The Road to Redemption: Restoring Credibility in Indian Organic Exports

India is currently the largest organic producers’ hub, with approximately 44% of the world’s certified organic producers cultivating in India (Research Institute of Organic Agriculture-FiBL and IFAOM- Organics International). India is 5th largest in terms of organic agricultural land with a total of 9.1 million Ha area under organic production. The Government of India’s persistent efforts are fuelling the growing organic exports through various incentive schemes encouraging organic production. APEDA is a government body that plays a crucial role in India’s trade performance. In India, APEDA has implemented NPOP (National Programme for Organic Production) for accrediting certification bodies, regulating the quality standards, and monitoring organic exports from India. APEDA has made it a mandate that products exported from India to any destination shall be certified as per National Programme for Organic Production (NPOP) by an accredited Certification Body and shall accompany with Transaction Certificate issued on TraceNet by NPOP accredited Certification Body. TraceNet collects, stores and reports – forward and backward traces and quality assurance data entered by the operators / producer groups and certification bodies within the organic supply chain in India.

However, India’s performance in commercializing organic products to global markets remains a challenge. The global organic market was valued at ~ 138 million USD in 2021 but India had only a share of only 0.2% in the export market (FiBL, IFAOM).

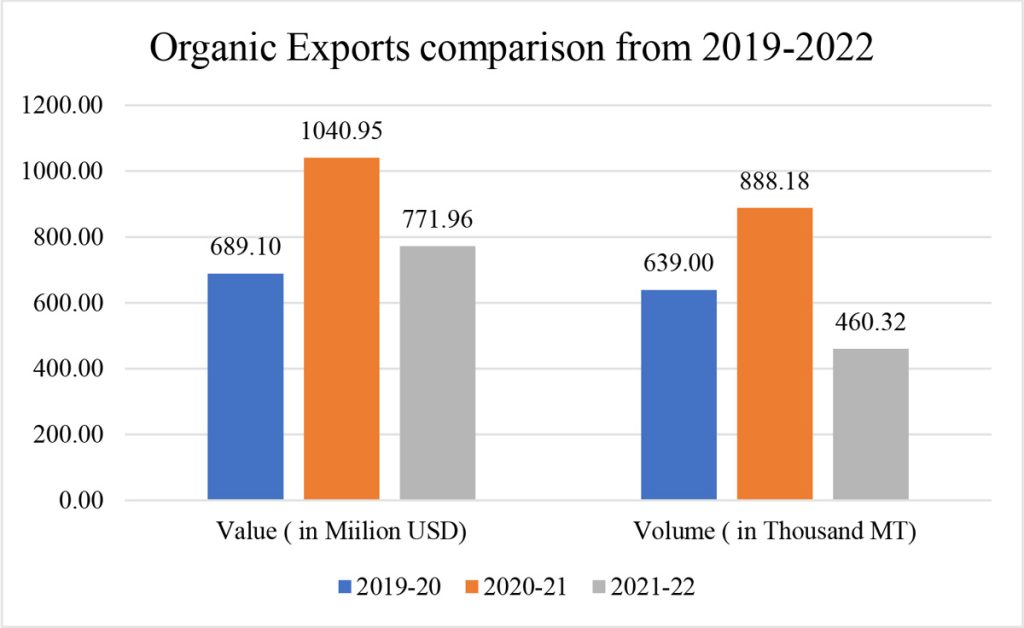

Figure 1 (Source: APEDA)

Figure 1 (Source: APEDA)

In terms of Value, the organic products exports from India showed YoY growth of 51% in 2020-21 but plunged by 26% in 2021-22. And in terms of volume, the exports grew by 36% in 2020-21 but decline by 48% in 2021-22. (Refer Figure 1)

