Role of CRAMS in Evolving Agrochemical Industry

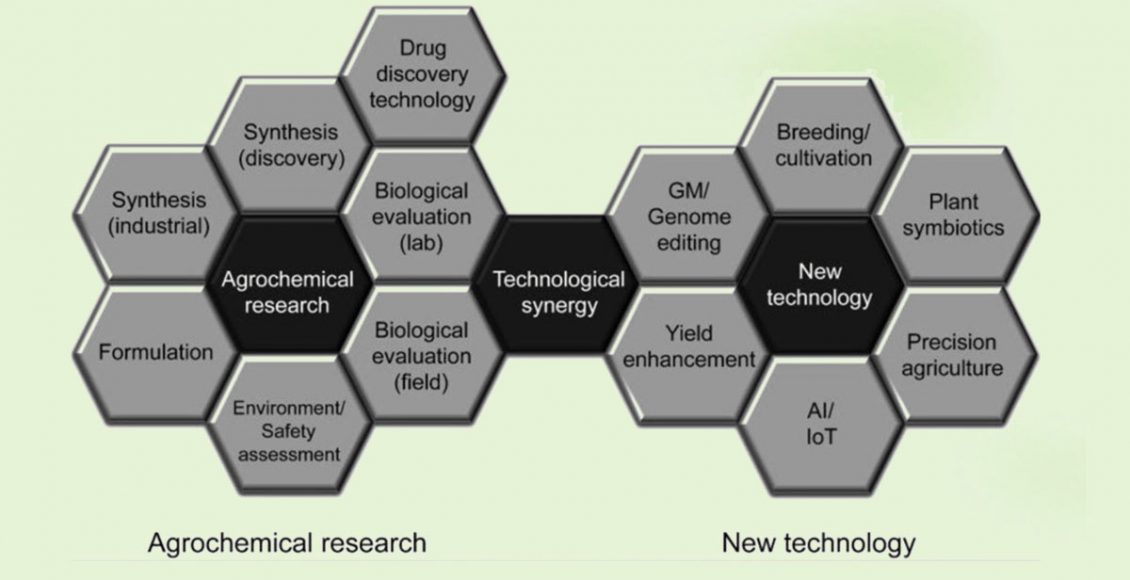

Over the last few decades, the agrochemical industry has been continuously evolving owing to the changing needs such as emerging new pests, safety and environment-friendliness, biodiversity protection, resistance management, climate changes, and efficient product utilization rate. Approximately 80% global market is dominated by generics and new active ingredients account for only 20%. The generics developed in developing markets, have grown significantly in the last decade because China and India, the leading manufactures in Asia take the lead in production of the off patent technicals and formulations. The rate of new active ingredients entering the market has significantly declined owing to longer product development cycles (~11 years), huge amounts of investments (~$286Million) and rigid regulations. To tackle these issues, industry players are diversifying into integrated pest management (IPM) and precision farming. The companies are exploring outsourcing of various stages of research testing and manufacturing to contract research organizations (CROs) and contract manufacturing organizations (CMOs) collectively known as CRAMS (Contract Research and Manufacturing Services) for economic as well as strategic purposes. The global market for CRAMS is expected to grow at a CAGR of 10% from 2020-2024 and CROs are playing a critical role in its growth. CROs offer expertise, ensure quality, and provide sustainable solutions and have become an integral part of the crop protection business as they offer tailored solutions that frees up companies’ time and resources.

Agrochemical sector is one of the most heavily regulated ones and the regulatory guidelines change rapidly forcing companies to supply more data to meet regulations, conduct more testing at different locations and risk assessment analysis to remain competitive. This has changed the relationship between CROs and Agrochemical companies from ‘buyer- supplier’ relationship to ‘strategic partners’ in the last decade. Selection of CROs is key as they play a critical role in meeting the global harmonised guidelines for regulatory approvals. CROs also undertake field trials and lab studies and offer the complete bouquet of services for registration of the molecules.

MNCs like BASF, Bayer and Syngenta are already outsourcing more than 70% of their production to either Europe, China or India. The increasing costs in Europe and the COVID-19 pandemic has helped India become one of the favourable destinations for manufacturing of agrochemicals and availing services from CROs and the past year has witnessed an increase in volume too. In this rapidly growing sector, currently the leading CRAMS/CROs in India include, JRF global, UPL, PI Industries, SRF, Tata Chemicals, Rallis India, and Dhanuka Agritech which not only offer CRO services but also contract manufacturing services. These CRAMS providers cater to various needs including agricultural experimentation, regulatory affairs and consultancy, coordination of registration dossiers in plant-protection and nutrition and provide services for field and laboratory testing and regulatory registrations.

Custom Synthesis and Manufacturing (CSM) is another trend in agrochemical industry which has been gaining importance. The CSM companies not only offer Custom research but also custom manufacturing services to innovator companies. The agrochemical companies define the quality of the molecule and the custom synthesis companies develop new synthesis route. Once the process has been developed, it becomes economical to produce the same molecule in higher quantity rather than new molecules. They also conduct evaluations and field trials of these agrochemicals. China is one of the leading countries for custom synthesis, however, India is emerging as one of the leading hubs for the desired services with European sources often providing local backward integration and full independence from Chinese raw material sources. In India, PI Industries, and SRF are globally popular for custom synthesis of agrochemical molecules.

The players in India for CRAMS. and custom synthesis are few and the market is fragmented and will be expanding with increasing demand of outsourcing services. India can soon become the hub for custom synthesis and manufacturing and CROs in agrochemicals with increasing number of GLP and NABL accredited labs, centres with quality infrastructure offering services, increasing expertise and new supporting government policies.

Author:

Connect with Author at: E-mail agribusiness@sathguru.com

Grow Beyond

Grow Beyond