How Modern Dairy Products are Replenishing the Dairy Market in India

The Indian dairy market was valued at USD 107 billion in 2020, which is expected to witness a CAGR of 10% during 2021-2025 and reach 172 billion(1). Various factors such as increasing young population, inclination towards healthier, high protein diet, convenience and aggressive growth plans of quick-service restaurants are expected to accelerate the industry’s growth.

The dairy market in India includes

- Milk,

- Traditional value-added dairy products, which include Butter, Ghee, Paneer, Khoa, Curd and Skimmed milk powder

- Modern value-added dairy products, which include Yoghurt, Cheese, whey, flavoured milk and ice cream

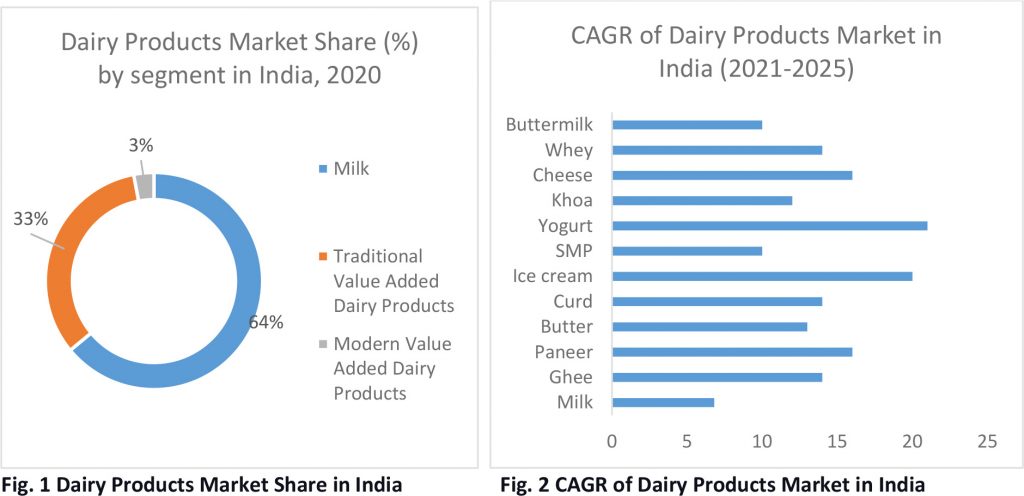

Milk dominates the segment with a 64% share in the dairy market, followed by traditional dairy products and the modern value-added dairy products market. The demand for UHT milk fuels the retail milk consumption during the pandemic and the premium milk packs. There is a growing demand for premium retail packaged such as antibiotic-free milk, farm to home milk brands, etc, driven by health enthusiasts and rising premiumization trend among consumers. For instance, in 2019, Parag Milk Foods and Hatsun launched new brands, “Pride of Cows”, focused on farm to fresh and single-origin milk products, and “Hatsun Cow Milk” farm-to-home fresh cow milk, respectively. Sarda Dairy launched “Vachan Farm Classics Cow Milk”, a premium cow milk claiming to be completely untouched by human hands.

The traditional value-added dairy products segment is expected to witness a CAGR of 10-12% during 2021-25(1). The growing popularity of convenience food, such as ghee as a spread, and rising demand for traditional Indian recipes and household cooking are driving the traditional dairy products market. Despite the fall in demand for modern dairy products in 2021 due to the pandemic, the segment is expected to witness a CAGR of 16% during 2021-25 (1). The on-the-go consumption of dairy products such as Yoghurt, Cheese and flavoured milk as a source of instant nutrition drives the modern value-added dairy products market. In addition, children and millennials are the major consumers of such products, fuelling the modern dairy products demand. For instance, the dairy yoghurt category emerged in India in 2015 with the launch of Epigamia yoghurt brands. Durum Foods was the first company in India to launch products in the Greek yoghurt segment. The company later expanded its portfolio to include other dairy products, including yoghurt snack packs, artisanal curd, cheese, and smoothies. After Epigamia’s entry, the competition in the yoghurt category started getting fierce and many other brands such as a+ Grekyo (Nestle), Flaavyo (Amul), Fruit Yoghurt (Mother Dairy), Daily Fresh (Britannia), Go Yoghurt (Parag Dairy), Hatsun Yoghurt and shakes, and Milky Mist entered the market. Companies are focusing on product differentiation as a key strategy to compete in the market, such as introducing yoghurt with low sugar/no added sugar, no added preservatives, 100% natural ingredients claim and lactose-free range of Greek Yoghurt and Yoghurt based smoothies.

The traditional value-added dairy products segment is expected to witness a CAGR of 10-12% during 2021-25(1). The growing popularity of convenience food, such as ghee as a spread, and rising demand for traditional Indian recipes and household cooking are driving the traditional dairy products market. Despite the fall in demand for modern dairy products in 2021 due to the pandemic, the segment is expected to witness a CAGR of 16% during 2021-25 (1). The on-the-go consumption of dairy products such as Yoghurt, Cheese and flavoured milk as a source of instant nutrition drives the modern value-added dairy products market. In addition, children and millennials are the major consumers of such products, fuelling the modern dairy products demand. For instance, the dairy yoghurt category emerged in India in 2015 with the launch of Epigamia yoghurt brands. Durum Foods was the first company in India to launch products in the Greek yoghurt segment. The company later expanded its portfolio to include other dairy products, including yoghurt snack packs, artisanal curd, cheese, and smoothies. After Epigamia’s entry, the competition in the yoghurt category started getting fierce and many other brands such as a+ Grekyo (Nestle), Flaavyo (Amul), Fruit Yoghurt (Mother Dairy), Daily Fresh (Britannia), Go Yoghurt (Parag Dairy), Hatsun Yoghurt and shakes, and Milky Mist entered the market. Companies are focusing on product differentiation as a key strategy to compete in the market, such as introducing yoghurt with low sugar/no added sugar, no added preservatives, 100% natural ingredients claim and lactose-free range of Greek Yoghurt and Yoghurt based smoothies.

In addition, to the nutritional value-added dairy products, the convenient pack size plays an important role in driving the Yoghurt snacking trend in India. Another modern value-added dairy segment, Cheese, is growing at 15% to 20% annually. The Indian cheese market is presently worth around USD 237 million(1). The rise in foodservice outlets and changing food habits are driving the Cheese market. Earlier, the cheese market in India was dominated by block cheese, slices and cubes. However, various product innovations are changing the market. For instance, Amul launched low-calorie Cheese called “slim cheese” for calorie conscious people. Parag Milk Food, the second-largest player in the Cheese market, launched “Go Cheese”, a mix of two types of Cheese – Cheddar & Mozzarella. Processed cheese accounts for 60% of the share in the Cheese market, followed by Cheese spreads 30% and favoured and speciality cheeses 10%.

Export of Dairy Products and Challenges

In India, milk production is growing at 6.4% annually. However, dairy products account for a small volume of Indian exports despite being the largest milk producer globally. However Indian dairy products exports have increased by three times in the past five years, recording a volume export of 180,688 tonnes in 2019 from 66,424 tonnes in 2014(2). Dairy products exported from India include mainly Skimmed Milk Powder (SMP), butter, butter oil, Cheese, ghee and buttermilk. SMP has a share of around 30% in dairy products exports. The major export destinations for dairy products are Turkey, United Arab Emirates, Egypt, Bangladesh, Bhutan, the United States, Saudi Arabia and Malaysia.

The various restrictions on the import of dairy products from India are affecting the dairy export market. More than 17 countries have restricted the import of dairy products from India either through a reciprocal ban or by increasing import tax. For instance, European Union has not approved any Indian dairy plant, for exports, under the pretext of veterinary control, Antibiotic and Pesticide residue etc. The US has an import duty of 40 to 60% on dairy products imports from India. Australia does not permit dairy products from India due to Foot and Mouth Disease (FMD). Indian companies are interested in exporting milk-based products such as ethnic sweets and ready-to-eat food products but are facing several /stricter trade requirements. Also, some companies pointed to the variation in test results across laboratories in the EU, restricting the export of dairy products. Indian companies must adhere to much higher standards for exports compared to the domestic market.

Competitive landscape

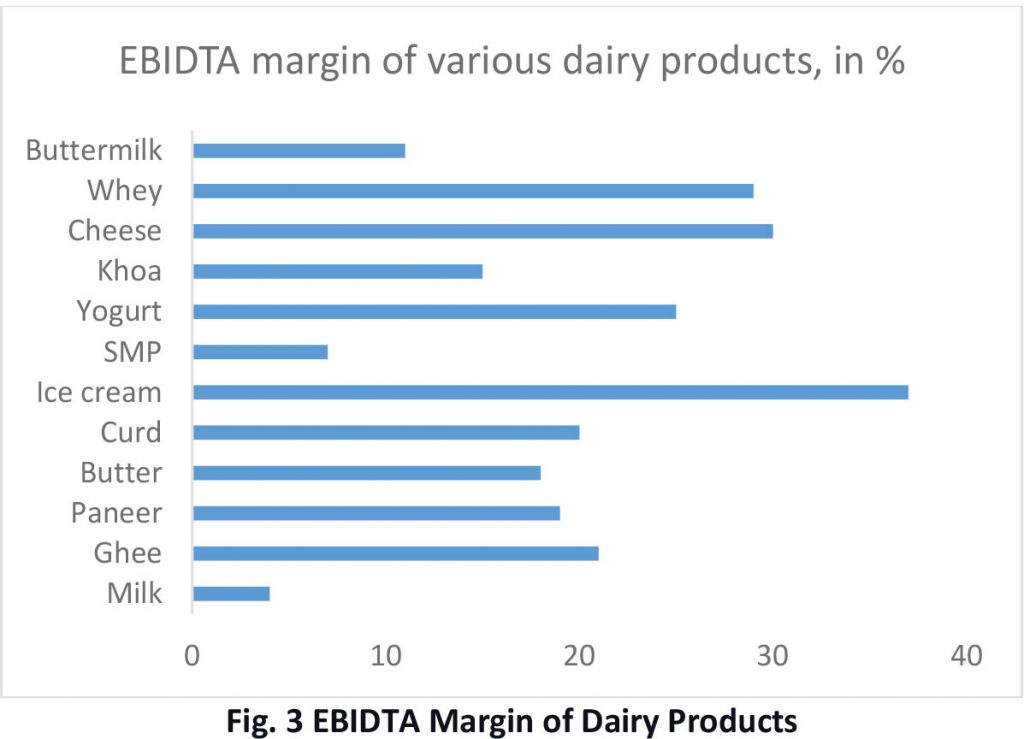

Cooperatives dominate the Indian dairy market, followed by private players. However, in recent years, the percentage of milk handled by private players is increasing significantly. Various players include Parag Milk Foods, Schreiber Dynamix Dairies, Heritage Foods, Tirumala Milk Products, Sterling Agro Industries, VRS Foods, Nestle India, Prabhat Dairy, Indapur Dairy, Dodla Dairy, Creamline Dairy Products, SMC Foods, Milkfood, Gopaljee Dairy Foods and Anik Industries. Regional players are dominant in most markets and product segments. For example, Amul accounts for a 25% market share in the Curd market, followed by Nestle and Mother Dairy. Competition in the curd market has increased with the entry of Milky Mist, Heritage, Parag and Dodla Dairy, to name a few, in recent years. While in the butter segment, Amul occupies 75% of the market share, but it has only 11% share in the ghee market. Many dairy players have established a national presence and built a strong brand to ensure sustainable growth or command a premium over the competition. Rising consumption of value-added dairy products is seeing players expand into B2C sales. Yoghurt, Cheese, Whey and Ghee segments offer attractive profit margins to the companies among other value-added dairy products (Fig 3)

There is a growing demand for whey protein both as a B2B and B2C product due to rising health enthusiasts. The growth in the direct consumption of yoghurt and cheese as healthy snacks will continue to drive the yoghurt and cheese segment, a lucrative value-added dairy business, offering promising opportunities for market entry.

There is a growing demand for whey protein both as a B2B and B2C product due to rising health enthusiasts. The growth in the direct consumption of yoghurt and cheese as healthy snacks will continue to drive the yoghurt and cheese segment, a lucrative value-added dairy business, offering promising opportunities for market entry.

Though the competition in the domestic market is high, the dairy companies should increase their presence in the value-added dairy products segment, which offers potential growth opportunities in the Indian market. In addition, dairy companies need to strengthen their processing facilities in the dairy sector and ensure traceability to the farm and cattle to overcome export challenges and explore the global market presence.

References:

- Annual Report – Parag Milk Food, and Dodla Dairy.

- FICCI Paper on Development of Dairy Sector in India, , 2020

Author:

Consultant- Food Processing and Retail practice,

Connect with Author at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond