The COVID-19 pandemic has been a stark reminder of the need to better manager zoonotic threats and focus on the One Health approach. Across geographic borders, we hope this unfortunate past year results in substantially higher level of stakeholder focus on animal health and welfare.

In human healthcare, the silver lining during the pandemic has been the high level of stimulus of technology adoption and ecosystem priming for technology led disruption of healthcare delivery. It is exciting to note that the trend has been true for animal healthcare as well. In addition to the focus on technology, there has been substantial momentum in India and in the global context on consolidation, M&A, vaccines for zoonotic diseases and next generation technologies for feed and nutrition. In our first animal health newsletter of 2021, we bring you round up of key developments across animal health and nutrition from India and around the world. We hope you enjoy reading the newsletter and we look forward to your comments and reflections.

Telemedicine in private sector: As the COVID-19 pandemic transformed our world from  a physically interactive one to a virtual one, healthcare delivery as usual was no more a choice. Teleconsultation and digitization in healthcare delivery institutions that was long overdue finally surged rapidly during the pandemic. In addition humans being able to access healthcare online, his ‘best friend’ too got these privileges with several startups developing applications for online pet consultations with veterinarians. Some of the startups that garnered attention by using technology to service pet owners include: CoZo, an app designed to connect pet owners to veterinarians virtually that now claims to have more than 50 veterinarians across the country and cumulative consultations of more than 20,000. Pursuing an adjacency from the primary focus on human healthcare, Practo has also now added veterinary consultation. Other pet-centric startups that saw a rise in customer base are Pawshbox, a pet supplies store in Pune, and Wiggles, a one-stop solution for pet healthcare offering pet supplies, grooming products, and services along with online consultations. Beyond pets, the cattle IoT trend has been gaining momentum albeit with business models still being ambiguous. The relatively more deep pocketed startup in the segment, Stellapps, introduced “Moopay,” an automated platform for dairy farmers enabling dairy processors to directly pay every registered farmer, reducing cash handling and immediate transfer of money to dairy farmers.

a physically interactive one to a virtual one, healthcare delivery as usual was no more a choice. Teleconsultation and digitization in healthcare delivery institutions that was long overdue finally surged rapidly during the pandemic. In addition humans being able to access healthcare online, his ‘best friend’ too got these privileges with several startups developing applications for online pet consultations with veterinarians. Some of the startups that garnered attention by using technology to service pet owners include: CoZo, an app designed to connect pet owners to veterinarians virtually that now claims to have more than 50 veterinarians across the country and cumulative consultations of more than 20,000. Pursuing an adjacency from the primary focus on human healthcare, Practo has also now added veterinary consultation. Other pet-centric startups that saw a rise in customer base are Pawshbox, a pet supplies store in Pune, and Wiggles, a one-stop solution for pet healthcare offering pet supplies, grooming products, and services along with online consultations. Beyond pets, the cattle IoT trend has been gaining momentum albeit with business models still being ambiguous. The relatively more deep pocketed startup in the segment, Stellapps, introduced “Moopay,” an automated platform for dairy farmers enabling dairy processors to directly pay every registered farmer, reducing cash handling and immediate transfer of money to dairy farmers.

Telemedicine in public sector: With the pandemic and the floods in Southern India over the past year, the Animal Husbandry Department in Kerala (AHD) introduced tele-veterinary, comprising a telemedicine facility and a veterinary team to attend to animals in flood-hit areas. These district-level facilities were able to cater to priority cases and reduce the number of camps required to attend to cattle. In Kerala, the AHD directed teams to Kottayam, Idukki and sent Rapid Response Teams (RRTS) to various taluks to identify safe and flood-prone zones and devise a plan to move the cattle accordingly. AHD also provided the rescued cattle with treatment and fodder and compensated according to the National Disaster Fund, along with settling aid amount for flood mitigation.

While the COVID-19 pandemic ravaged across the country, simultaneously the swine  industry in the North East states of India continued to struggle into 2021 with the African Swine Fever (ASF) outbreak, a highly contagious hemorrhagic viral disease spread via contaminated feed and fomites. Although the symptoms are analogous to classical swine fever (CSF), ASF does not have an approved vaccine to date. Historic outbreaks of ASF have been reported across various parts of Africa, Europe, South Africa, and the Caribbean, followed by the recent occurrence in North East India from February 2020 through early 2021.

industry in the North East states of India continued to struggle into 2021 with the African Swine Fever (ASF) outbreak, a highly contagious hemorrhagic viral disease spread via contaminated feed and fomites. Although the symptoms are analogous to classical swine fever (CSF), ASF does not have an approved vaccine to date. Historic outbreaks of ASF have been reported across various parts of Africa, Europe, South Africa, and the Caribbean, followed by the recent occurrence in North East India from February 2020 through early 2021.

