2018: Year end round up of key developments across the Biopharma, MedTech and Healthcare delivery landscape

Strategic intent of transactions & 2019 outlook: Majority of the large transactions were dominated by intent to expand portfolio and strengthen pipelines in areas strategic priority. Transactions reflect continued investment focus from the industry in the area of rare diseases. With more than half of the FDA approvals for novel drugs in 2018 being for orphan diseases, we expect this investment trend to continue into the next couple of years. Thought RoW markets are gradually gaining greater momentum, US clearly dominated as the market that controlled investment interest. Finally, there was an emphatic message that next generation therapies are here are stay and are the next big battle ground for pharma. Cell/gene therapies and gene editing will rule the roost on corporate investments for the next five years and the biggest beneficiary of this momentum will the patients worldwide. Now, to top this investment appetite with a globally coordinated regulatory framework and pragmatic evolution of pricing and reimbursement models.

Mega acquisitions purely to fuel scale were far and few with the only notable one being the Aurobindo-Sandoz transaction. In September, Aurobindo announced the $900 millionacquisition of Sandoz’ commercial operations in Dermatology and Oral Solids in the US along with three manufacturing facilities. The deal will position Aurobindo as the second largest company in the US generics market in terms of prescriptions. The acquisition is also likely to expand Aurobindo’s portfolio and pipeline with upto 300 products while strengthening commercial and manufacturing capabilities in the US.We expect a similar opportunistic approach even in 2019 for acquisitions that are motivated by global/regional scale. However, corporate investment interest in generics, OTC and biosimilars will only increase and we expect to see more traction in the next couple of years as compared to 2018.

2018 was a vibrant year for regulatory approvals in the largest commercial markets, USA and Europe. While EMA has been the pioneer in biosimilar approvals, 2018 was a landmark year for FDA approvals and positive signaling of regulatory support in the most sought after market.

In Europe, the most notable example with commercial essence isAbbVie’s blockbuster drug Humira (adalimumab) that lost its patent protection in Europe in October 2018. Given intensity of corporate focus and regulatory support, a quartet of biosimilar drugs (Sandoz’s Hyrimoz, Amgen’s Amgevita, Mylan/Fujifilm’s Hulio, Biogen/Samsung Bioepsis’ Imraldi) were waiting to capture the $4.4 billion market. AbbVie’s patent expiry presented healthcare providers with a major cost saving opportunity, which was displayed in UK NHS’ deal in November with various biosimilar manufacturers. The NHS is expected to save £300 million, the biggest saving in history from a single drug negotiation.

| Drug Product | Europe | USA | ||

| # of Approvals | Companies | # of Approvals | Companies | |

| Bevacizumab | 1 | Amgen Europe B.V. | – | – |

| Infliximab | 1 | Sandoz GnbH | – | – |

| Insulin glargine | 1 | Mylan S.A.S | – | – |

| Pegfilgrastim | 5 | Accord Healthcare Limited, Coherus, Cinfa biotech/ Mundipharma, Sandoz, Mylan/Biocon | 2 | Mylan/ Biocon, Coherus |

| Trastuzumab | 4 | Celltrion Healthcare, Amgen/Allergan, Pfizer, Mylan/Biocon | 1 | Celltrion Healthcare/ Teva Pharmaceutical |

| Epoetin alfa | – | – | 1 | Pfizer |

| Adalimumab | 4* | Sandoz GnbH, Mylan S.A.S | 1 | Sandoz GnbH |

| Filgrastim | – | – | 1 | Pfizer |

| Rituximab | – | – | 1 | Celltrion Healthcare |

| * Sandoz received 3 regulatory approvals by EMA for adalimumab (Halimatoz, Hefiya, Hyrimoz), and Mylan received one approval (Hulio) | ||||

The US FDA’s historical slower pace of embracing biosimilars was replaced with warm support this year with 7 approvals, a large number compared to the total of 9 biosimilar approved until this year. However, despite this forthcoming regulatory landscape, there were no significant strides in 2018 at the commercial end outside of EU. Challenges are multifold with the most critical being innovator patent strategies and clinician/payor receptiveness. Adalimumab in the US is the most poignant example for the former with biosimilars launched in Europe in October 2018 but delayed all the way through 2023 due to patent settlements with the innovator, Abbvie. Certain European countries also provide great models for engagement of clinicians and other ecosystem partners. While the FDA had issued draft interchangeability guidelines in 2017, no approvals till date have been designated interchangeable. Fostering confidence in biosimilars and designated interchangeability will help accelerate much needed market creation in the US.

