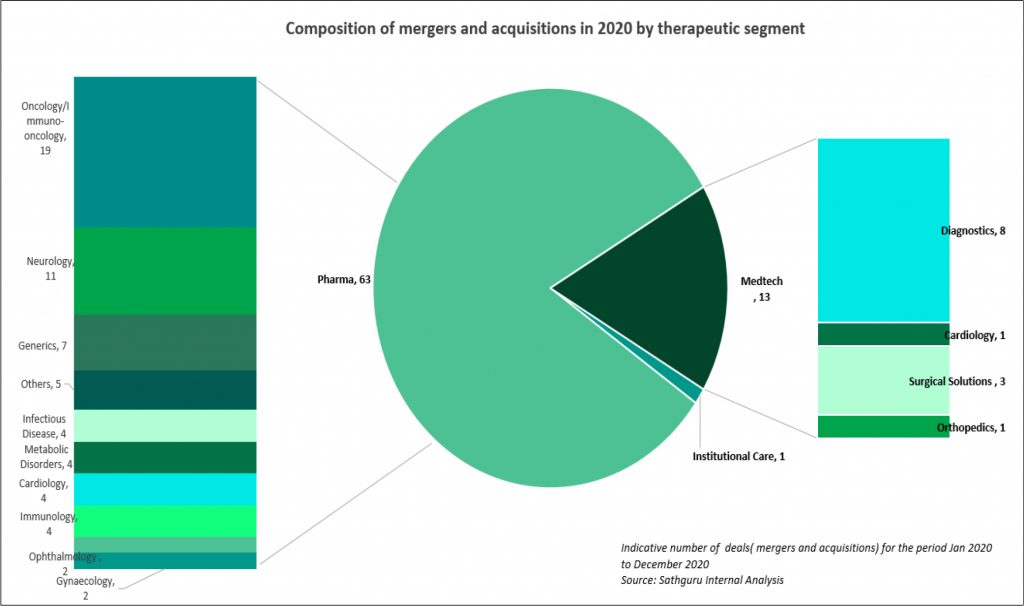

Despite the pandemic, robust deal making was true across segments of healthcare in 2020 with total deal value being north of USD 170 Bn. This is encouraging in the context of the economic impact of COVID, and the pervasive preference for cash preservation across sectors. However, when compared with deal momentum in previous years, this reflects substantially subdued appetite across both pharma and MedTech (medical device, diagnostics and digital health) companies. With 2019 aggregate deal value crossing USD 300 billion globally, there was a steep drop in total deal value. Structurally too, companies have pivoted towards deal structures that have minimized upfront cash outlay and risk; and licensing has taken precedence over outright M&A.

We have analyzed below drivers of dal activity in 2020 across the spectrum of pharma, MedTech and institutional care. While pharma expectedly had a lion’s share of the overall healthcare pie, the steeper fall in medtech deals has experienced a rebound in early 2021.