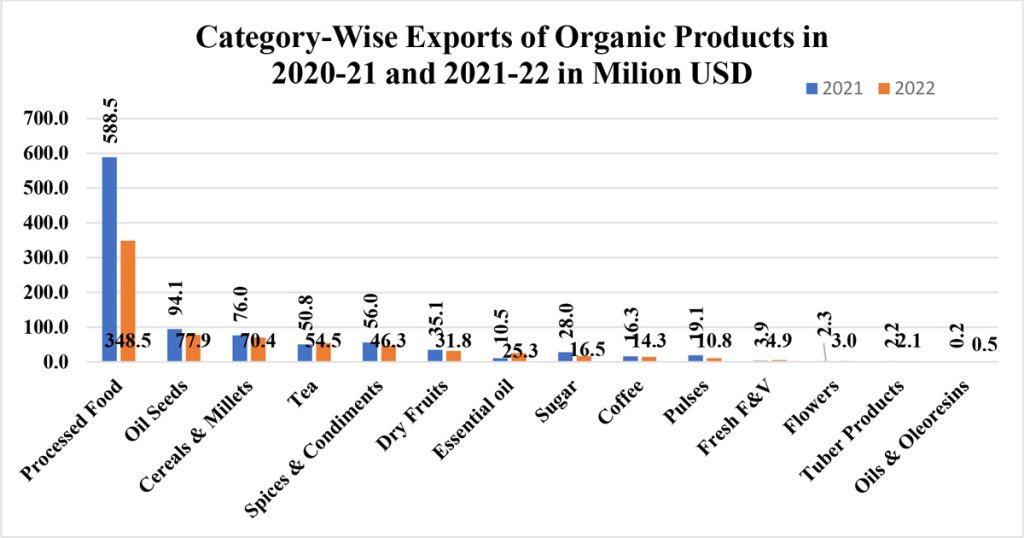

Figure 2 (Source: APEDA)

Figure 2 (Source: APEDA)

Except a few categories, the exports have dipped for almost all the commodities. Major decline was seen in Processed Foods category (refer Figure 2). USA is the most prominent hub of exports, with 0.5 million MT being exported there in 2021-22, followed by EU, Canada and UK. The decline in organic exports occurred due to multiple reasons, while COVID-19 is one of the major reasons, the other reason is non-compliance with the EU and USDA organic standards. EU and US markets combined account for 87% (in value) of the organic exports from India and violations by a few players lead to implications for farmers as well as the other players in the market.

Series of incidents hampered India’s market image on organic products trade:

USDA de-recognized APEDA accreditors: In 2021, the non-compliance with the organic standards led to USDA ending its 15 years old recognition agreement with APEDA. The earlier recognition agreement considered the NPOP and National Organic Program (NOP) accreditors equal and authorized APEDA to accredit certifiers to provide USDA organic certification in India. After termination of agreement, USDA had allowed 18 months transition span for the APEDA-accredited Indian Organic players to obtain the certification from a USDA-accredited certifier.

EU de-listed Indian certification bodies: In July 2022, the EU also barred five Indian certification bodies from sanctioning organic certifications. EU’s decision was due to presence ethylene oxide (ETO) residues in India’s Organic products. ETO functions as a fumigant, disinfectant, insecticide, and sterilizing agent. However, the residues were not linked to production but occurred due to mishandling and issues in warehousing. The delisting by the EU and the end of the NPOP-NOP equivalence agreement have led the world to question the integrity of Indian-origin Organic produce. In a circular dated November 27, 2020, APEDA also issued a notice addressing multiple instances of ETO detection. However, even after multiple violations, ETO residue tests have not been made mandatory. Apart from ETO residues, it was noticed that the producers were also not following the organic farming standards. A few instances have been observed where agrochemicals were found in the produce. All these violations and rejections have harmed India’s credibility in the global organic market.

Due to recurrent violations, APEDA suspended multiple certification bodies in 2021. This led to issues in the certification process. This has also led to monopoly of certain certification bodies which has significantly increased the compliance costs.

Way Forward

The above changes in the validation of India Organic Certification have made the regulations more stringent. APEDA has scrutinized the accreditation process after repeated violations by the certification agencies. Exporters to US and EU markets must strictly adhere to the standards to avoid rejections in these two markets. The UK has, however, waived off the ETO residual test for Indian-origin Organic products, thus, giving hope that the EU might take similar steps.

Violations must be penalized strictly rather than with mere monetary fines. India possesses promising organic export market prospects since a considerable amount of cultivation area is under the conversion process. To harness this potential, all the stakeholders need to make dedicated efforts. The growers, processors, and exports need to understand the quality standards in the international market. State-of-art residue testing labs must be equipped in accordance with the import standards of the major importing countries. Better promotion and branding strategies also need to be undertaken. India has established its brand value as an ethnic and culinary-rich nation; the players need to leverage this image through better branding strategies like advertising, packaging, and labelling. Labelling is the most prominent mode for communicating the quality of the products. Organic products are premium and high-value products and thus need premium packaging and labelling to convey the credibility and authenticity of the products. The regulatory bodies must also focus on India Organic as a brand. Coherent branding strategies should be mapped out for the short and long term in the global markets. This will help to build a better positioning of the India Organic certified products.

Traceability is the key to maintaining product integrity and increasing transparency in the value chain. Better traceability will certainly help in improving the credibility of the Indian Organic products. The TraceNet services by APEDA must be streamlined, and better steps must be taken to ensure that correct information is entered on the TraceNet Portal. Digitization is the most eminent way to enhance traceability. This will streamline all the information regarding organic fruits and vegetables, thus increasing the credibility of the organic products and strengthen India’s image in global organic market.

Author:

Associate Consultant – Food Processing and Retail practice

Connect with Author at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond