Drug maker Pfizer Inc plans to combine its generic drugs business with Mylan NV in a deal that will reshape the brand name and remodel one of the world’s biggest pharmaceutical companies. This includes Pfizer’s older blockbusters such as EpiPen, Lipitor and Viagra which were parked into a new unit called UpJohn.

Drug maker Pfizer Inc plans to combine its generic drugs business with Mylan NV in a deal that will reshape the brand name and remodel one of the world’s biggest pharmaceutical companies. This includes Pfizer’s older blockbusters such as EpiPen, Lipitor and Viagra which were parked into a new unit called UpJohn.

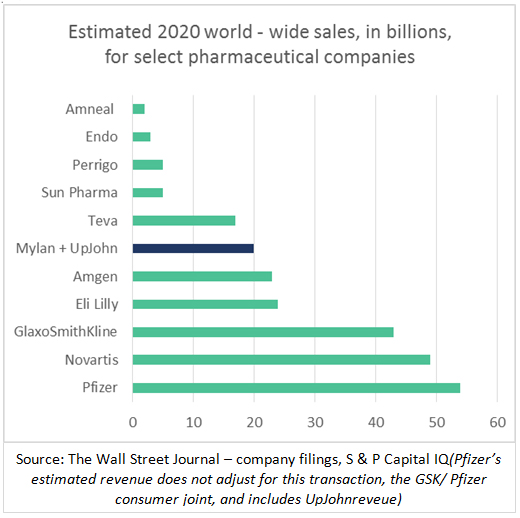

The new company (Mylan + UpJohn), The new company (Mylan + UpJohn), which hasn’t been named yet, is expected to be among the world’s biggest sellers of generic and off-patent medicines with more than $19 billion in yearly sales. Under the terms, shareholders of Pfizer will own 57% of the new company, while Mylan shareholders will own the rest.Mylan brings to the table; combination size, strong pipeline across generics and biosimilars but also the burden of debt. Merits of the deal can only be assessed once portfolio synergy is reviewed in more detail – especially in the area of biosimilars where the merger could imply portfolio overlap. Pfizer, with the Hospira pipeline, and Mylan, with its strong global product specific partnerships have both nurtured strong portfolio of assets, and thus there will be a need for rationalization.

The new company (Mylan + UpJohn), which hasn’t been named yet, is expected to be among the world’s biggest sellers of generic and off-patent medicines with more than $19 billion in yearly sales. Under the terms, shareholders of Pfizer will own 57% of the new company, while Mylan shareholders will own the rest.Mylan brings to the table; combination size, strong pipeline across generics and biosimilars but also the burden of debt. Merits of the deal can only be assessed once portfolio synergy is reviewed in more detail – especially in the area of biosimilars where the merger could imply portfolio overlap. Pfizer, with the Hospira pipeline, and Mylan, with its strong global product specific partnerships have both nurtured strong portfolio of assets, and thus there will be a need for rationalization.

This move is part of a long strategic effort for Pfizer to separate its portfolio into different parts; innovative medicines & vaccines, lower margin generics and consumer healthcare. In the last eight months in his role as chief executive of Pfizer, Albert Bourla has been making moves to reshape Pfizer into a company focused on patent – protected prescription drugs with high potential for sales growth. This strategy was earlier reflected in Pfizer’s plan to combine its division selling Advil, vitamins and other medicine-chest staples with GlaxoSmithKline PLC’s consumer-health business in a joint venture that will eventually be spun off. This spin-off strategy combined with the Mylan merger creates a new, stronger behemoth.

Pharmaceutical companies are becoming more innovative to fuel high priced gene therapy uptake by collaborating with payers and developing new payment & pricing models. With growing Interest in schemes like “pay-for-performance”, “pay-over-time”, and “rebate program based on effectiveness”, in place of merely “paying for pills”, has improved the adoption and affordability of these therapies. These payment and pricing plans have brought hope to patients by not only increasing reachability to these therapies but also reducing financial burden if the therapy does not work in the long run. In this regard it is encouraging to note introduction of gene therapy drug – Zynteglo by Bluebird Bio, for treatment of beta thalassemia. The therapy is priced at EUR 1.5 Mn (US$ 1.76 Mn) in Europe and as per “pay-for-performance” scheme, the total treatment cost can be split up into five instalments of EUR 315,000 over five years. The payments for 2nd to 5th year need to be made only if patient continues to achieve independence from transfusion. The company is currently filing the pricing and reimbursement dossiers across major European countries, and is expected to launch the scheme in Germany followed by UK, France and Italy.

Pharmaceutical companies are becoming more innovative to fuel high priced gene therapy uptake by collaborating with payers and developing new payment & pricing models. With growing Interest in schemes like “pay-for-performance”, “pay-over-time”, and “rebate program based on effectiveness”, in place of merely “paying for pills”, has improved the adoption and affordability of these therapies. These payment and pricing plans have brought hope to patients by not only increasing reachability to these therapies but also reducing financial burden if the therapy does not work in the long run. In this regard it is encouraging to note introduction of gene therapy drug – Zynteglo by Bluebird Bio, for treatment of beta thalassemia. The therapy is priced at EUR 1.5 Mn (US$ 1.76 Mn) in Europe and as per “pay-for-performance” scheme, the total treatment cost can be split up into five instalments of EUR 315,000 over five years. The payments for 2nd to 5th year need to be made only if patient continues to achieve independence from transfusion. The company is currently filing the pricing and reimbursement dossiers across major European countries, and is expected to launch the scheme in Germany followed by UK, France and Italy.

In similar lines, the National Institute for Health and Care Excellence (NICE) has recommended AstraZeneca’s drug, Lynparza at confidential discount through Cancer Drugs Fund (CDF). The drug is used for maintenance treatment of advanced BRCA mutation-positive ovarian cancer after three rounds of chemotherapy. However, to win the coverage, patients will need to apply for CDF approval. This routine NICE recommendation is likely to expand further once clinical trials establish significant efficacy of the drug over placebo. This could in turn would boost revenue for Lynparza,enabling the drug to strike its first blockbuster sales year and strengthening AstraZeneca’s foothold in the oncology market.

The herpes simplex viruses are ubiquitous, host-adapted pathogens that cause a wide variety of disease states and affects billions of people worldwide every year. The World Health Organization (WHO) estimates that HSV – 1 infects 67% of the people below the age of 50, while HSV – 2 infects 11% of people between 15 and 49. Although most oral and genital herpes infections are asymptomatic, the viruses can also cause severe diseases such as recurrent keratitis — that can cause blindness — as well as encephalitis, and systemic disease in neonates and immunocompromised patients. Currently, antiviral drugs, including acyclovir (Zovirax), famciclovir (Amir), and valacyclovir(Valtrex) are some of the treatments approved by the FDA to fight HSV.

The herpes simplex viruses are ubiquitous, host-adapted pathogens that cause a wide variety of disease states and affects billions of people worldwide every year. The World Health Organization (WHO) estimates that HSV – 1 infects 67% of the people below the age of 50, while HSV – 2 infects 11% of people between 15 and 49. Although most oral and genital herpes infections are asymptomatic, the viruses can also cause severe diseases such as recurrent keratitis — that can cause blindness — as well as encephalitis, and systemic disease in neonates and immunocompromised patients. Currently, antiviral drugs, including acyclovir (Zovirax), famciclovir (Amir), and valacyclovir(Valtrex) are some of the treatments approved by the FDA to fight HSV.Companies that have been pursuing the development of a herpes vaccine previously, have had to abandon their pursuit due to unsatisfying therapeutic effects in humans; Vical Incorporated announced in June of 2018 that their clinical trial was unable to meet “its primary endpoint”. In September of 2017, Genocea officials announced that they would be exploring “strategic alternatives” for its herpes vaccine, GEN – 003 and removed it from their pipeline. In the midst of these unsuccessful attempts, a third company’s experiment with their herpes vaccine is in legal hot water due to no apparent safety oversight during clinical trials.

In this field littered with disappointments so far, X – Vax Technology, Inc claims to have found a herpes vaccine, ∆gD-2 that is more promising than previous candidates. This novel vaccine takes on a new approach and kills infected cells – eliciting a different type of immune response against HSV – 1 and 2. The company has raised $56 million in an upsized series A round of financing, with participation from strategic and institutional investors.

Other developments in the field include Gilead Sciences’ plans to license three preclinical antiviral programs from Novartis, including agents with the potential to treat herpes virus. The antiviral deal will see Gilead acquire the exclusive global rights to develop and commercialize novel small molecules, and Novartis will receive an upfront payment and is eligible to receive up to an additional $291 million in potential milestone payments, as well as royalties on annual net sales. The continued interest in the field despite past failures renews hope in a successful herpes vaccine.

In-licensing continues to gain traction in emerging markets, especially in therapeutic areas with high market maturity. This month witnessed one such interesting development in the diabetic segment when Glenmark and Torrent signed a licensing agreement for co-marketing of Remogliflozin in India. Remogliflozin is a patented sodium glucose co-transporter-2 (SGLT2) inhibitor indicated for the treatment of type-2 diabetes in adults. The drug was discovered and developed by Kissei Pharmaceutical Co. Ltd. and later out-licensed to GSK and BHV Pharma, a Glenmark collaborator, for further development. Leveraging its rights gained by collaboration with BHV, Glenmark conducted successful phase III trials for Remogliflozin in India, leading to DCGI approval for the drug’s first global launch in the diabetes capital. The in-licensing trend demonstrates evolution of the appetite beyond marketing partnerships that have been in vogue for patented chronic drugs in India (such as DPP4 inhibitors and insulin) where wider market reach calls for a large sales footprint. Indian companies expanding appetite to invest in earlier stages of product development is a great sign that the ecosystem is evolving to deliver more novel drug options to Indian patients in an affordable and timely manner.

In-licensing continues to gain traction in emerging markets, especially in therapeutic areas with high market maturity. This month witnessed one such interesting development in the diabetic segment when Glenmark and Torrent signed a licensing agreement for co-marketing of Remogliflozin in India. Remogliflozin is a patented sodium glucose co-transporter-2 (SGLT2) inhibitor indicated for the treatment of type-2 diabetes in adults. The drug was discovered and developed by Kissei Pharmaceutical Co. Ltd. and later out-licensed to GSK and BHV Pharma, a Glenmark collaborator, for further development. Leveraging its rights gained by collaboration with BHV, Glenmark conducted successful phase III trials for Remogliflozin in India, leading to DCGI approval for the drug’s first global launch in the diabetes capital. The in-licensing trend demonstrates evolution of the appetite beyond marketing partnerships that have been in vogue for patented chronic drugs in India (such as DPP4 inhibitors and insulin) where wider market reach calls for a large sales footprint. Indian companies expanding appetite to invest in earlier stages of product development is a great sign that the ecosystem is evolving to deliver more novel drug options to Indian patients in an affordable and timely manner.

During the same month, the Sun Pharma’s Chinese partnership demonstrates great momentum in South-South partnerships. The company signed a licensing agreement with China Medical System Holdings Ltd. (CMS) for the development and commercialization of Tildrakizumab in Greater China which includes Mainland China, Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan. The drug is an innovative biologic product and is indicated for the treatment of psoriasis and psoriatic arthritis. Under the terms of the agreement CMS will be responsible for development, regulatory filings and commercialization of the product and will pay Sun Pharma an initial upfront payment, regulatory and sales milestone payments, and royalties on net sales. The initial tenure of the agreement will be for 15 years from the first commercial sale of Tildrakizumab in Greater China and may be extended for additional 3 years under certain conditions. The development is similar to the licensing agreement signed earlier this year by Glenmark and South Korea’s Yuhan Corporation for commercialization of Glenmark’s Ryaltris nasal spray in South Korea. These developments emphasizes a strong focus on partnerships and collaborations as a medium to gain geographic penetration in the Asian markets.

While the Chinese generic market has shown high affinity for innovation access towards western opportunities, it has been highly receptive to Indian generic companies in the recent past, and these deals further strengthen the trend for more South-South partnerships in the coming years.

US – Gaining Momentum in Approvals:

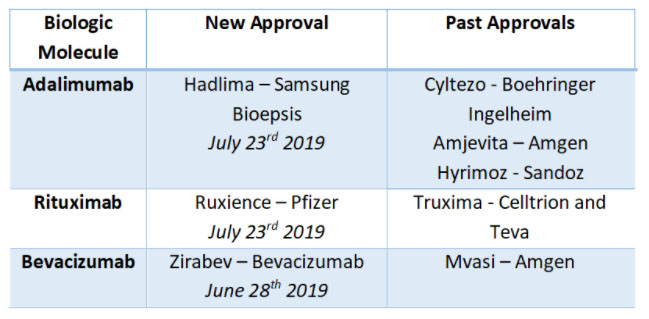

US – Gaining Momentum in Approvals: Biosimilar applications and approvals in the US have increased multifold with biologic patent expiration dates approaching. Approvals for biosimilar medicines for Humira (adalimumab), MabThera (rituximab), Avastin (bevacizumab) among other have been seen in 2018, with the trend continuing into this year. Recently, the FDA has approved Samsung Bioepsis’ biosimilar for adalimumab (Hadlima) and Pfizer’s rituximab biosimilar (Ruxience) and also its bevacizumab biosimilar (Zirabev).

No launch date has been set for the Rituximab or Bevacizumab biosimilars yet as biosimilar delays and innovator commercialization games continue. The Biosimilars Council recently published a white paper, “Failure to Launch,” which found that delayed US entry to biosimilars due to patent abuse by originator has cost $7.6 billion in savings since 2015, assuming that biosimilars had been marketed upon receiving FDA approval. But, the long and excruciating delay in market access is expected to end this year for multiple therapy areas.

China – Strategic Collaborations and JVs:

On the other side of the world, the Chinese market is now warming up and getting attractive after the approval of the first biosimilar. To embrace the Chinese market and bring drugs to one of the largest patient pools in the world, pharmaceutical companies are employing different strategies.So far, Amgen has established a strategic collaboration with Simcere to co-develop and commercialize biosimilars in China. The partnership will focus on inflammation and oncology areas. Samsung Bioepis’ entry strategy is to establish a partnership with 3SBio to expand in China. The deal will combine Samsung Bioepis’ proven development platform with 3SBio’s strong commercialization platform.

More recently, Celltrion has partnered with Nan Fung Group and created a joint venture, Vcell healthcare. The JV will exclusively manufacture and commercialize three of Celltrion’s biosimilar assets (CT – P13 (Remsima), CT – P10 (Truxima) and CT – P6 (Herzuma)) in China. The rise of the Chinese biosimilar market will have a huge impact on the biosimilar regulatory frameworks of the world and will also propel the global market forward.

Other Emerging Markets:

Another evolving development in the biosimilars landscape is the exclusive partnership between Biopharmaceutical company Alvotech and Cipla Gulf for the commercialization of AVT02, an adalimumab biosimilar, in certain emerging markets. According to the agreement, Cipla is going to responsible for registration and commercialization of the biosimilars while Alvotech will be handling development and supply of product. AVT02 is a phase 3 mAb biosimilar to AbbVie’s HUMIRA®, and will be a significant addition to Cipla’s portfolio of offerings in the global biosimilars market. Alvotech will benefit from Cipla’s strong commercial strengths and capabilities.

In recent years, there have been several government initiatives pointing towards development of new drugs in the Asian region. In this context, it is encouraging to note the introduction of “National New Drug Development Research Project” by the Korean Government forthe development of new drugs in the country. The project is a government funded plan to invest 3.5 trillion Won (US$2.9 billion) over 10 years from 2021 to financially support major drug development researches in the country. The project will build on the Korean Drug Development Fund (KDDF), a government-initiated drug development program established in 2011 which was supported with a budget of US$ 1 billion and aimed towards development of at least 10 new global blockbuster drugs by 2020.

In recent years, there have been several government initiatives pointing towards development of new drugs in the Asian region. In this context, it is encouraging to note the introduction of “National New Drug Development Research Project” by the Korean Government forthe development of new drugs in the country. The project is a government funded plan to invest 3.5 trillion Won (US$2.9 billion) over 10 years from 2021 to financially support major drug development researches in the country. The project will build on the Korean Drug Development Fund (KDDF), a government-initiated drug development program established in 2011 which was supported with a budget of US$ 1 billion and aimed towards development of at least 10 new global blockbuster drugs by 2020.

Through this project, the government agency aims to specifically target development of new innovative drugs and plan to cover all major indications except infectious disease and dementia. The program will also support vaccines without conflicting with the Infectious Disease Prevention and Treatment Development Project. However, gene therapy and immune cell therapy products, among other biopharmaceuticals,will be excluded as these are funded by government’s regenerative medicine projects. The project also ambitiously aims to gain a global market share of 6% for South Korea, develop two new drugs that would make it to top-200 drug list, out-license US$10 billion worth of technology assets, and export US$16 billion worth of innovative drugs by 2030.

This development points towards expanding innovation momentum in Asia and high potential for geographic concentration of drug discovery-development evolving substantially in the region over the next decade.

Featured Mandates:

1. Opportunity for licensing and strategic partnership for a recombinant GLP – 1 asset

2. Divestiture of midsize IVD diagnostic company (reagents & POC) in India with robust market footprint and strong product pipeline

Connect with us at lifesciences@sathguru.com to learn more.

Featured publication:

Grow Beyond

Grow Beyond