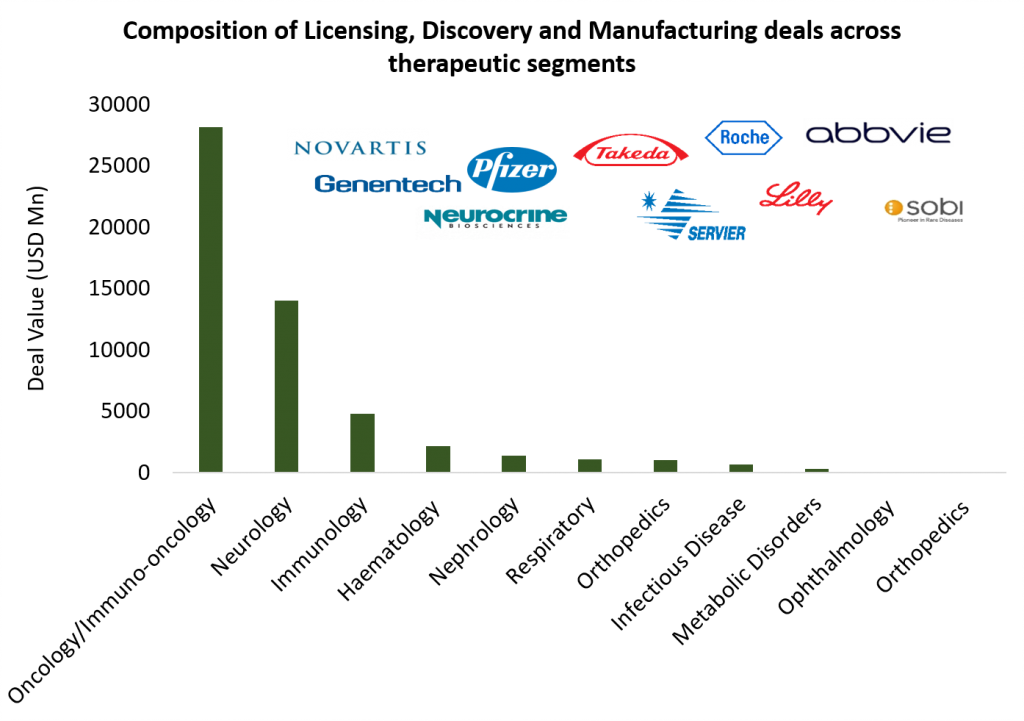

Oncology and Immunology dominate high value M&A deals as well as comprise largest share of licensing transactions

Oncology and immunology have attracted largest share of pharma’s interest and capital. This is reflected in both revenue accretive M&A deals as well as pipeline bolstering acquisitions and licensing transactions:

Alexion’s and Momenta’s acquisition by AstraZeneca and Johnson and Johnson respectively pushed the envelope on deal value and embodied intensity of industry interest in auto-immune disease / rare diseases. Buoyed by these mega deals, aggregate deal value in immunology in 2020 exceeded USD 60 Bn. The largest deal of the year was AstraZeneca’s acquisition of Connecticut based rare disease champion Alexion Pharma for USD 39 Bn. In addition to being revenue accretive (~ USD 6 Bn in 2020), the acquisition rolls into AstraZeneca’s stable 11 pipeline molecules. More details on the deal is available on our PharmForward update here.

Johnson and Johnson’s acquisition of Momenta for ~ USD 6.5 Bn was again driven by the latter’s autoimmune portfolio. The acquisition was completed in October and provides Johnson and Johnson access to Momenta’s lead asset nipocalimab, Phase III ready for generalized myasthenia gravis (gMG). More details on the deal available here.

Sanofi also added to the momentum in immunology with acquisition of Principia Biopharma for USD 3.6 Bn. Driver for the acquisition was Principia Biopharma’s late stage lead candidate SAR443168, currently undergoing Phase III clinical trials to manage Primary Progressive Multiple Sclerosis. More details on the deal are discussed here.

Oncology / immuno-oncology, however, continues to top the deal table for number of deals. Following right behind immunology in deal value, the overall oncology/Immuno-oncology segment had more than 20 deals with aggregate deal value exceeding USD 40 Bn. Gilead emerged the most active acquirer as well as the one with deepest pockets. Largest deal in the therapeutic area was Gilead’s USD 21 Bn acquisition of Immunomedics; with the centrepiece of the deal being antibody-drug conjugate (ADC), Trodelvy that was under review by the US FDA as a third-line treatment for metastatic triple negative breast cancer. Following on its heel was Gilead USD 4.9 Bn acquisition of Forty Seven, a clinical stage immune-oncology company holding expertise in developing immune evasion pathways and targeted cell therapies based on technology licensed from Stanford University. Other deals forged by Gilead include USD 1.7 Bn acquisition of Pinoyr Therapeutics and USD 300 Mn acquisition of Tizona Therapeutics (for 49.9% interest in the company and an option to acquire the remaining for an additional USD 1.25 Bn), both bolstering Gilead’s pipeline with oncology assets under early clinical development.

Merck acquired Velos Bio, a clinical – stage biopharmaceutical company developing receptor tyrosine kinase-like orphan receptor 1 (ROR1) targeted therapies. The USD 2.7 Bn deal strengthens Merck’s cancer portfolio with Velos’ star candidate VLS-101, a ROR-1 targeting ADC, currently being evaluated in phase 1 for the treatment of hematological malignancies and in phase 2 for the treatment of solid tumors, including triple-negative breast cancer (TNBC), hormone receptor-positive and/or HER2-positive breast cancer, and non-squamous non-small-cell lung cancer (NSCLC). More details on the deal available in our Pharm Forward Website here.

