Emergence of global mid-sized pharma companies – cell and gene therapy goes beyond big pharma & VC funded ventures

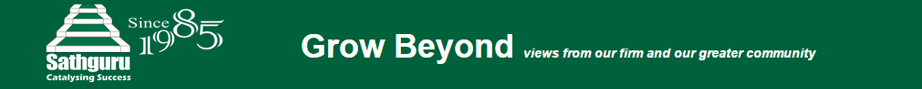

Five years have passed since the first CAR-T cell therapy was approved by USFDA and EMA. 2017 saw three companies advance transformative regenerative solutions through the approval milestone – Novartis with Kymriah, Kite Pharma with Yescarta and Spark Therapeutics with Luxturna. With sustained pipeline investments and approval momentum, 14 Cellular and Gene Therapy Products (excluding cord blood products) have been approved by the US FDA since 2017. Of these 14 approvals, 65% were in the last two years with 5 approvals in 2022 and 4 in 2021. The boundaries have been pushed by both – big pharma betting big on the potential of regenerative therapy as well as pioneering ventures fuelled by venture capital.

Amongst big pharma, Novartis continues to expand investments in cell and gene therapy. Most other large pharma companies who have gained a spot on the league table with approved products have done so through acquisitions. Young ventures have continued to be a domineering force, often powered by science that originated in academia. M&A activity has been rife since 2017 with Gilead first acquiring Kite Pharma, a venture with Israeli origin and initially based on technology spun out of Weizmann Institute and NIH. BMS gained significant ground with integration of two major strategic investments – Juno and Celgene. Roche invested in Spark Therapeutics, one of the pioneers of CAR-T cell therapy.

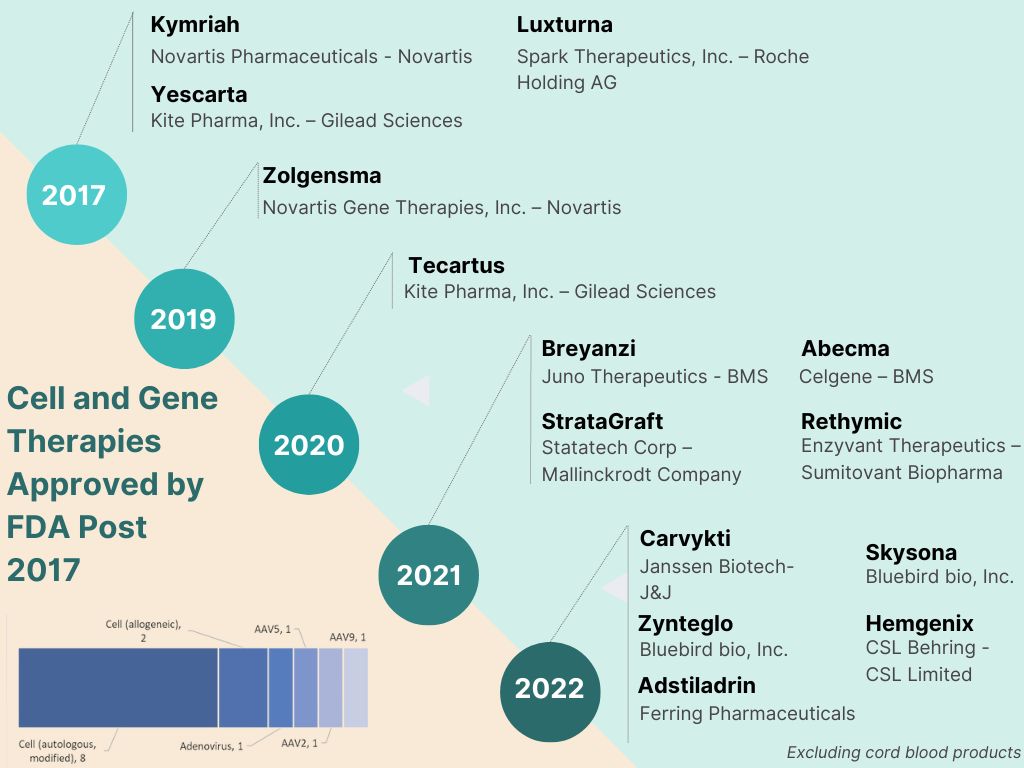

The five approvals in 2022 signal this composition evolving into a broader base. The first approval of 2022, Carvykti a CAR-T cell therapy for certain kinds of relapsed or refractory multiple myeloma marked the entry of another big pharma contender, Janssen. Two of the five approvals were nabbed by Bluebird Bio, one of the standalone ventures in the field. Bluebird’s approvals included the first cell-based gene therapy for treatment of adult and paediatric patients with beta-thalassemia and another for a kind of cerebral adrenoleukodystrophy. The November and December approvals are significant reflection of the expanding industry engagement. They signify the entry of the mid-sized pharma companies in a field dominated by investment hungry big pharma until now. The two major USFDA approvals towards the year end were taken by Ferring Pharmaceuticals and CSL Behring. These established mid-sized companies not only achieved key regulatory milestones but were also successful in developing the first gene therapies for respective indications.

Ferring Pharmaceuticals received US FDA and EMA approval for the first gene therapy for bladder cancer, Adstiladrin, based on a novel adenovirus apyvector. The approval is a significant step towards expanding current treatment options for adult patients with high-risk Bacillus Calmette- Guérin (BCG)- unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS) with or without papillary tumours. This approval enables Ferring to integrate next generation solutions in uro-oncology, a segment where the company already enjoys high portfolio strength.

CSL Behring and uniQure received US FDA’s nod for haemophilia B gene therapy, Hemgenix, the first gene therapy approved for the rare condition. The approved gene therapy is priced at USD 3.5 million per dose, pegging it as one of the most expensive drugs globally. CSL bagged the commercial rights for the gene therapy from uniQure for USD 450 million in 2020 with an additional USD 1.5 billion payable in milestone payments and royalties.

Amongst EMA approvals, in August 2022 BioMarin jumped on the bandwagon of mid-sized pharmaceutical companies entering the gene therapy segment. BioMarin received conditional marketing authorization from European Commission for Roctavian, first gene therapy for adults with severe Hemophilia A. BioMarin, a company focused on development and commercialization of novel therapies for rare disease conditions, currently has 7 commercial products, which include multiple small molecule therapies. The company’s pipeline in gene therapy includes 3 assets for indications such as hereditary angioedema, phenylketonuria, and hypertrophic cardiomyopathy.

Start of the Global Ripple – Base of product developers and innovators expanding globally

Momentum has been rife in both in innovation investments and SRA approvals. The potential for transformative therapies is now globally acknowledged and the quest for solutions to the 5000+ uncured rare indications is now evolving into a more global phenomenon. The domino effect has been across borders and is evident in RoW or LMIC markets. This expanding innovation engagement is likely to result in significantly widening the global pipeline. More importantly this can potentially pave the way towards more equitable and affordable access to cell and gene therapy.

The engagement in LMIC spans pioneering research groups in academia as well as young ventures. Two notable examples include Immuneel Therapeutics & Eyestem, both with origins in India. Immuneel Therapeutics, based in Bengaluru was founded in 2019 by Kiran Mazumdar-Shaw, Dr Siddhartha Mukherjee and Dr Kush Parmar. The company is developing CAR-T cancer therapies and it raised USD 15 million in Series A round, led by their existing investor Eight Roads Ventures, True North Fund VI LLP and F-Prime Capital. In June 2022, the company announced commencement of India’s first phase II patient trials for CAR-T cancer therapies at Narayana Hrudyalaya in Bengaluru. Another Bengaluru and Delaware based cell therapy company founded in 2016, Eyestem raised USD 6.4 million (INR 51 Crore) investment in Series A, with participation of financial sponsors as well as multiple Indian pharma companies. The company will utilize the investment, to expand their flagship pipeline asset, EyeCyte-RPE for treatment of Dry Age-related Macular Degeneration (Dry AMD) through early clinical trials. Other two pipeline assets of the company include EyeCyte-PRP and AirCyte-AEC. EyeCyte-RPE is patented flagship allogenic product of the company, designed to restore sight for patients in early stages of Macular Degeneration by replacing damaged retinal pigment epithelium cells.

We enter 2023 with optimism and excitement – cell and gene therapy has become more mainstream, innovation pipeline continues to expand globally, mid-sized pharma companies have emerged as competitive investors in the segment and finally, and, equitable access could ultimately become a reality as well.

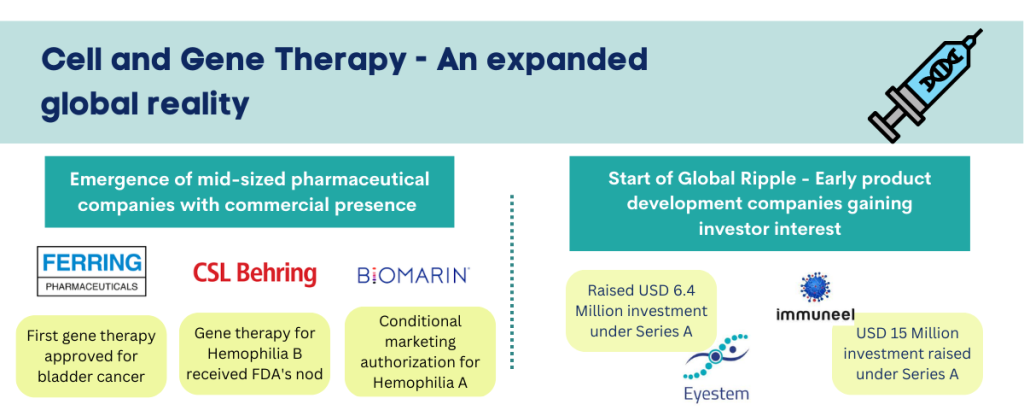

The COVID-19 pandemic has had glaring impact on the global biopharma manufacturing landscape. The world order of concentrated manufacturing in a few global hubs is now in question. Supply chain disruptions and supply shocks have highlighted threats to health system resilience. There is global focus on reducing risks associated with high dependence on single/limited-sourcing models for pharmaceutical products. The quest for strengthening domestic and regional value chains is true across geographic regions and economic tiers. Not only LMIC (low and middle income) countries, even HIC (high income) countries are exploring policy measures, economic and monetary incentives, and ecosystem development approaches to nurture the pharma and biotech manufacturing base. The global phenomenon also holds true across product categories – small molecule Active Pharmaceutical Ingredients, (API) and formulations, vaccines, and other biologicals. The most lasting impact of strategic measures initiated in 2022 could be in this direction – reshaping of global landscape in pharma and biotech manufacturing.

The COVID-19 pandemic has had glaring impact on the global biopharma manufacturing landscape. The world order of concentrated manufacturing in a few global hubs is now in question. Supply chain disruptions and supply shocks have highlighted threats to health system resilience. There is global focus on reducing risks associated with high dependence on single/limited-sourcing models for pharmaceutical products. The quest for strengthening domestic and regional value chains is true across geographic regions and economic tiers. Not only LMIC (low and middle income) countries, even HIC (high income) countries are exploring policy measures, economic and monetary incentives, and ecosystem development approaches to nurture the pharma and biotech manufacturing base. The global phenomenon also holds true across product categories – small molecule Active Pharmaceutical Ingredients, (API) and formulations, vaccines, and other biologicals. The most lasting impact of strategic measures initiated in 2022 could be in this direction – reshaping of global landscape in pharma and biotech manufacturing.

United States – The focus on advanced manufacturing in pharmaceuticals:

The Biden Harris Administration has acknowledged the importance of onshoring pharma manufacturing and securing America’s supply chain for drugs and vaccines. Over the last two years, the response has progressively expanded with the initial US FDA report to Congress leading into a 100-day report, an Executive Order and several investments in the prioritized directions. In February 2021, the President signed Executive Order (E.O.) 14017 “America’s Supply Chains”, with the objective of addressing supply chain vulnerabilities by expanding manufacturing base of four critical products: semiconductor manufacturing, large capacity batteries, critical minerals and pharmaceuticals and active pharmaceutical ingredients. A sector-by-sector approach will also be deployed, to guard against single-source risk for critical materials. Essential Medicines Report on Supply Chain and Manufacturing Resilience Assessment was released in May 2022 by U.S. government. The report and assessment highlights bottlenecks affecting critical medicines, specifically on FDA’s essential medicine list.

Measures being explored include on-shoring through investments in advanced manufacturing, stockpiling along with investments in sustainable domestic production, near-shoring and ally-shoring to address threat of geo-political developments on health security. Policy developments driven by United States’ near-shoring and ally shoring intent are likely to impact geographic focus for future pharma investments in global manufacturing capacity. Investments in advanced manufacturing are also likely to significantly impact competitiveness and global business landscape, especially in areas where manufacturing platforms are likely to have significant impact. This includes enzymatic biotransformation and continuous manufacturing in API and bio-manufacturing across more established product categories such as peptides and monoclonal antibodies and emerging categories such as cell and gene therapy.

The MENA region:

Other high-income countries in MENA region, such as Kingdom of Saudi Arabia (KSA), UAE and Oman have been focusing on developing policies for incentives linked development of domestic pharmaceuticals and API manufacturing in respective countries. As KSA pursues the comprehensive Vision 2030 plan, pharmaceutical localization has gained centre stage. Most prominent policy lever in this high-income country has been market linked incentives with preferential price fixation for locally manufactured products. Other countries such as Egypt and Oman (Vision 2040) are among the set of countries in MENA region with initiatives providing framework and guidance for meeting long-term localization goals. While the LMIC countries in the region offer more cost competitive regional manufacturing opportunity, the HIC countries have greater leverage with market linked incentives for localization. Across both, expanding size of addressable market will be critical for nurturing sustained manufacturing operations at scale.

Latin America – PAHO emerges as anchor:

Within Latin America, the focus is high on localization for both vaccines and API. With limited regional vaccine manufacturing base, the quest for localization is high in the interest of health security and pandemic preparedness. Pan American Health Organization (PAHO) has emerged as a key regional anchor and has called on countries to nurture expanded regional manufacturing base. The organization has laid down a three-step plan where the first phase will focus on strengthening research and development in Latin America and Caribbean, specifically in mRNA vaccine development. The Regional Platform to Advance Manufacturing of COVID-19 Vaccines and other Health Technologies was launched in 2021. Sinergium Biotech based in Argentina and Institute of Immunobiology Bio-Manguinhos based in Brazil are participating in the WHO’s mRNA Hub initiative and receiving technology transfer for manufacturing mRNA vaccines. The second phase will entail development of the regulatory ecosystem and the third phase will include working along with regional and international partners to create roadmap for localizing health technology manufacturing in Americas.

Africa – expanding collective momentum on the continent:

The starkest import dependence and hence the deepest impact during COVID-19 has been in the African region. To address the looming threat to health security, several countries initially announced initiatives to foster local manufacturing of pharma and biotech products. Over the last two years this has evolved into significant collective will and continental initiatives. Given the relatively fragmented market base and the sub-optimal size of national markets, collective intent and market integration will be critical for overall success in the content. Hence, we are enthused by the developments in 2022 and bear high optimism as we look forward to these initiatives resulting in significant mid-term impact.

Focus on vaccine manufacturing – The African Center for Disease Control and Prevention (African CDC) articulated the goal of the ‘New Public Health Order’ and has served as a key anchor along with the African Union (AU). The vision of self-reliance espouses the target of meeting 60% of vaccine needs through locally manufactured by 2040. Partnerships for African Vaccine Manufacturing (PAVM) has been a key champion for localization of vaccine manufacturing in Africa converging activities across key workstreams such as technology access, regulatory capacity enhancement, funding, and market shaping. With anchor investors such as BioNTech and initial partnerships with established LMIC vaccine manufacturers getting forged, 2022 has important for sustaining momentum and stewarding projects through pragmatic interim milestones. The BioNTech investment in Rwanda and Senegal is a key milestone as it is the first major investment in the continent by an international vaccine company to locally produce vaccine drug substance. The commitment continues to be high with execution commenced across both sites. Partnerships forged by Aspen and Bio Vaccine Nigeria with LMIC manufacturer Serum Institute of India serve as initial milestones in fill finish formulation capacity creation on-continent. As the momentum and stakeholder support further expands, we perceive physical presence and more commitment joint ventures from LMIC manufacturers with significant public health focus. Financial support of USD 30 million from the Gates Foundation and CEPI to Aspen GAVI’s current commitment to design a financial instrument to nurture viability are all encouraging indicators of the initiative’s sustainability.

Regulatory ecosystem development is also a critical element to enable the goal of local manufacturing. Formalization of the African Medicines Agency as a unified continental regulator pave for market integration, a key aspect for business viability. Five African National Regulatory Authorities (NRAs) have now achieved Maturity level three (ML3) as per WHO Global Benchmarking Tool (GBT). The latest being South Africa’s SAHPRA attaining maturity level three (ML3) in October 2022, providing the regulatory authority with the recognition as capable system to ensure quality, safety and effectiveness of vaccines manufactured, imported or distributed in the country. The other ML3 regulators now on the continent include Egypt, Nigeria, Ghana and Tanzania. With significant investments in ecosystem development, foundation is primed for sector growth across pharma and biotech. However, for sustained impact there is urgent need to shape pragmatic solutions for nurture sustained cost competitiveness vs imports from dominant global manufacturing hubs.

India – Bulk Drug Parks and PLI:

The quest for local manufacturing value chain also extends to countries perceived as dominant manufacturing hubs for pharmaceuticals. Case in point is India. While India’s pharma exports reached ~ USD 25 billion in FY2022, health security threat runs high with significant dependence on Chinese imports for API for several essential drugs. While the problem is not new, the sense of urgency post COVID resulted in much needed policy action. Two major policy measures were the Production Linked Incentive (PLI) scheme and creation of new Bulk Drug Parks. The bulk drug parks are envisioned to create new clusters for API production with promise of well-developed common infrastructure and consequent cost optimization. Three parks have been approved with a total outlay of about USD 400 million. The PLI scheme incentives new project investments in price eroded essential medicines where import substation is critical. Total outlay for pharmaceutical PLI is about USD 2 billion and 55 projects have been approved for execution.

Beyond 2022 – Sustaining momentum & adapting to new model of more distributed manufacturing presence

COVID-19 has been the force triggering this momentum around localization around global regions. We end 2022 with heightened political will, emerging mechanistic approaches to foster business viability and ecosystem investment to nurture the value chain. While the journey is longer, the foundation is being built. While the level fo actualization of the intent will vary across regions and countries, developments of the last two years are going to have far reaching impact. Global pharma value chains and world order as we know them today are unlikely to remain so five years later. This raises the question for industry to consider – what is the plan to adapt, remain competitive in the new world with more distributed pharma manufacturing?

Pharma API continues to be in focus for M&A and investments. The momentum built over the last few years continues to hold up; and PE funds and strategic investors continue to track the segment with interest across global regions. Additionally, contract services also continue to gain traction. The limelight stretches across all segments of opportunity within contract services – discovery, in-vivo and clinical services, contract manufacturing with heighted emphasis on biologicals. 2022 deal activity builds on base of multiple transactions over the last few years.

Pharma API continues to be in focus for M&A and investments. The momentum built over the last few years continues to hold up; and PE funds and strategic investors continue to track the segment with interest across global regions. Additionally, contract services also continue to gain traction. The limelight stretches across all segments of opportunity within contract services – discovery, in-vivo and clinical services, contract manufacturing with heighted emphasis on biologicals. 2022 deal activity builds on base of multiple transactions over the last few years.

To expand oral-dose drug development, Catalent pharma acquired Metrics Contract Services from Mayne Pharma for USD 475 million. In early 2022, Merck acquired CDMO Exelead for USD 780 million and invest upto USD 567 million for technology expansion. Exelead specializes in PEGylated products and complex injectable formulations, including Lipid Nanoparticle (LNP) based drug delivery technology. Merck has also made organizational changes to boost CDMO operations. The new life sciences services unit (LSS) will combine the existing CDMO and contract testing units, along with the respective marketing, sales, research and development, manufacturing, and supply chain operations. CDMO Novasep merged with PharmaZell to create a powerhouse in API contact manufacturing services. The combined company has a footprint in Europe, the US, and India with combined revenues of nearly EUR 500 million (USD 545 million). Sweden based Recipharm which has historically engaged in small molecule API and fill-finish space is entering into biologics manufacturing space with acquisitions of multiple CDMO’s such as GenIbet, Arranta Bio, Vibalogics. Euroapi, a Sanofi spin-off, launches as a stand-alone CDMO. A new API CDMO Pharmira was launched as joint venture between Shionogi Pharma, Osaka, Fujimoto chemicals and 5 other Japanese companies.

India has also emerged as a hub of activity, and the outlook remains robust with the country expected to gain from industry inclination to minimize or de-risk from value chain presence China. Advent International has acquired India based CDMO Suven pharma for USD 727 million. Hyderabad based CDMO Gland pharma has acquired EU based Cenexi group for USD 127 million. This builds on activity of last few years where notable transactions included TPG Capital’s investment in Sai Lifesciences in July 2018, CX Partners’ investment in Veeda Clinical Research in December 2018 (and subsequent bolt-on acquisition of Bioneeds by Veeda in July 2021), True North’s investment in Anthem Biosciences in March 2021 and Goldman Sachs’ investment in Aragen Life Sciences (earlier GVK Bio) in May 2021. The focus on biologicals was also evident in transactions over the last two years with the intent emphatic in Laurus’ investment in Richcore and Piramal’s investment in Yapan Bio (January 2021 and December 2021 respectively).