Sandoz and Boehringer Ingelheim’s decisions in 2018 were a stark reminder of the high level of these commercial barriers. Sandoz abandoned US development of it’s rituximab biosimilar that was filed for approval after additional data was requested by the FDA. The decision is a glaring red flag on market circumstances anticipated as Sandoz did not find a justifiable business case for incremental investments despite the prospect of being second or third to market in US. Particularly so, as Sandoz accomplished approval for this asset in EU and several other markets. Boehringer Ingelheim also made a program abandonment decision, but in this case for their entire biosimilar program outside of US (while they continue the legal battle with Abbvie in US for a pre-2023 launch of adalimumab).

While year on year growth in most RoW markets has been substantial, overall market expansion in most RoW markets is still unsatisfactory. One of the most promising developments in 2018 for RoW markets was initial roll-out of the WHO Prequalification Program. While it is currently being piloted for two drugs, trastuzumab and rituximab, when scaled-up it could substantially accelerate and widen market access possibilities similar to what has been achieved in the case of vaccines.

While 2018 has been a highly momentous year for biosimilars, there is an urgent need across global markets to foster greater market maturity. With great optimism, we look forward to 2019 being the year when the commercial opportunity and business case get more tangible and corporate investments can expand.

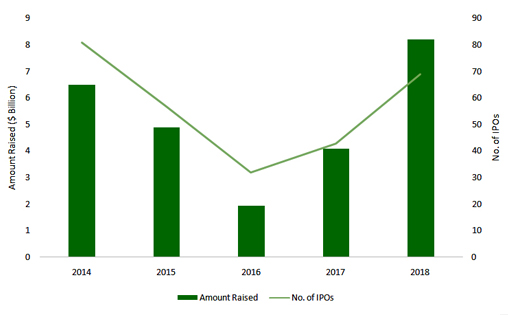

Per NASDAQ data, funding raised of $8.2 billion broke 2014’s record of $6.5 billion despite the number of IPOs at 69 being slightly lower than the 2014 record of 81 IPOs. The largest raises included $604 million by Moderna, $372 million by Allogene and $240 million by Rubius Therapeutics. These overshadowed the earlier landmark for largest raise by a Biotech IPO -June Therapeutics with $304 million in 2014. The IPO market was not only upbeat, it turned out to be a significant catalyst and supporter of next generation therapies. It is notable that the three ventures named above are pursuing mRNA therapies, CAR-T cell therapies and allogenic red blood cell therapies respectively.

Per NASDAQ data, funding raised of $8.2 billion broke 2014’s record of $6.5 billion despite the number of IPOs at 69 being slightly lower than the 2014 record of 81 IPOs. The largest raises included $604 million by Moderna, $372 million by Allogene and $240 million by Rubius Therapeutics. These overshadowed the earlier landmark for largest raise by a Biotech IPO -June Therapeutics with $304 million in 2014. The IPO market was not only upbeat, it turned out to be a significant catalyst and supporter of next generation therapies. It is notable that the three ventures named above are pursuing mRNA therapies, CAR-T cell therapies and allogenic red blood cell therapies respectively.

Robust licensing activity with coming of age of emerging market innovation: Again, a robust year all around but particularly one that marked high level of success accomplished by emerging market companies. If this transaction momentum continues into 2019, a definitive coming of age story for innovation originating in emerging markets.

The most significant development was towards the year end when Indian pharma company Lupin licensed global commercialization rights (excluding India) for its preclinical stage haematological cancer drug (MALT1 inhibitor) to Abbvie. The transaction was concluded at globally benchmarkable terms that included upfront of $30 million, milestone payments of upto $947 million and double digit royalties. In Q3, Korean company JW Pharmaceutical had out-licensed its preclinical stage novel atopic dermatitis drug candidate (JW1601) to Danish company LEO Pharma for $17 million upfront and milestone payment of uptoUS$ 402 million. There was an interesting precedent set for more South-South partnerships with Indian pharm company Glenmark out-licensing commercialization rights for GBR 1302, a First-in-Class Bispecific Antibody for Treatment of HER2-Positive cancersfor Greater China to Harbour BioMed (China) for total upfront and milestone payments of upto$ 120 million.

