The COVID-19 pandemic severely disrupted manufacturing operations across the globe. Beyond manufacturing, global supply chains were set astray and the risk of import dependence was starkly evident.

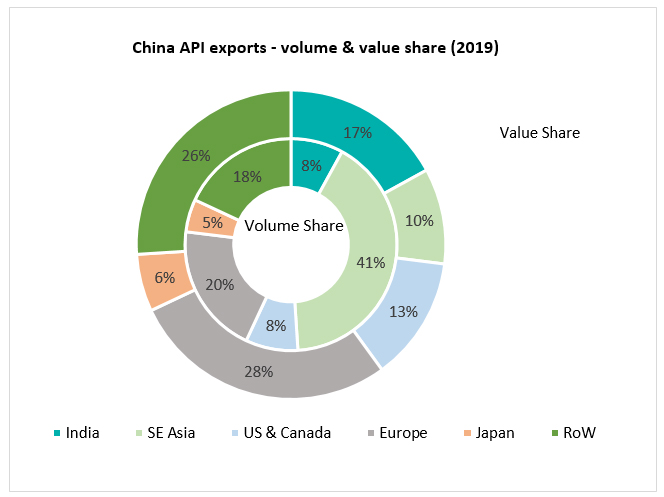

Over the last several decades, pharmaceutical value chain, especially for generic drugs, has become more geographically concentrated in a smaller set of countries globally. While China has emerged as a major base for API production,  India has emerged as the dominant hub for high quality formulation manufacturing. Analysis of the composition of China’s ~ $30billion API export points to pervasive global dependence on Chinese starting material for the pharmaceutical value chain. This has led of shrinking of domestic manufacturing capacity in most countries across the world, especially for generic drugs. In countries where historical capacity was lean, there has been a progressive deterioration of business case for new manufacturing investments in generics. Constant pricing pressure in generic drugs across geographic markets (including the US) and quest for cost competiveness has deterred industry investments and driven deeper import dependence. Hence, for most essential drugs that are now highly genericized, formulations are often imported. Even if formulations are produced domestically, the API are imported. Domestic API production is also often a façade with high import dependence for the building blocks, intermediates and key starting materials (KSMs).

India has emerged as the dominant hub for high quality formulation manufacturing. Analysis of the composition of China’s ~ $30billion API export points to pervasive global dependence on Chinese starting material for the pharmaceutical value chain. This has led of shrinking of domestic manufacturing capacity in most countries across the world, especially for generic drugs. In countries where historical capacity was lean, there has been a progressive deterioration of business case for new manufacturing investments in generics. Constant pricing pressure in generic drugs across geographic markets (including the US) and quest for cost competiveness has deterred industry investments and driven deeper import dependence. Hence, for most essential drugs that are now highly genericized, formulations are often imported. Even if formulations are produced domestically, the API are imported. Domestic API production is also often a façade with high import dependence for the building blocks, intermediates and key starting materials (KSMs).

COVID19 led disruptions have laid bare the gaps in the pharma manufacturing value chain at the country level. This has triggered long overdue action from policymakers to nurture more resilient manufacturing engagement in country for essential drugs. The awakening spanned high and low/middle income countries, the east and the west:

![]()

United States – Catalyzing domestic productions & advanced manufacturing for competitiveness

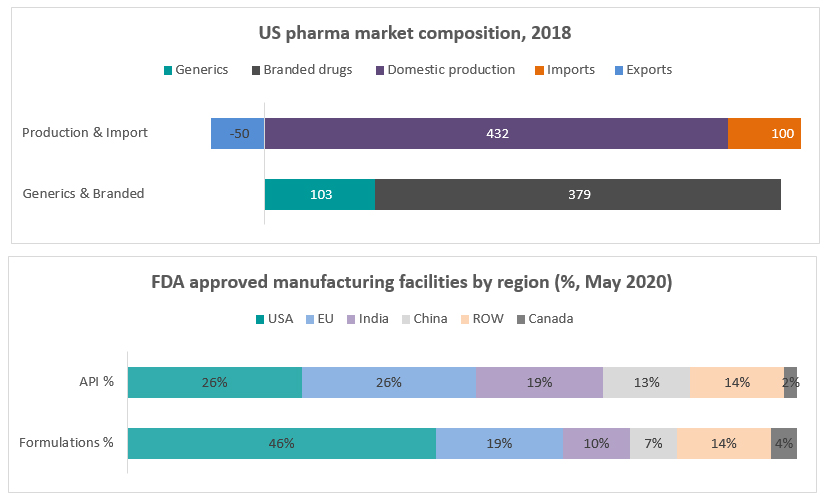

The US continues to be the largest pharma market in the world, clocking close to $450billion. Import dependence is limited to about $100billion; and value wise ~60% of the imports are from Europe and UK primarily for branded drugs. However, the challenge to the ecosystem resilience is from the high import dependence for generics, especially essential drugs such as anti-infectives. As of 2018 end, while generics only comprised 21% of the pharma market by value, they had breached 90% of number of prescriptions dispensed.

Attention to the issue of pharma resilience has snowballed in many ways: a Congressional hearing in October 2020 with the Director of CDER, FDA testifying with data on number of facilities outside the country, implications for national security and measures to revitalize domestic pharmaceutical manufacturing. The testimony acknowledges the growing dependence on imported Chinese API (with 72% of approved API facilities being overseas), dearth of data on quantum of dependence and proposes advanced manufacturing to foster competitiveness in American companies who will also be supported by extra-mural and intra-mural grants. The US Government’s focus was also evident in multiple instances of stimulative funding to industry to create domestic production that can negate offshoring. Indicative examples include:

$765million to Kodak: Initiated as a domestic response to COVID-19, under the Defense Production Act (DPA), Eastman Kodak Company (Kodak) received a USD 765 Million loan from US International Development Finance Corporation (DFC) to launch Kodak Pharmaceuticals. The loan will accelerate repurposing and expanding the facilities in Rochester, New York and St. Paul by incorporating manufacturing and advanced technology capabilities. When fully operational, Kodak Pharmaceutical will have the capacity to produce about 25% of the APIs used in non-biologic, non-antibacterial, generic pharmaceuticals.

$354million to Phlow Corporation led consortium: One of the largest ever grant awards by BARDA, the 4-year and $354million contract with BARDA (extendable to $812 million over 10 years) will support creation of a new drug manufacturing facility in Virginia along with increased capacity to produce active pharmaceutical ingredients (APIs) and chemical compounds for those ingredients. Ampac Fine Chemicals, a custom API manufacturer; Civica RX, a non-profit generic drug company; and the Medicines for All Institute at Virginia Commonwealth University’s College of Engineering

$285million to Paratek: BARDA also extended $285million to Paratek Pharmaceuticals, maker of novel antibiotic Nuzyra for on-shoring of the manufacturing supply chain. Though commitment for stock piling of Paratek’s drug is only for 10,000 courses of treatment, BARDA’s support will negate future dependence on the all-European base of API and formulation that Paratek currently relies on.

![]()

India – Reducing API import dependence and fostering value chain resilience

Shrinking of API manufacturing base has been true even for countries such as India. India has rightfully earned the reputation of ‘’Pharmacy of the World” and exported pharmaceutical products worth $15.61billion in 2020. However, India pharma manufacturing landscape represents stark contrasts. Leading export oriented pharma companies thrive on backward integration (~ 70% in larger companies) to power competitiveness in global generics. But, at the other end, several smaller API companies holding 1 to 5 DMFs and revenue less than $100 Million have faced mortality. Lack of competitiveness vs lower priced Chinese APIs continues to deepen import dependence for several essential drugs. Even in products where API import dependence is relatively lower, the health system and supply chain continue to be fragile if there is high import dependence for intermediates and key starting materials (KSMs). Policy action was long overdue and the 2015 Katoch Committee Report emphatically called for action. India’s policy stimulus has included two pronged approach covering 53 APIs identified as essential drugs with high import dependence:

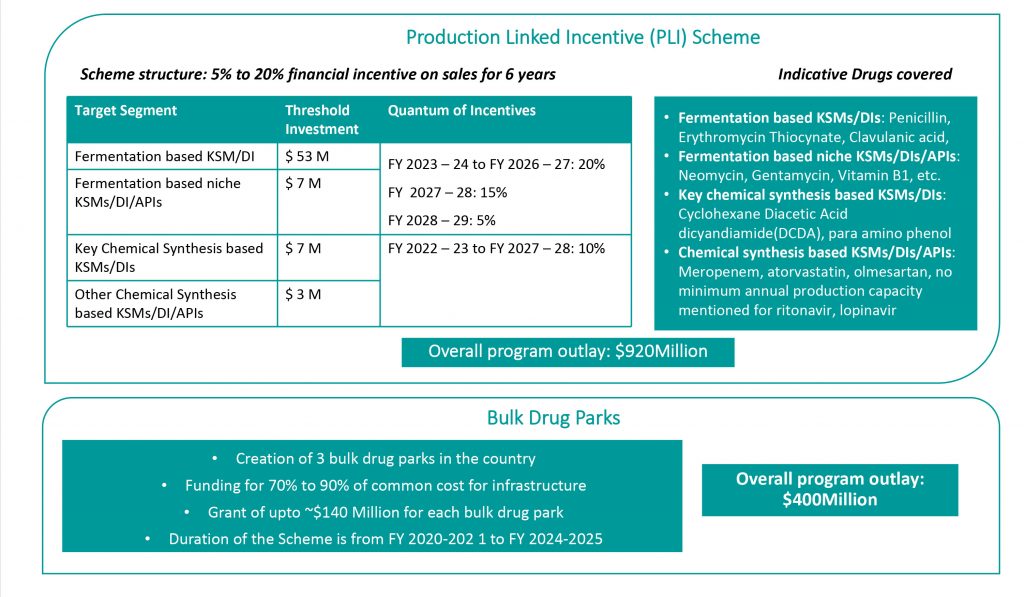

Production Linked Incentive Scheme: In a bid to counter the persistent business threat of low priced Chinese imports, the Government has introduced the Production Linked Incentive Scheme (PLI) for domestic manufacture of 53 APIs where import dependence is a threat to access to essential drugs as well as certain Key Starting Material (KSMs) and Drug Intermediates (Dis). With an overall outlay of $920Million, the scheme hopes to provide production linked incentives of 5% to 20% on revenue for the stipulated drugs.

Bulk Drug Parks: Capex recovery for new API investments is a deterred due to marginal cost based imports from Chinese companies. As part of the efforts to create competitiveness for Indian companies, the Government has committed to fund 70% to 90% of the costs of common infrastructure in bulk drug parks that will provide soft landing for API companies. This will enable environmental compliance in production without burdening companies with capex for common Effluent Treatment Plants.

Grow Beyond

Grow Beyond