FAO has been monitoring the outbreak of ASF in Asia since 2018, and about 1.19 Mn pigs were culled since its first outbreak in China in August 2018. The outbreak in India was reported first in Assam and Arunachal Pradesh earlier in February 2020. In the absence of vaccination, the Government authorities brought preventive measures that included culling operation across 14 districts of Assam and ban on import of live pigs and sale of pork in Nagaland. Additionally, the Pygmy Hog Conservation Program (PHCP), a collaborative project by Durrell Wildlife Conservation Trust, IUCN/SSC Wild Pig Specialist Group, local biodiversity conservation group, Assam forest department, and Ministry of Environment Forest and Climate Change, has been initiated to set up a decontamination facility for Pygmy hogs at Pygmy Hog Breeding Center, Guwahati and Nameri breeding center. The treat of disease transmission continues with incidence in Mizoram reported as recently as April 2021.

The ASF outbreak has brought the threat of extinction to pygmy hogs, the smallest and rarest pigs enlisted as Critically Endangered species by the International Union of Conservation of Nature (IUCN), currently left in some pockets in Assam only. According to the Animal Health Statistics 2019 data, pigs comprise 1.7% of India’s total livestock population, with higher concentration in North Eastern states of Assam, J&K, Meghalaya, Tripura, and Chhattisgarh. Import of Indian pork has been banned after report of outbreak to The World Organisation for Animal Health, formerly OIE, in May 2020. Given the lower value of pork exports of India, economic impact may not be of an alarming magnitude. However, given the high level of backyard farming in Indian piggery industry in the North East, the outbreak is likely to impact livelihoods and sustenance of backyard farmers, especially in the midst of a pandemic.

Brucellosis is one of the most significant One Health threats in the Indian context.  India has the largest livestock population in the world. Literature points to brucellosis incidence across all states in India. NIVEDI’s 2016 Annual Reports indicates overall prevalence of bovine brucellosis to be around 2.3% with Nagaland, Punjab, Rajasthan and Telangana being identified as hotspots in the country. Brucellosis is an endemic and deadly zoonotic disease in India, and affects the reproductive health of animals, causing abortions, retained placenta and infertility. Hence, in addition to the zoonotic threat, it is also highly detrimental to the dairy industry, which depends on year-round calving of milch animals.

India has the largest livestock population in the world. Literature points to brucellosis incidence across all states in India. NIVEDI’s 2016 Annual Reports indicates overall prevalence of bovine brucellosis to be around 2.3% with Nagaland, Punjab, Rajasthan and Telangana being identified as hotspots in the country. Brucellosis is an endemic and deadly zoonotic disease in India, and affects the reproductive health of animals, causing abortions, retained placenta and infertility. Hence, in addition to the zoonotic threat, it is also highly detrimental to the dairy industry, which depends on year-round calving of milch animals.

Considering the importance of this incapacitating disease, the government started the Brucellosis-CP in the year 2010, enabling mass vaccination of all female calves of age between 6-8 months in areas of high incidence. However, the vaccination program’s outcomes were impacted by poor coverage, short supply of vaccines needed for the program and lack of coverage of small ruminants. This vaccination of calves is done using live attenuated B. abortus S19 strain. Current vaccines have challenges such as residual virulence, lack of suitable for vaccination of adult animals and possibility of abortion when used in pregnant animals. To enable the country’s immunization program with a more effective program, ICAR-IVRI’s funded by DBT’s network program on brucellosis had developed a vaccine with a modified strain of B. abortus S19. With this technology being licensed to private sector in September 2020, the country stands to gain with improved access possibility for a key zoonotic disease vaccine where there is an explicit control program.

According to the 20th Census data, the pig population in India is small and mainly concentrated in the Northeastern corner of the country, with pork consumption representing about 9% of the country’s animal protein source and governments focus on a healthy and disease free swine population. To achieve such a goal, the government of India has initiated the National Classical Swine Fever Control Program (CSF-CP) in its 10th-year plan for vaccinating the pigs in the North Eastern States and gradually increasing to other states due to the current limitation of a domestically produced vaccine. However, relatively low volume of demand and lack access to technology have implied reliance on imported vaccines for the CSF vaccination program. To address this continuing challenge, Indian Council of Agricultural Research (ICAR)’s Indian Veterinary Research Institute (IVRI) developed a cost-effective live attenuated CSF vaccine with longer immunity. Scale-up and access to the vaccine for the country’s immunization program has been facilitated through licensing to multiple private sector partners. While Indian Immunological Limited (IIL) has launched the vaccine in May 2020, the second licensee Hester Biosciences is also in the process of advancing to commercial milestones.

There are currently about 68,000 registered veterinary practitioners in India [PIB press release dated 26th July 2016 from Ministry of Agriculture] across the public and private sector. With more people adopting pets, there is a tremendous shortage of veterinarians across the country. While metro cities have great establishments of small and mid-sized pet clinics, the tier II and tier III cities face hurdles in accessing care for their pets and livestock. As the growing focus on animal health has elucidated the need for increasing the capacity of veterinarians in the country, various state governments are taking up initiatives to address this demand. The States of Tamil Nadu and Odisha have inspected sites and allocated lands to establish veterinary colleges in their respective states. Tamil Nadu Chief Minister announced setting a veterinary college and research institute across 2.5 acres of land, with a budget of INR 265 Crore, out of which INR 94.72 crores is sanctioned for the first Phase. The college plans on admitting 40 students annually. Similarly, 63.23 acres of land have been allocated to Centurion University of Technology and Management (CUTM) to recommend the Odisha Industrial Infrastructure Development Corporation by the higher education department to establish a school of veterinary science and animal husbandry in the district of Gajapati. The college will collaborate with an Australian University for research work and have programs for training farmers.

[PIB press release dated 26th July 2016 from Ministry of Agriculture] across the public and private sector. With more people adopting pets, there is a tremendous shortage of veterinarians across the country. While metro cities have great establishments of small and mid-sized pet clinics, the tier II and tier III cities face hurdles in accessing care for their pets and livestock. As the growing focus on animal health has elucidated the need for increasing the capacity of veterinarians in the country, various state governments are taking up initiatives to address this demand. The States of Tamil Nadu and Odisha have inspected sites and allocated lands to establish veterinary colleges in their respective states. Tamil Nadu Chief Minister announced setting a veterinary college and research institute across 2.5 acres of land, with a budget of INR 265 Crore, out of which INR 94.72 crores is sanctioned for the first Phase. The college plans on admitting 40 students annually. Similarly, 63.23 acres of land have been allocated to Centurion University of Technology and Management (CUTM) to recommend the Odisha Industrial Infrastructure Development Corporation by the higher education department to establish a school of veterinary science and animal husbandry in the district of Gajapati. The college will collaborate with an Australian University for research work and have programs for training farmers.

Private equity investment appetite in Indian animal health has been high.  Perceived as a niche segment with substantial opportunity for growth, investment momentum historically has been subdued due to limited depth in investments of target scale. In a largely fragmented landscape, there is substantial scope for consolidation and capital efficient growth. The last year has been an emphatic statement of expanding investor appetite and potential for consolidation. When combined with deals in the pipeline, animal health deal appetite has spanned domestic formulations business, domestic and global API as well as innovation led ventures that offer solutions for unmet needs. The segment basked in glory with two larger investments ratifying the compelling investment thesis:

Perceived as a niche segment with substantial opportunity for growth, investment momentum historically has been subdued due to limited depth in investments of target scale. In a largely fragmented landscape, there is substantial scope for consolidation and capital efficient growth. The last year has been an emphatic statement of expanding investor appetite and potential for consolidation. When combined with deals in the pipeline, animal health deal appetite has spanned domestic formulations business, domestic and global API as well as innovation led ventures that offer solutions for unmet needs. The segment basked in glory with two larger investments ratifying the compelling investment thesis:

Buyout of Zydus Cadila’s animal health business: Carve out deals in animal health have been common in the global pharma landscape. The first on those lines in India was the buy-out of the animal health business of Cadila Healthcare (Zydus). Announced in May 2021, the deal reflected growth potential perceived in Indian domestic animal health market. A consortium of private equity funds led by Multiples Alternate Assets Management will acquire 100% of the business of Zydus Animal Health for around USD 390 million (INR 2,900 crores). The animal health subsidiary of the Ahmedabad based Pharmaceutical Company enjoys a pioneering position in India offering a wide spectrum of therapeutic and nutritional products for livestock and poultry. With expansion into United States and European markets planned, the buy-out offers a well primed foundation to capitalize on growth opportunities in global animal health landscape.

Carlyle investment in Sequent Scientific: In May 2020, Carlyle acquired majority interest in the largest single platform for animal health in India, SeQuent Scientific. SeQuent Scientific’s revenue for the twelve months ended December 2019 was USD 154 million (INR 1,160 crores) and the deal announcement entailed a consideration of USD 210 million for stipulated ownership of 74% in SeQuent. As a PIPE deal, the final ownership structure has been impacted by outcome of the open offer subsequently made. The deal again emphasized scalability and potential for consolidation for an India based animal health market to target global markets.

The USD 6.89Bn Elanco – Bayer deal: Despite being a niche segment, deal activity  in animal health continues to be ripe with momentum across both strategic and financial investments. The largest deal in the segment, was Elanco’s acquisition of Bayer’s animal health business announced in August 2020. The deal helped Elanco sprint up the ladder and become the second-largest animal health company at the heel of Zoetis, a former subsidiary of Pfizer. Almost two years after Bayer initiated talks of casting off its Animal health division to revamp and strengthen its focus on life sciences, the deal valued at USD 6.89 Bn was closed with Elanco with USD 5.17 Bn cash payment and USD 72.9 Mn shares of common stock. The acquisition will strengthen Elanco’s portfolio by incorporating Bayer’s direct-to-consumer experience and will expand overall portfolio of solutions. It will also strengthen Elanco’s Innovation, Portfolio, and Productivity (IPP) strategy by adding new capabilities to Elanco’s existing R&D Pipeline. Elanco anticipates that the deal with expand scale of its pet health business by 50 percent while the farm animal and aquaculture portfolio will benefit from a broader customer base.

in animal health continues to be ripe with momentum across both strategic and financial investments. The largest deal in the segment, was Elanco’s acquisition of Bayer’s animal health business announced in August 2020. The deal helped Elanco sprint up the ladder and become the second-largest animal health company at the heel of Zoetis, a former subsidiary of Pfizer. Almost two years after Bayer initiated talks of casting off its Animal health division to revamp and strengthen its focus on life sciences, the deal valued at USD 6.89 Bn was closed with Elanco with USD 5.17 Bn cash payment and USD 72.9 Mn shares of common stock. The acquisition will strengthen Elanco’s portfolio by incorporating Bayer’s direct-to-consumer experience and will expand overall portfolio of solutions. It will also strengthen Elanco’s Innovation, Portfolio, and Productivity (IPP) strategy by adding new capabilities to Elanco’s existing R&D Pipeline. Elanco anticipates that the deal with expand scale of its pet health business by 50 percent while the farm animal and aquaculture portfolio will benefit from a broader customer base.

Merck on an acquisitive spree: Merck Animal Health added to the deal momentum with a spree of acquisitions and partnerships. Strategic deal drivers spanned the breadth of: increasing product portfolio in companion animal and poultry segment, manufacturing capacity expansion for vaccines, as well as partnerships for education and awareness creation:

- Companion animal portfolio expansion: Merck Animal Health acquired from the leading French company, Virbac, the US rights for parasiticides for dogs – SENTINEL® FLAVOR TABS® and SENTINEL® SPECTRUM® for a deal value of approximately USD 400 Mn. With this divestment, Virbac paves an opportunity to rebalance its North American portfolio. Merck’s companion animal product portfolio was also strengthened by the US FDA’s approval of BRAVECTO, monthly chews providing protection against flea and ticks.

- Merck Animal Health also announced a USD 100 Mn investment in its DeSoto, Kansas manufacturing facility. Merck initially invested USD 34 Mn to expand and improve its vaccine production capacity at the plant, which focuses on cattle, swine, and equine vaccines, and monoclonal antibodies for companion animals. The remaining USD 66 Mn will be for future investments planned.

- In March 2020, Merck Animal Health outside the United States and Canada closed the acquisition of Poultry Sense. This UK-based privately-held company provider’s poultry farmer’s technology based solution to track and analyze their flock’s overall health performance and thereby enhance farm productivity and food safety. Poultry Sense’s technology platform also prevents disease outbreaks with early detection of health conditions which can be read through software reports in real-time. Its product portfolio will join the newly formed operating unit, Merck Animal Health Intelligence, which specializes in identification, traceability, monitoring solutions, and services that improve animal health and management outcomes.

- ‘Mooing’ towards its focus on livestock, Merck Animal Health partnered with one of the largest beef-breeding associations in the US, Kansas City’s American Hereford Association (AHA), to provide an opportunity for cattle producers and its members to be educated on animal health programs for maximizing the genetic potential of cattle. This educational partnership will last for five years, with Merck being involved in AHA’s Annual Membership Meeting and Conference while also providing various online and in-person learning opportunities to enhance animal productivity.

Ceva – ThunderWorks: Earlier last year, Ceva Animal Health acquired ThunderWorks, a company famous for its thunder shirts, calming shirts for companion animals. Ceva anticipates that this acquisition will bolster its existing portfolio of drugs such as ADAPTIL, FELIWAY, SELGIAN for behavior and wellbeing in cats and dogs. The shirts are targeted to address behavioral disorders such as anxiety during travel, storms, or fireworks in companion animals.

PE investments: We earlier discussed the PE buy-outs of the Zydus’ animal health business and Sequent Scientific on the home turf. Globally, while strategic investments overshadowed PE deals, appetite from PE funds has been rife. KKR acquired a majority stake from Tomlinson Group in Argenta Limited, a New Zealand-based animal health company, for about USD 100 Mn. Argenta is an integrated CRO and CMO specially focused on animal health. The company has expanded its base beyond New Zealand with substantial coverage of leading animal health companies from US and Europe. This investment will enable Argenta to further expand its capabilities while continuing to focus on prioritized markets, U.S. and Europe.

Innovation in therapeutics: Pursuit of novel solutions in popular therapeutic areas and advent of next generation therapies

The last year has been momentous on new therapeutic approvals in therapeutic areas of current commercial significance such as anti-parasitic drugs as well as in emerging opportunities such as oncology. The year was also encouraging on animal health industry embracing the possibility of regenerative medicine and next generation solutions:

of current commercial significance such as anti-parasitic drugs as well as in emerging opportunities such as oncology. The year was also encouraging on animal health industry embracing the possibility of regenerative medicine and next generation solutions:

Small molecule innovation:

Small molecule innovation has included the breadth of novel formulations, indication and species expansion for approved drugs and geographic expansion for new drugs. A notable species expansion included Elanco Animal Health getting FDA approval for Credelio Cat and introducing it in the US market. The feline approval for chewable fast acting solution for treating flea and tick in cats and expands on Elanco’s 2018 approval in dogs and marks approval of the first oral product for cats in this category. In the direction of lifecycle management and reformulations / combinations, Elanco also reported a positive opinion from EMA’s Committee for Medicinal Products for Veterinary Use (CVMP), for marketing authorization for Credelio Plus Chewable tablets (for dogs), a combination of lotilaner and milbemycine oxyme.

FDA approvals for drugs being used off-label:

Levothyroxine for canine use is a case in point where FDA action led to marketers formally seeking FDA approval to formalize off-label use. In 2016, the FDA had issued a warning on use of approved drugs to treat hypothyroidism and had notified six marketers of levothyroxine for dogs including Neogen, Virbac, Dechra, Merck. With only one product FDA approved in January 2016 (THYRO-TABS CANINE from Lloyd, Inc.) there was an undersupply of approved products until recently. In January 2021, Neogen obtained US FDA approval for its levothyroxine for canine use, ThyroKare. Another case of approval of drug used off-label is the January 2021 approval of KBroVet-CA1 (potassium bromide chewable tablets) to control seizures in dogs with idiopathic epilepsy. Idiopathic epilepsy is a type of seizure disorder without a known cause. Potassium bromide has been used in dogs for an extensive period of time to control seizure disorders, however, there was no FDA approved drug.

Expanding focus on oncology:

The year was significant for approval of various oncology solutions for companion animals:

In January 2021, the FDA conditionally approved Laverdia-CA1 (verdinexor tablets) developed by Anivive Lifesciences Inc. The drug was conditionally approved to treat canine lymphoma, a cancer of the lymph nodes and lymphatic system. It is the first conditionally approved oral treatment for dogs with lymphoma and thus creates the possibility of pet parents administrating the drug at home. This approval expands therapy options for canine lymphoma where the first major breakthrough was the approval of the injectable drug Tanovea-CA1 (rabacfosadine) approved by FDA in 2017. Tanovea-CA1 was developed by Vet-DC and is currently marketed by Elanco.

In November 2020, the FDA approved STELFONTAⓇ (tigilanol tiglate injection) for the treatment of non-metastatic skin-based (cutaneous) mast cell tumors in dogs. Mast cell tumors (MCTs) are the most common form of skin cancer in dogs. Stelfonta is injected directly into the MCT as an intra-tumoral injection and activates a protein that spreads throughout the treated tumor, thus disintegrating tumor cells. As the first approved drug, Stelfonta adds another option to the current arsenal of surgery, chemotherapy and radiation. The drug also marks Virbac’s foray into the oncology segment. It was also approved by the EMA in January 2020. Intriguingly, it is an extract from blushwood berries of Queensland, Australia.