Interest in regional partnerships for emerging markets continued with US based Synergy Pharmaceuticals out-licensing its lead product TRULANCE (plecanatide) for IBS and Chronic Idiopathic Constipation to a Chinese company, Luoxin Pharmaceutical Group in a pre-Chapter 11 transaction andNASDAQ listed Tocagen granting exclusive rights to ApolloBio for its Phase III cancer immunotherapy candidate Toca 511 and Toca FC for development and commercialization in China as well as Hong Kong, Macao, and Taiwan.

IPO boom far east:While it is encouraging to note the out-licensing success and pole vaulting level of innovation engagement in emerging markets, the promise of sustainability is marked by opening up of the IPO market within Asia for biotech stocks. The Hong Kong Stock Exchange opened its doors to pre-revenue IPO listings and success during the year was historic. While several companies filed for listing, the first IPO by Ascletis (anti-viral platform) that raised $400million was followed by three big issues – Innovent, Hua Medicine (diabetes) and BeiGene (immune-oncology) that raised $421 million, $200 million and $903 million respectively. Sealing the momentum was Junshi’s year end IPO amassing $394million. 2019 holds promise with a slew of other companies having filed for listing.

Volatile market response and pulse of caution: In the middle of the excitement, it is important we don’t ignore the pulse of caution from the sometimes tepid to often volatile market response post-listing on both the NASDAQ as well as the relatively new Hong Kong exchange. The poster-boy IPO of 2018, Moderna listed at 4% below IPO price and slipped 20% by end of the day when trading opened. Eastwards, Innovent was the only stock to gain on listing while Hua Medicine, BeiGene and Ascletis substantially dropped on trading. Winds of caution abound. We hope the capital market momentum for pre-revenue biotech IPOs continues unabated in 2019 and listing responses only result in moderated valuations and not an overall appetite setback.

As hospitals and health systems try to find their space in the exciting yet daunting era of genomics, precision medicine and connected care, the medical technology industry is not far behind. This year saw great leaps in precision and connected care focused technology and digital integration in healthcare. Particularly, there was significant developments in the area of Continuous Glucose Monitors (CGMs) and wearables that spelt greater integration in the future of medical devices and diagnostics, biopharma and other stakeholders to enhance care outcomes through data-driven connected care and expand level of patient centricity. This also implies ‘precision care’ as a term is a now used even outside of oncology and is now a quest even in chronic diseases such as diabetes.

Although the insulin market is considered impenetrable to a high level due to oligopolistic control by a few large companies, the breakthroughs in CGM could imply a change in this landscape in the future. Along with Abbott and Medtonic, the relative smaller Dexcom has emerged as a world wide market creator. Although CGMs have been around for a while, with more tangible insurance covering support,2018 emerged as the year when they become a widespread reality for patients across the world . The centers for Medicare and Medicaid services (CMS) changed their previous policy and enveloped CGM devices and mobile apps into their insurance coverage, granted that certain criteria be met by the patient (such as use of a glucose monitor multiple more than four times a day and use of multiple daily doses of insulin). Wider adoption of CGMs and increasing sophistication of CGM devices also implies a shift in the future of insulin delivery with precision delivery through integrated pumps becoming more attractive in the future. Even in that realm, EU clearance of the Tandem insulin pump that uses the Dexcom CGM device signals the creation of a wider ecosystem anchored by the CGM players. We begin 2019 on the upbeat note of transformations in chronic care and an ecosystem shaped more technology driven companies.

Along the same lines of continuous monitoring, wearable devices have come a long way in the lifecycle from initial phases of low sensitivity in most sensors to near medical grade devices today, with potential for widespread application such as continuous screening &monitoring and emergency alert functionalities. While they are yet to become a widespread commercial reality, they offer great promise for enhancing outcomes of both in-hospital and post-hospital care. There is also a growing convergence of more complex healthcare technologies in consumer products such as FDA approved Apple smart watch which comes with an ECG – sensor for cardiac monitoring and Omron’s new blood pressure monitoring watch. With growing medical application areas of wearable devices, the global market is projected to reach $12.1 billion by 2021 from $5.3 billion in 2016.

