Agri services – Addressing the Needs of Smart Agriculture

India is home to about 150 million smallholder farmers that contribute to over 40% of its grain production and around half of its fruits, vegetables, and other crops[1]. However, the demand for food is growing proportionally with the population, making it imperative that crop productivity increases from the current levels. The food supply is crippled by marginal yield gains in majority crops, arable land shrinkage, erratic monsoon patterns, labour shortage, and difficulty in affording and accessing quality Agri inputs, mechanical equipment, technologies, and market platforms for smallholder farmers.

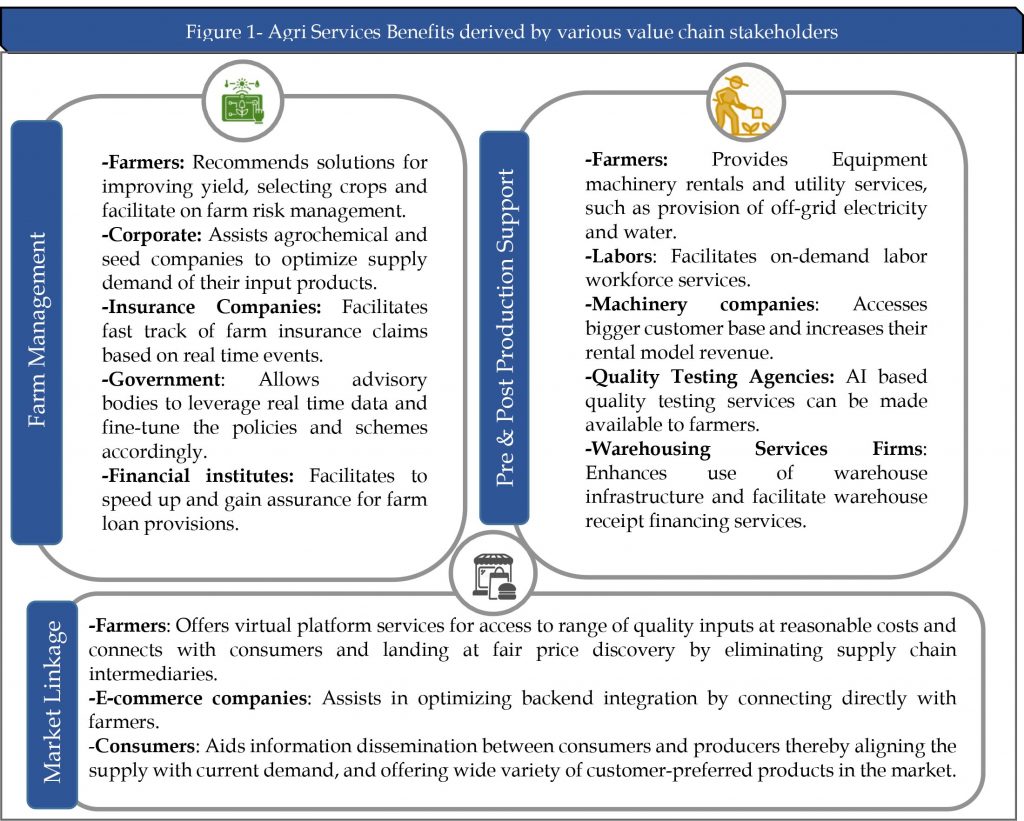

Agri services hold immense potential in offering affordable technology solutions for efficient and smart farming. It aim to convert fixed costs into variable costs for farmers, making the technologies and services accessible and affordable to the small farm holder community. Agri services providers work on two transactional models, i.e. subscription and pay-per-use, making it an economically viable option for farmers. The Agri service offerings are being provided across three crucial elements that govern the Agri value chain- (Figure 1)

As per recent market reports, in India, the number of Agri services-based start-ups has doubled since 2013. As of 2018-19, the total investment in the Indian Agri services segment is around $105 – $115 million, with more than 40% A and B series stage funding rounds, highlighting high investment interest. Major investors are Accel Partners, Aspada, Aavishkaar, Ankur Capital, IvyCap Ventures, and IDG Ventures.

As per recent market reports, in India, the number of Agri services-based start-ups has doubled since 2013. As of 2018-19, the total investment in the Indian Agri services segment is around $105 – $115 million, with more than 40% A and B series stage funding rounds, highlighting high investment interest. Major investors are Accel Partners, Aspada, Aavishkaar, Ankur Capital, IvyCap Ventures, and IDG Ventures.

Mahindra & Mahindra Group offers Agri services across the value chain through its venture, ‘Trringo’, which offers rental farm equipment and operates on a franchise-based and marketplace-based model. The firm has also invested in ‘MeraKisan’, an e-commerce market linkage platform that sells fresh fruits and vegetables directly to consumers. While John Deere India has custom hiring centres and has partnered with EM3 Agri Services to provide tech and farm equipment on a Pay-for-Use basis. At present, other firms such as UPL through its recently established entity- ‘Nurture. Farm’ and Amazon Retail are gaining traction in the market with their entry into the agri-service segment. Both businesses aim to facilitate farmers in purchasing inputs, book a service for operations such as soil testing, sowing, spraying, and harvesting, and seek crop protection advisory to tackle pests and diseases.

The government is actively assisting by offering financial assistance and incubation facilities to small and medium-sized service firms through NABARD funding initiatives. Several state governments have established Custom Hiring Centres (CHC) in rural areas where farm machinery is made available to farmers via PPP Model. Soil health cards and eNAM services are also directed towards promoting the Agri services model in India. In years to come, it is expected that Agri services will connect all value chain stakeholders and align the crop production to market requirements and encourage more product innovations in the Indian Agri services segment.

[1] http://www.fao.org/3/i5251e/i5251e.pdf

Author

Connect with Author at: E-mail agribusiness@sathguru.com

Grow Beyond

Grow Beyond