Regenerative medicine and next generation therapeutics:

The most promising wave currently in human health is the pursuit of cell and gene therapy solutions and plunging into the broader world of regenerative and next generation medicine. As a natural expansion, the momentum is now noted in animal health as well. Emphasizing broader corporate appetite, in July 2020, Boehringer Ingelheim (BI) acquired Global Stem cell Technology (GST), an animal biotech company focused on state–of–the–art stem cell products for horses and dogs. The acquisition resulted from an existing two-year partnership that led to Arti-Cell® Forte, the first stem cell product to be authorized by the European Commission for veterinary use. GST, founded in 2012, is currently conducting clinical trials for two stem-cell products, Degenerative joint disease (DJD) and tendon healing. These investigational products allow GST to avail all the technology and resources from BI, aligning the company’s strategy to focus on regenerative medicine, stem cell research, and harboring external partnerships for innovations, setting both the companies ahead in the field of stem cell research in animal health.

Innovations in Diagnostics:

Mars Veterinary Health’s Antech Diagnostics released a product to detect the most prevalent reason behind visits to the veterinarian, fungal organisms causing ringworms. Ringworm affects horses, dogs, cats, small rodents, and rabbits. The Fast Panel® Ringworm PCR test is the most comprehensive test for detecting the most extensive group of Ringworm-causing fungal organisms in veterinary medicine. This test stands to be unique due to its rapid turnaround time compared to the dermatophyte culture, high specificity, and sensitivity. This DNA based test instantaneously depicts whether it is positive or negative for the fungal examination, allowing initiation of correct and immediate medication, preventing further discomfort and spread of infection.

Last year, Antech Diagnostics achieved a milestone in the world of animal health technology with RenalTechTM, an Artificial Intelligence-driven diagnostic tool, to detect chronic kidney disease (CKD) in cats two years before onset by analyzing the pet medical records data. This was considered as a step towards personalizing pet healthcare and hence improving diagnosis and treatment.

Embracing Technology: Across tele-medicine and traceability:

The tele-medicine wave is also a common phenomenon between human and animal health. We anticipate expanding industry appetite and innovation momentum in this realm across the world. The month of February 2021 saw Pawru, Inc. and Boehringer Ingelheim Animal Health USA Inc. expand the digital collaborative animal healthcare platform, PetPro Connect. PetPro was made available in the United States last year and served incredibly to 1 Mn pets through Telemedicine. Pawru originated from BI X, a subsidiary of Boehringer Ingelheim formed in 2017 to incubate ideas for digital innovation in the healthcare sector. It is also seeking strategic partners for the expansion of its commercial offerings. With the establishment of Pawru, Boehringer Ingelheim Animal Health will further work on building valuable digital health services and creating a path for the delivery of future digital innovations and growth for the benefit of the customers and partners.

Taking a deeper dive into investment in Tech Ventures, Merck Animal Health announced the acquisition of Quantified Ag® and IdentiGEN for venturing into the world of technology-centric detection and traceability for animal health management. Quantified Ag® uses data and analytics to develop cutting-edge technologies for transforming livestock health monitoring. Their product, Quantified Ag® TAG (Ear tags), monitors the health of individual cattle by collecting and sending encrypted biometric and behavioral data. The data can be used to improve overall cattle health, increased efficiency to health management, proactive monitor disease outbreaks, etc. In April 2018, Merck Animal Health had also invested and partly funded Quantified Ag® for its development work in data analytics in livestock. The quantified Ag® product portfolio will join the Allflex Livestock Intelligence, a business unit of Merck and a world leader in design, development, manufacturing, and delivering solutions for animal identification, monitoring, and traceability. This acquisition strengthens Merck Animal Health’s stance on sustainability and commitment to animal health management system by establishing a whole new platform of data health management, procuring extensive scale data, and digitalizing monitoring and real-time detection in livestock.

IdentiGEN, on the other hand, aims at improving accountability of food production by establishing an evidence-based technology for tracing animals from farm to table through the company’s proprietary platform, DNA TraceBack®. This product combines the DNA of species and data analytics to ensure food safety, promote transparency and provide actionable data and information. In 2019, Merck acquired a similar company focused on real-time video monitoring, Vaki. With these acquisitions, Merck has expanded industry investment appetite in the broader realm of IoT in livestock sector.

With the potential to redesign biological systems, synthetic biology carries the potential to transform how we grow our food, what we eat and how we source our input materials. The technology has been deployed in different industries now – pharma, agriculture, biofuels. Here we discuss how synthetic biology is transforming the animal industry.

Industrial applications of synthetic biology can date back to more than a decade, however the applications in the animal industry kick-started only in the recent past. It has now been deployed across the continuum of animal husbandry, interestingly so, at two opposite ends of the spectrum.

Alternative animal protein startups march forward: Alternative animal protein is now catching up and has been pulling in substantial investments. Last year, in August 2020, Impossible Foods secured USD 200 Mn in funding in a funding round led by the existing investor Coatue, bringing in the total funds raised to USD 1.5 Bn, one of the largest ever for a food-tech company. Transforming how we eat out burgers, the company identified Heme as the molecule responsible for the inherent flavor and texture of animal protein and now deploys a yeast-based fermentation process to produce large quantities of leghemoglobin, a Heme-identical molecule found naturally in the roots of soy plants.

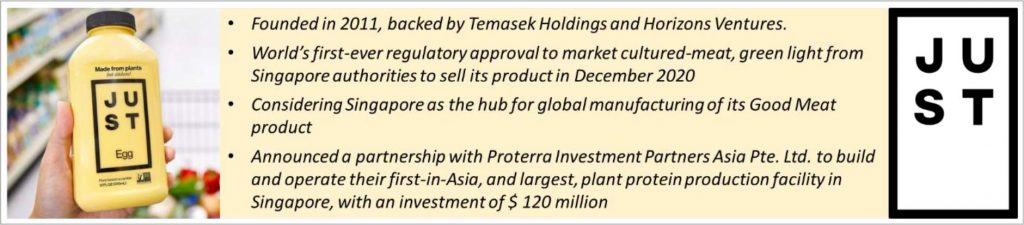

Another startup Memphis Meats, raised USD 161 Mn in Jan 2020 in a funding round led by SoftBank. The company uses cell culture techniques to produce meat directly from animal cells without the need to slaughter animals. The company has now re-branded itself as Upside Foods and has broken ground on a pilot production facility and is ready to launch cultured-chicken as the first consumer product. Rising consumer awareness on the carbon footprint of the meat industry, shift to low carbon, ethical and sustainable sourced food alternatives have driven the advancement of startups in the plant-based and lab-grown meat sector. While plant-based meat sources rely on plant sources that are processed to resemble the texture and taste of natural animal meat. Cultured-meat, on the other hand rely on cell-culturing of animal stem cells to produce meat that retains the properties of its animal source. There are still technical, economical and regulatory obstacles to be overcome for cultured-meat such as the substantially lower cost of production on livestock-reared meat, lack of defined regulatory framework et al.

Another startup Memphis Meats, raised USD 161 Mn in Jan 2020 in a funding round led by SoftBank. The company uses cell culture techniques to produce meat directly from animal cells without the need to slaughter animals. The company has now re-branded itself as Upside Foods and has broken ground on a pilot production facility and is ready to launch cultured-chicken as the first consumer product. Rising consumer awareness on the carbon footprint of the meat industry, shift to low carbon, ethical and sustainable sourced food alternatives have driven the advancement of startups in the plant-based and lab-grown meat sector. While plant-based meat sources rely on plant sources that are processed to resemble the texture and taste of natural animal meat. Cultured-meat, on the other hand rely on cell-culturing of animal stem cells to produce meat that retains the properties of its animal source. There are still technical, economical and regulatory obstacles to be overcome for cultured-meat such as the substantially lower cost of production on livestock-reared meat, lack of defined regulatory framework et al.

Regulators are gradually warming up to the idea of cultured-meat, in a first, Singapore’s food regulator agency approved the sale of cultured meat developed by US start-up Eat Just, marking the first commercial sale of cultured meat. On the US-front, which is potentially one of the most-attractive markets for alternative meat, bringing in regulatory oversight has been rather slow. In 2019, the Food and Drug Administration (FDA) and Food Safety Inspection Service (FSIS) agreed to establish a joint regulatory framework and determined that cultured-meat will require regulatory oversight from both entities. The next big-step for the startups in the space would be to have a well-defined regulatory framework in place and have approved products serve as a precedence for others in the space.