However, the potential will remain an elusive promise unless there is greater integration across islands of data and stakeholders. Healthcare delivery has been harder to permeate with limited appetite for change across the world. It is glaring that adoption/interoperability of EMR is still a question that a question we grapple with in most countries. 2018 was the year of products and technology – hopefully, 2019 will be the year of adoption and ecosystem change required to realize the potential.

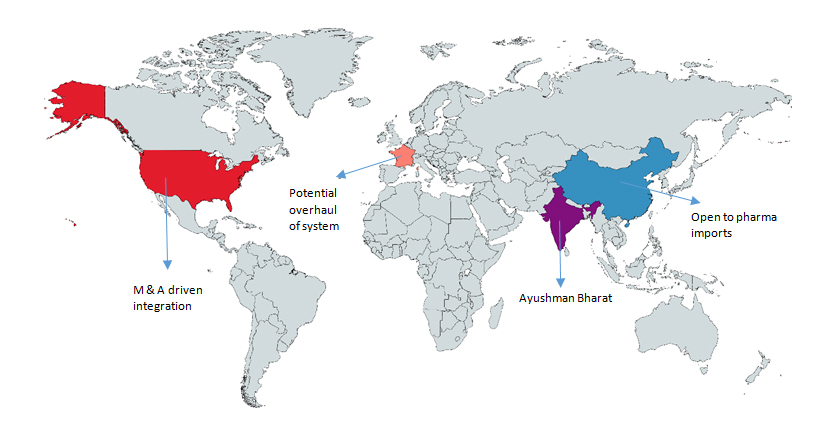

2018 set in motion of a wave of transformation in the healthcare delivery value chain across countries – M&A driven integration in the highly fragmented and multi-stakeholder US ecosystem, an overhaul announcement by France, China opening up its pharmaceutical market to imports and simplifying product registration, and India announcing the largest healthcare coverage program.

2018 set in motion of a wave of transformation in the healthcare delivery value chain across countries – M&A driven integration in the highly fragmented and multi-stakeholder US ecosystem, an overhaul announcement by France, China opening up its pharmaceutical market to imports and simplifying product registration, and India announcing the largest healthcare coverage program.

At the US end, powered by big mergers and strategic investments by 2018, a transformation in the healthcare delivery value chain is brewing slowly and power of value chain is gradually shifting. Several layers are being peeled away in this highly complex market and we are enthused by the promise of resultant data transparency and use for rationalizing healthcare costs. While Amazon acquisition of Pillpack introduced a surprise new entrant in the $400 billion pharmacy business and gained more media coverage, it is notable that Microsoft, Apple and Google have also made substantial investments across the realm of healthcare, especially in AI, ML and data driven solutions. As payors seek to get more engaged with patients they serve, the CVS Health-Aetna, Cigna-Express Scripts, United Health-Avella mergers paving wave for more integrated PBM and pharmacy operations held strategic value. The CVS-Aetna mega-merger is testimony to value found in integration of one of the largest pharmacy chains with the 22 million subscriber insurance company to unveil potential of more integrated health management, roll out screening, wellness and preventive programs and leverage power of data and patient reach to lower cost of care.

Further East, the Indian Government rolled out its landmark initiative ‘Ayushman Bharat’ a universal health cover scheme that is touted to be the largest globally. Itaims to cover over 100 million families or around 500 million Indians with coverage of upto$7,000 per year for primary, secondary and tertiary care hospitalization. The landmark program,which is planned to be implemented through empaneled private partners, has significant potential to blur constraints of healthcare access for vast majority of the population and consequently drive market growth in the long term. Simultaneously, the Government also overhauled the Medical Council of the country to address concerns on malfunctioning and introduced a Bill to create an oversight framework for allied healthcare professionals. Significant policy goal posts and we hope 2019 can deliver on implementation expectations.

Further East, while the Biotech startup boom continued in China and Hong Kong, China acknowledged need for greater import friendliness for vaccines and pharma and opened up markets. Most notably, the Government relaxed requirements for local validation of drugs and medical devices for products already approved in other countries and also waived import duty on certain oncology formulations. The API industry continued to be in the midst of a forced consolidation. Everything around healthcare delivery experienced grater shifts in this Far East market. 2019 could be the year global generic companies and device companies find easier foothold in China and access to drugs and devices for this massive healthcare delivery ecosystem is more robust.

[/su_accordion]

Authors

Connect with Authors at: E-mail healthcare@sathguru.com

Grow Beyond

Grow Beyond