Cell and gene therapies and regenerative solutions continued to attract industry investments. Bayer’s acquisition of Askelpios Biopharmaceuticals for USD 4 Bn builds on Bayer’s previous investment in Blue Rock Therapeutics. AskBio boasted of a pipeline of cell and gene therapies for neuromuscular, CNS and CVS disorders, along with a Parkinson’s disease candidate developed with Brain Neurotherapy Bio. Its Pro10 technology platform uses Human Embryonic Kidney based cell line in serum free suspension media to develop AAV vectors at high scales and yield. Other transactions in Cell and Gene Therapies included Sanofi’s acquisition of Kiadis Pharma providing the former full rights over the Off-the-shelf natural killer (K-NK) cell platform, which consists of allogenic NK cells from healthy donors and a pipeline of cell–based cancer immune therapeutics and infectious disease treatments. More details on the deals available here.

More than 120 licensing and co-development deals with therapeutic area thrust dovetailing M&A trend

With economic uncertainty remaining a deterrent for larger deal outlays, the preference for more distributed and risk staged cash outflows resulted in high momentum in licensing and co-development partnerships. While at least 41 licensing deals carried deal values north of USD 100 million, the upfront outlay would have been substantially higher had some of these pivoted to outright acquisitions. Overall aggregate value of upfront + potential payouts for announced deals was north of USD 50 billion.

Oncology and immuno-oncology had the largest share with about 53 deals and aggregate deal value being north of USD 26 Bn. In terms of stage of development, drug candidates under clinical validation garnered maximum interest. While the late stage pipeline is more pronounced for relative mature areas of innovation such as mAbs and antibody-drug conjugates, earlier stage partnerships characterized the evolving space of cell and gene therapies.

One of the largest deals in oncology is Abbvie’s and Genmab’s collaboration to co-develop and co-commercialized Genmab’s differentiated antibody therapeutics targeted to treat solid tumors and hematological malignancies. In the USD 3.1 Bn deal, Abbvie shall pay Genmab an upfront payment, along with milestone payments and tiered royalties ranging from 22% to 26%.

Another significant deal in oncology was Vaccibody entering into a licensing and collaborative agreement with Genentech to develop neoantigen cancer vaccines. Under the partnership, Vaccibody will conduct development through end of Phase Ib trials for its DNA based VB10.NEO vaccines and Genentech will be responsible for further development and commercialization. The deal value is estimated at USD 1.4 Bn in the form of upfront, near-term and potential milestone payments along with tiered royalties on sale of commercialized products.

The oncology partnerships wave continues into the first few months of 2021, with Novartis announcing partnership agreement with Beigene to market Tislelizumab outside China. Tislelizumab is a novel humanized anti–PD-1 monoclonal antibody, indicated for the treatment of classical Hodgkin’s lymphoma and metastatic urothelial carcinoma. Under the terms of the agreement, Novartis receives development and commercialization rights to tislelizumab in the USA, Mexico, Canada, the United Kingdom, EU, Switzerland, Russia, Norway, Iceland, Liechtenstein and Japan for an upfront payment of USD 650 million along with royalties and milestone payments. BeiGene holds the rights for China and other markets not covered under the license agreement. More details on the deal are covered here.

Immunology and Neurology also attracted substantial deal making momentum with several pharma companies making pipeline bets. Trailing oncology in deal activity, Immunology and Neurology had more than 25 deals with over USD 11 Bn in aggregate deal value. Relatively earlier stage partnerships were also more common in these therapeutic areas. Eli Lilly forged multiple partnerships with Precision Biosciences, Rigel Pharmaceuticals and Seed Therapeutics for development of drugs targeted at Immunological disorders and with Evox Therapeutics to develop therapies for treating neurological diseases. While the deal with Precision Biosciences will utilize the ARCUS, the genome editing platform developed by Precision, the strategic collaboration with Rigel Pharmaceuticals will focus on co-development and commercialization of Rigel’s investigational product R552, targeting multiple auto-immune disorders. The USD 800 Mn deal signed with Seed Therapeutics is directed towards treating multiple indications ranging from cancer to Alzheimer’s disease using the p53 protein degradation pathway. Eli Lilly announced its partnership with Evox Therapeutics earlier to explore multi-target RNA interference therapeutics designed to treat neurological disorders. Under the terms of this agreement, Evox will receive nearly USD 1.2 Bn on successful commercialization and sale of products developed under collaborative effort.

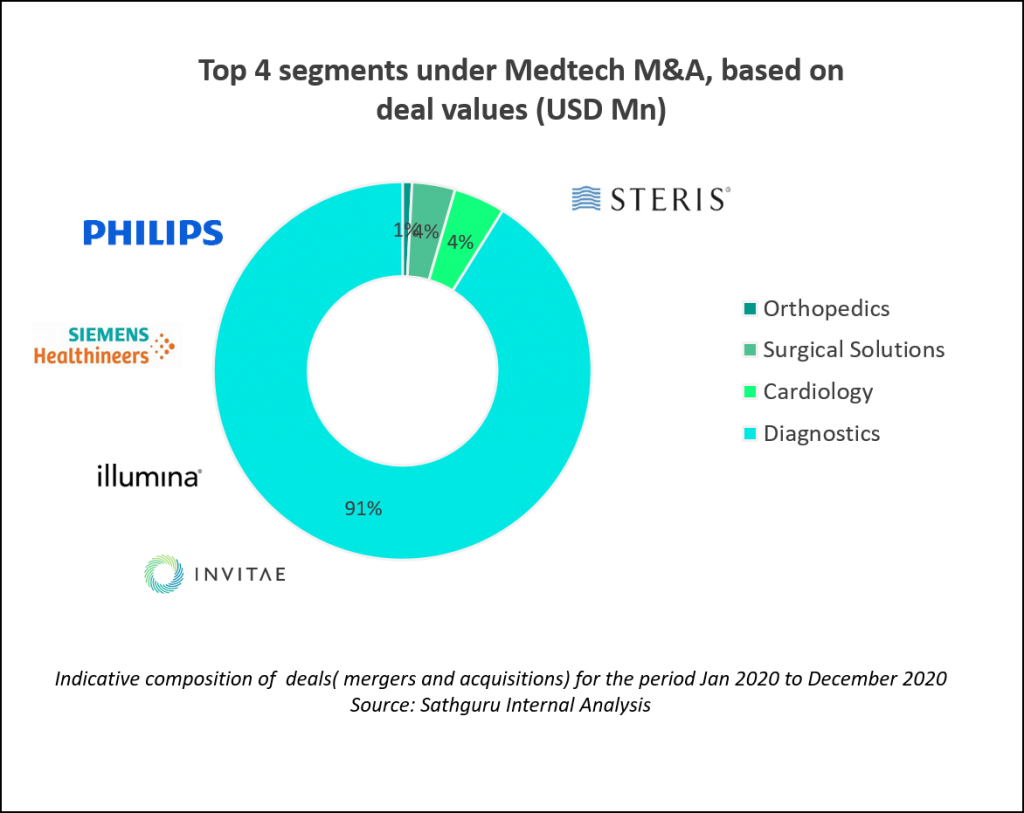

Diagnostics take center stage in medtech transactions during 2020

M&A transactions in the medical devices and diagnostics (together referred to as MedTech)  segment was also relatively subdued compared to previous year. Greater traction was noted in the diagnostics space with the pervasive theme of oncology looming large in this segment as well. Across the medtech segment, diagnostics received a fair share of interest and transactions last year.

segment was also relatively subdued compared to previous year. Greater traction was noted in the diagnostics space with the pervasive theme of oncology looming large in this segment as well. Across the medtech segment, diagnostics received a fair share of interest and transactions last year.

The biggest deal of the year was the mega acquisition by of Varian Medical Systems by Siemens Healthineers in a USD 16.4 Bn transaction. The deal was announced in August 2020, approved by Varian’s shareholders in October and as of early 2021 has also crossed the hurdle of antitrust approvals in US and Europe. The combined entity thus created will be a global powerhouse in oncology care. Varian had nurtured a formidable position as the leader in radiation oncology systems and software. With USD 3.2 Bn revenue in both FY20 and FY19, the Varian acquisition catapults Siemens to a unique position in the high growth global oncology market. This deal moves Siemens Healthineers into the top 5 position amongst medical device peers. The mega deal gave the year’s deal table much needed fillip in the otherwise cash conservation driven temperament.

The economic impediments to deal closures were many and were emphatic in the context of what could have otherwise been the second largest MedTech deal of 2020 – the intended acquisition of Qiagen by Thermo Fisher Scientific for USD 12.5 Bn. Despite a sweetening of deal value, the purported acquisition was not approved by shareholders of Qiagen, an established molecular testing company with presence across the diagnostics and life sciences segments.

Another deal betting one expansion of molecular diagnostics in oncology – was Illumina’s acquisition of Grail for USD 8 Bn. In 2016, Grail was spun out by Illumina as a spin-out based on its NGS platform. Now, Grail comes back to the Illumina portfolio with a near commercial multi-cancer, lab developed test, Galleri. This acquisition embodies the coming of age of sensitive and non-invasive cancer screening and diagnostic possibility with more tangible value realization perceived in the near to mid-term horizon.

Other than oncology, the digital health theme was also popular during 2020. Buoyed by digital consultation and treatment requirements posed by a pandemic of unprecedented scale, digital health innovations globally have benefited from renewed investment appetite. Notable deals include Philips’ acquisition of BioTelemetry with the objective of transforming remote patient monitoring. With deal value of over USD 2.8 Bn, the acquisition will strengthen Philip’s portfolio of cardiac care and its integrated healthcare solutions.

As a refreshing change from the subdued momentum in 2020, the first couple of 2021 have demonstrated resurgence in overall deal appetite across segments of healthcare. January 2021 was particularly exciting with multiple large transactions being announced (covered in our blog post here). Some of the noteworthy deals include, Steris’s acquisition of Cantel Medical for a deal value worth USD 4.6 Bn. Driven by the intent of portfolio strengthening, the acquisition complements Steris’s portfolio of infection control products and expands Steris’ reach in the dental and endoscopy markets. Boston Scientific announced acquisition of Preventice Solutions Inc. for USD 925 million and an additional USD 300 million as potential payments upon meeting commercial milestones. Preventice offers a well-established portfolio of mobile cardiac monitoring systems along with integrated AI algorithms, including Body Guardians, a set of wearable cardiac monitors for adults and pediatric patients. We are excited about the brewing deal appetite in 2021 and remain hopeful that COVID led uncertainty will soon no more be an impediment to inorganic growth and global expansion.

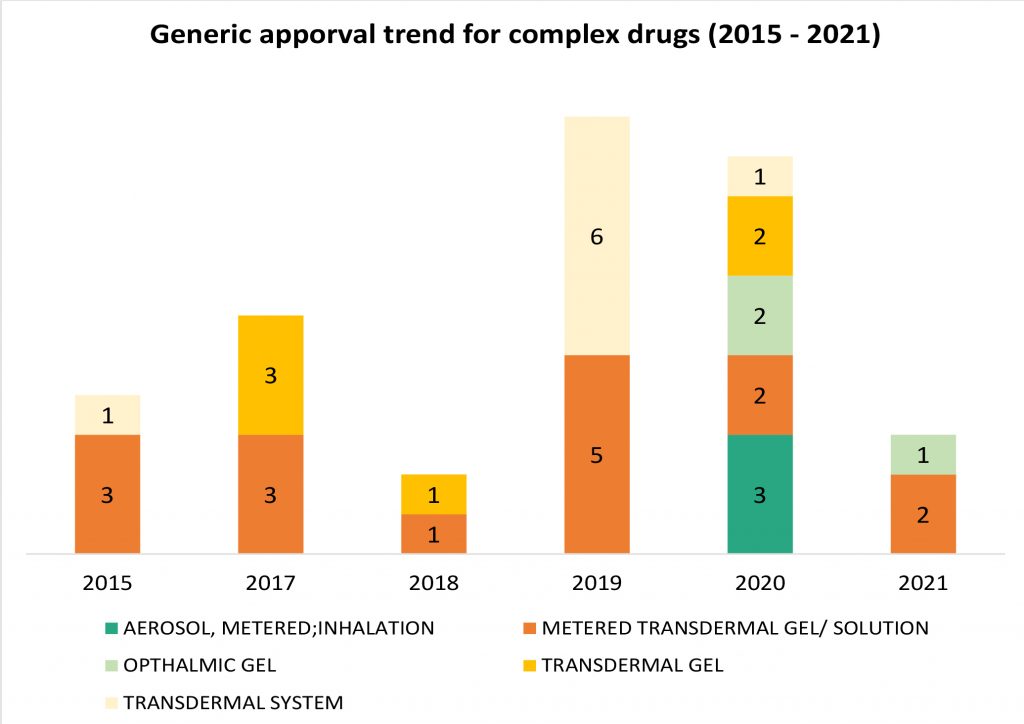

While steep price erosion has moderated, intensity of competition in generic drugs continues unabated. Traditional formulation types such as oral tablets/ capsules or suspension provide that weak competitive ring-fencing to generic players, are more prone to crowding in the market and eventual price erosion. Given this strategic consideration, generic companies continue to dive deeper into complex formulations and route of delivery such as inhalation, ophthalmic, transdermal et al. that have relatively high barrier to entry. Over the past five years, this portfolio investment focus has continued to expand is now reflective in recent product approvals. However, given the higher risk, higher reward profile of these products, product level investments continue to be judiciously stage-gated.

Reflected from the approval trend in 2019 and 2020 in the chart above, it is evident that complex drug generic approvals have increased in 2019 and 2020, with much larger diversity in formulation types pursed in 2020 and the trend continues into 2021 with 3 approvals in the first quarter. For some of the categories such as ophthalmic gel formulation and metered dose inhalers, 2020 was the year that first-time-generics were approved and introduced in the market. The patented reference listed drugs for the same enjoyed a market exclusivity of approximately 15 years, expanding well beyond the usual period of 10-12 years for small molecule drugs.

In inhalation generics, Cipla, Lupin and Perrigo were able to break into the niche category aerosol metered dose inhaler for albuterol sulfate in 2020. In February 2020, Perrigo received the FDA approval for the first generic metered dose inhaler in over twenty years. The generic approval is for Teva’s Proair HFA and the product development was done in collaboration with Catalent. This was followed by Cipla getting an approval for the generic version of Merck’s Proventil HFA in April 2020. Lupin  was the third company to get a generic approval in August 2020, referencing Teva’s Proair HFA. Both Proair HFA and Proventil HFA enjoyed a market exclusivity of more than 15 years, with their NDA approvals being in 2004 and 1996 respectively. With the three generic approvals now, inhalation market for metered dose inhalers for albuterol sulfate is finally an open field, a positive sign for bronchospasm patients. Both drugs have chronic or long-term use and were devoid of price rationalization until now.

was the third company to get a generic approval in August 2020, referencing Teva’s Proair HFA. Both Proair HFA and Proventil HFA enjoyed a market exclusivity of more than 15 years, with their NDA approvals being in 2004 and 1996 respectively. With the three generic approvals now, inhalation market for metered dose inhalers for albuterol sulfate is finally an open field, a positive sign for bronchospasm patients. Both drugs have chronic or long-term use and were devoid of price rationalization until now.

Another indicative example of market opening for complex drugs is that of ophthalmic gels. Ophthalmic gel formulations overcome the limitations of solution formulation that have lower bioavailability, retention time and prone to lacrimal drainage. Gel formulations allow less frequent administration due to a higher corneal retention time and hence, better patient compliance. In Oct 2020, Alembic Pharma received the approval for the first generic variant of Bausch Health’s Timoptic XE® – timolol maleate gel forming solution for glaucoma, the NDA for which was approved in 1993, giving it an exclusivity of more than 20 years. FDA designated the generic approval for Alembic as a Competitive Generic Therapy, meant for drugs with an “inadequate” generic competition, imparting the generic an exclusivity period of 180 days. Another ophthalmic gel drug, Bausch Health’s Lotemax®, initially approved in US in 1998 and indicated for the treatment of postoperative inflammation and pain following ocular surgery saw a generic variant approval for Akorn in 2021. Both drugs have a market value of approximately USD 70 to USD 80 million and are areas with lean competition.

Extend release vaginal inserts and rings are another segment of complex drugs that has a high barrier to entry due to the complex nature of formulation, fewer companies having the capability to execute generic development and bioequivalence qualification. Merck’s Nuvaring, vaginal ring with a combination ethinyl estradiol and etonogestrel indicated as a contraceptive was initially approved in 2001, patents expired in 2018 and the first generic by Amneal was approved in Dec 2019, followed by Teva’s Generic variant in 2021. Glenmark and Dr. Reddy’s are others with a generic version in the pipeline. With only two generics in the market two years after patent expiry, the market still has lean competition. While RoI on future launches may not be comparable to the first entrant (corroborated by Dr Reddy’s impairment charge), pipeline of generics is expected to further expand. Notably, there are yet other hormonal drug products in the form of vaginal inserts that were approved before 2000, have enjoyed market exclusivity for more than 20 years and are still without a generic competitor.

Extend release vaginal inserts and rings are another segment of complex drugs that has a high barrier to entry due to the complex nature of formulation, fewer companies having the capability to execute generic development and bioequivalence qualification. Merck’s Nuvaring, vaginal ring with a combination ethinyl estradiol and etonogestrel indicated as a contraceptive was initially approved in 2001, patents expired in 2018 and the first generic by Amneal was approved in Dec 2019, followed by Teva’s Generic variant in 2021. Glenmark and Dr. Reddy’s are others with a generic version in the pipeline. With only two generics in the market two years after patent expiry, the market still has lean competition. While RoI on future launches may not be comparable to the first entrant (corroborated by Dr Reddy’s impairment charge), pipeline of generics is expected to further expand. Notably, there are yet other hormonal drug products in the form of vaginal inserts that were approved before 2000, have enjoyed market exclusivity for more than 20 years and are still without a generic competitor.

In niche categories of complex formulations the inherent entry barrier limits competition. However, timing of market launch becomes very crucial since the first to enter the market enjoys higher value realization prior to generic competition led price erosion. This consideration coupled with substantially steeper level of development investment per drug results in a risk threshold several orbits higher than traditional generic portfolio investments. Despite this, we anticipate that within the overall expanse of generic launch opportunities, complex formulations will continue to attract relatively higher share of R&D investments and new product launches. We also continue to be engaged in forging wider set of enabling technology partnerships as industry’s investments in this space get deeper. We continue to emphasize the importance of partnerships, timing and judicious decision making in complex generics and foresee diversion of investments from the specialty / 505(b)(2) into deeper nurturing of platform capacity in niche formulations.

Asian and European companies emerge as active biosimilar licensors

With biosimilar markets maturing in most key geographies and rapidly gaining traction amidst regulators and physicians, more Asian and European biosimilar companies have emerged as active licensors and partners in 2020 as compared to all previous years. It is noteworthy that while these relatively young companies have been able to conquer the development challenge for biological molecule and are advancing portfolio assets through clinical development, several of them lack experience to market or commercialize the biosimilar in geographies beyond their home turf. Since timing continues to be of essence for value realization in the biosimilars, strategic marketing alliances have become more important than ever for commercial success.

Some new noteworthy biosimilar licensors in the arena include China-based companies such as Henlius, Bio-Thera. Earlier in 2020, Henlius made news by getting an EMA approval for trastuzumab, making it the first biosimilar coming out of China into the regulated market. Henlius’ strategic commercialization partner for the European and North American markets is Accord Healthcare, a subsidiary of India based Intas Pharmaceuticals. The Indo-China biosimilar partnerships exemplifies the importance of mutually beneficial partnerships for de-risking and maximizing value realization in the biosimilar market. Henlius has also forged a partnership with Essex Bio-Tech, one of the leaders in biologics in China, for the global commercialization of bevacizumab biosimilar indicated for the treatment of wet-Age Related Macular Degeneration (wet-AMD).

Along similar lines, Bio-Thera forged a partnership with Russian Pharmapack for the commercialization of its clinical stage golimumab biosimilar, in Russia and Commonwealth of Independent Nations (CIS) countries.

Further east, several Asian companies are at the forefront of expanding biosimilars market and have been making news in 2020 with their marketing partnerships. Following on the success pathway demonstrated by South Korean companies Celltrion and Samsung, several Asian aspirants have gained lime light in 2020. Singapore-based Prestige Biopharma partnered with Teva for the commercialization of the former’s trastuzumab biosimilar in Israel. Another recent entrant in biosimilars is Chong Kun Dang (CKD) Pharmaceuticals, an established Korean pharma company in small molecules. It made its foray into biosimilars with a darbepoetin alfa biosimilar in 2018 and last year entered a partnership with Lotus Pharmaceuticals to market the same in Taiwan and several Asian markets. CKD’s pipeline focus includes the ranibizumab (Lucentis®) biosimilar.

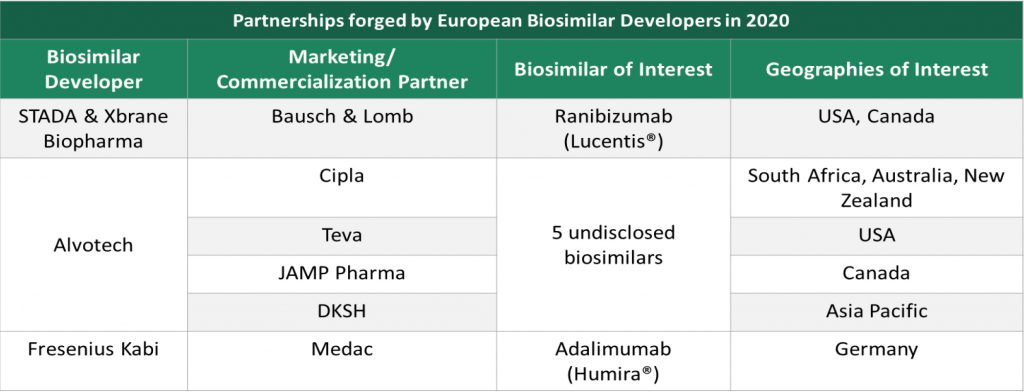

Among European companies, Alvotech, STADA and Xbrane Biopharma emerged as active licensors. Alvotech actively partnered with strategic commercialization partners having market presence in different geographies.

STADA and Xbrane Biopharma are collectively developing a ranibizumab (Lucentis) biosimilar and have granted exclusive commercialization rights to Bausch & Lomb for USA and Canadian markets. Bausch & Lomb carries extensive expertise, market presence and network with eye care professionals in the North American market and the biosimilar makes an excellent addition to their portfolio of ophthalmic products. This marks another example of appetite from innovators to leverage commercial presence to market biosimilars in geographies of focus.

Several of these emerging biosimilar companies are also simultaneously focused on nurturing a pipeline of beyond-2023 biosimilars assets such as ustekinumab, golimumab, denosumab et al. With this renewed investment focus and expanding pipeline, we anticipate expanding biosimilar investments from Asia and Europe; and consequently continued focus on such strategic partnerships.

Newer companies emerging as strategic marketing partners for biosimilar developers

Through 2019 and 2020, there has been a gradual uptake in the adoption of biosimilars in RoW and emerging markets. With biosimilar opportunities materializing in these markets, some new names are at the forefront of facilitating market access for developers as strategic partners. The idiosyncrasies in regulatory and payer landscape, competitive intensity and pace of adoption have to be taken into account while developing the go-to-market strategy for any country. Strategic partners with ingrained geographic strengths in the regulatory – market access continuum are invaluable as regional partners for biosimilar developers. The 2020 partnership landscape also symbolizes entry of several new marketing partners in the biosimilars opportunity across geographic markets.

Through 2019 and 2020, there has been a gradual uptake in the adoption of biosimilars in RoW and emerging markets. With biosimilar opportunities materializing in these markets, some new names are at the forefront of facilitating market access for developers as strategic partners. The idiosyncrasies in regulatory and payer landscape, competitive intensity and pace of adoption have to be taken into account while developing the go-to-market strategy for any country. Strategic partners with ingrained geographic strengths in the regulatory – market access continuum are invaluable as regional partners for biosimilar developers. The 2020 partnership landscape also symbolizes entry of several new marketing partners in the biosimilars opportunity across geographic markets.

Intriguingly, these partnerships have been forged for rather mature product opportunities that were earlier considered commercially saturated. Product interest for such regional partnerships has spanned highly competitive commercial products such as – trastuzumab, bevacizumab, adalimumab et al. We foresee more such emerging market partnerships taking shape albeit with asset focus tilting towards post -2023 biosimilar pipeline.

The pertinent consideration in the context of emerging market biosimilars opportunity, is the criticality of market expansion. Across geographic markets, commercial opportunity scaling up in the RoW aggregated belt hinges on market shaping driving wider adoption in public health markets, clinical education and expanding affordability net organically expanding private markets. India, for instance, has had encouraging inclusion of biosimilars in the Essential Drug Lists of certain states thereby triggering procurement for public health. Expansion of such momentum is much needed for wider drug access for patients and overall market growth.

Early entrants in global biosimilars engaged in value realization of current pipeline and development of post-2023 pipeline

Early entrants in the global biosimilars stage such as Amgen, Sandoz, Pfizer, Samsung, Celltrion and Biocon led the first and the second wave of biosimilars. While they were relative quieter in 2020 on the deal-making and partnership front compared to their emerging counterparts from Asia, they have been entrenched in realizing commercial potential of their biosimilar portfolio. Simultaneously, they have been invested in advancing the post – 2023 pipeline. The third wave of biosimilars also faces a competition from emerging competitors such as Bio-Thera, Henlius et al. who are also prepping for a regulated market filings and advancing into mid-to-late stage clinical trials.

Critical developments during 2020 across biosimilar pioneers includes regulatory approvals, pipeline progress as well as market launch milestones. RoI on biosimilar investments is more tangible than before with regulatory developments being forthcoming and commercial value realization in US being around the anvil. We remain enthused by recent regulatory impetus around transparency with respect to patent-associated information and focus on biosimilar education. If spurred by payor thrust and clinical receptivity, expanded biosimilar adoption in the US market could be an impending reality. Value realizing on the first wave of monoclonal antibody biosimilars will be important for triggering the cycle of investments and restating perceived risk level of biosimilar investments. 2021 will be a pertinent year for value realization; and in turn driving further expansion in industry investments.

Grow Beyond

Grow Beyond