Single Cell Proteins as alternative animal feed make progress:

While alternate proteins for human food could potentially disrupt the demand side of animal husbandry, the supply side has an equally intense force that could power sustainability as well as economics. Biotechnology based solutions including single cell proteins that have disruptive potential to transform the value chain and provide alternate feed solutions across species, aquaculture, poultry and cattle. The trend has perpetuating momentum and we anticipate substantial leapfrogging in innovation, regulatory and commercial landscape over the next few years:

Single Cell Proteins (SCP) have emerged as a sophisticated and sustainable alternative to protein feedstock for animal feed, particularly in poultry and aquaculture. SCP based animal feed promises better production economics and can substantially reduce the cost of animal feed, which accounts for 60%–70% of total livestock production costs. Additionally, there is a heavy reliance on soybean meal and fish meal for protein supply in feeds. SCPs can be produced in a cost-efficient process, in systems that are readily-scalable and use renewable sources of input materials such as biogas, animal and plant waste etc. Additionally, SCP can supplement essential nutrients such as carotenoids, amino acids that the animals cannot produce on their own.

While commercial scale up of feed focused ventures has been slower than anticipated, overall the segment has made progress in the last year. In April 2021, Danish startup Unibio, out-licensed its SCP-production plant technology to Qatar-based Gulf Biotech. The planned facility will be the region’s first plant to convert natural gas into animal protein feed and will be based on Unibio’s U-Loop® technology, where natural gas is converted through continuous fermentation into Uniprotein®. The abundant availability of natural gas makes Qatar an ideal location for the conversion of natural gas into protein. The license agreement covers a plant with a total annual capacity of 6,000 tonnes of Uniprotein®.

While commercial scale up of feed focused ventures has been slower than anticipated, overall the segment has made progress in the last year. In April 2021, Danish startup Unibio, out-licensed its SCP-production plant technology to Qatar-based Gulf Biotech. The planned facility will be the region’s first plant to convert natural gas into animal protein feed and will be based on Unibio’s U-Loop® technology, where natural gas is converted through continuous fermentation into Uniprotein®. The abundant availability of natural gas makes Qatar an ideal location for the conversion of natural gas into protein. The license agreement covers a plant with a total annual capacity of 6,000 tonnes of Uniprotein®.

In March 2021, another startup, Deep Branch raised USD 9.5 Mn in a Series A funding round led by Novo Holdings and DSM Venturing to develop animal feed from carbon dioxide. The company plans to intiate development of first pilot-scale batches of its Proton product that will be validated for their nutrition profile with Europe’s leading feed producers BioMar (a large aquafeed producer) and AB Agri (a poultry feed producer).

Regulatory advantage: Knipbio’s GRAS certifications: US based KnipBio Inc achieved a critical milestone for wider commercial uptake, the USFDA GRAS certification for the KnipBio Meal. KnipBio Meal includes a portfolio of ingredients that combine immunonutrients with single cell proteins. In 2019, the company achieved GRAS certification for use in feeds for salmonids and other species of finfish. The July 2020 GRAS certification now extends it to crustaceans and hence sets the pace for broader adoption in aquaculture feed.

Asia Calling: In addition to Knipbio, Calysta is the other forerunner from US. Given the global spread of opportunity in aquaculture feed, Asia is an impotant target market for all SCP innovators. In pursuit of the Asia opportunity, Calysta initiated construction of production facility in China in a JV with Adisseo. The capacity creation is led by the JV entity Calysseo. The facility to be operational by 2022 will have capacity of producing 20,000 tons of feed in the first phase and an additional 80,000 tons in the second phase. To sustainable supply of inputs, Calysseo has forged a long-term contract with a leading Chinese gas company. Output of the facility will be exclusively used for supply to Asian markets.

On the Indian turf, String Bio has been validating its methane derived single cell protein product in poultry feed. The company de-clogged the major hurdle on access to methane through partnership with Indian public sector gas company, ONGC. With Asia comprising of 70% of the global aquafeed market, it is encouraging to note the momentum around domestic innovation and joint ventures. Looking forward, we envision substantial expansion of industry investment as well as innovation momentum in SCPs as well as the broader area of alternate proteins for feed.

While cell-culture meat is likely to disrupt future demand for animal derived protein, biotechnology in feed promises gains on production economics and sustainability. Overall the segment is likely to gain from investment and research intensity in synthetic biology, supported by enabling regulatory and policy framework. Going forward, we foresee a combination of biotechnology derived protein options becoming an integral part of feed as well as alternate proteins gaining greater share of human food. Overall, alternate proteins are here to stay and the decade of transformation lies ahead.

Grow Beyond

Grow Beyond