Equity funds have a primed appetite, and corporate purse strings are now beginning to get loosened after a year focused on cash conservation.

Grow Beyond

Grow Beyond