We foresee continued investment appetite by industry as well as financial sponsors to further bold breadth of capability and global presence in contract services as well as API. While biologicals in contract services are continuing to remain in focus, investment appetite is rife across the spectrum.

Biosimilars haven’t necessarily been the hottest topic of 2022. But it would be myopic to not discuss the very high impact developments during the year. In the previous years, we have been elated about approval momentum and them about delivery innovation coming of age in biosimilars. The latest trend to unravel implications of is the expanding reality of interchangeability and capital efficiency in pre-clinical and clinical validation. Finally, ophthalmic biosimilars have been the most visible this season!

Expanding reality of interchangeability:

The EMA earlier refrained from designating biosimilars as interchangeable and left that judgement to member states. Hence, individual countries developed their own approaches on determining interchangeability and substitutability of biosimilars. However, in stark departure from this earlier position, in September 2022 the EMA and the Heads of Medicines Agencies (HMA) issued a joint statement that biosimilars approved in the European Union are interchangeable with their reference medicines or with an equivalent biosimilar.

This position of automatic interchangeability without additional regulatory requirement or discretion of member states has significant commercial ramifications. This paves way for faster uptake of biosimilar and thus higher penetration in year 1. Speed to commercial milestones is now enhanced. This also avoids the financial burden of additional validation earlier perceived as required to establish interchangeability. However, at the other end, faster penetration and competitive dynamics is also likely to result in more intensive price-based competition and price erosion. Time to market is only becoming more important in a business segment where speed has always been of essence. EMA’s statement is based on significant experience now gained with biosimilars – more than 86 granted since 2006.

The other major SRA, US FDA still continues with the position that agency will designate interchangeability on a case-by-case basis. However, with the developments of 2021 and 2022, the threshold of evidence has been progressively decreasing and achievability has increased. The most notable cases are in insulin. In 2021, Mylan’s Semglee (insulin glargine) received the 1st FDA nod for interchangeable biosimilar for Sanofi’s Lantus. It was shortly followed by biosimilars Cyltezo (adalimumab) and Cimerli (Ranibizuumab). With US FDA’s expanding appetite to designate individual biosimilars as interchangeable, the overall achievability of this milestone has been significantly enhanced.

Emerging reality of capital efficiency – lower bar for both pre-clinical and clinical testing

While the emphasis on totality of evidence continues across regulators, level of reliance placed on bio-analytical characterization data, in-vivo data and clinical data continues to evolve.

Reduced focus on in-vivo trials – The current EMA guidance for biosimilars does not recommend nonclinical safety studies in higher animal models, such as non-human primates, but a repeat-dose toxicity study (integrated with immunogenicity and local tolerance study) in other animals may be acceptable. There has been high receptiveness from USFDA to accept well justified rationale for avoidance of in-vivo toxicology package. The FDA Modernization Act also signals the overall reduced emphasis on animal testing or approvals, including in biosimilars. The WHO’s latest guideline issued in 2022 and the UK MHRA guideline issued in 2021 also reflect the position taken by EMA.

Within clinical trials, there is decreased focus on efficacy and immunogenicity. This is resulting in significant capital efficiency in the stage of development that is usually the most expensive to undertake. Insulin is again a case in point here – both EMA and US FDA have both taken the explicit position that PD markers are sufficient and clinical safety and immunogenicity is not required for approval of insulin biosimilars.

WHO’s 2022 guideline also refers to PD markers in clinical trials negating need for efficacy endpoints. It also includes explicit references to examples of PD markers for various molecules such as G-CSF, insulin and denosumab biosimilars. India is also adopting the trend with Biocon’s Kixelle(insulin aspart) being approved by CDSCO after waiving phase 3 studies. However, across regulators, focus on comparative clinical data for PK and/or PD continues to be high. Overall, we perceive that all developments will together result in reduced cost of development, increased competition, and re-substantial shaping of the business case in biosimilars over the next few years.

Finally, the 2022 has been the year of ophthalmic approvals – high visible and significant competition in commercial products and late-stage pipeline. And as we embark on 2023, we can’t help remind ourselves that this is the big year when the adalimumab biosimilar market opens in United States. With more than 33 approvals globally and eight in the US waiting for the door to open, intense commercial dynamics await.

Grow Beyond

Grow Beyond