Rise and Bake: Leveraging Evolution in the Bakery Aisle

The baking industry has long been a major force in forming global culinary cultures, especially in India, where it has enriched communities with a vast array of delightful baked delicacies. Due to changing consumer preferences, advancements in technology and cultural influences, the bakery sector is continuously evolving. In today’s busy bakery aisles, customers are looking for more than just food – they want unique experiences that tickle their taste buds and fit their health-conscious lifestyles. This article explores the bakery industry’s current landscape and latest trends, like the growing interest in healthy eating and the impact of influencer marketing. It also discusses how bakeries are using curiosity to differentiate themselves. In India, bakeries are attracting health-conscious consumers by blending traditional flavours with modern health trends, offering a variety of choices, from classic breads to gluten-free muffins. They are also innovating by using ancient grains like millet and natural sweeteners like jaggery. Eye-catching packaging and digital marketing are making products even more appealing. Modern bakeries are collaborating with health experts and hosting events to build trust and engage with customers. By combining innovation, cultural relevance, and direct customer interaction, bakeries are thriving in India’s dynamic market.

Global Market

The global bakery products market was valued between USD 600-700 billion in the year 2023. The industry is further expected to grow at a CAGR of 6.7% from 2023 to 2028 (MOFPI, 2023). Germany, Canada, Italy, Belgium, and France lead the EU market. While in Asia, China leads the market, followed by Japan, South Korea, India, and Philippines.

Market consumption volume registered at a CAGR of 2.4% and totaled 141 million Metric tons in 2021 (Marketline Bakery & Cereals Global Industry Guide 2013-2022). Germany, France, UK, Italy, Spain are the major bakery consuming countries in Europe Region. USA, Canada and Mexico in North America region, Japan, China, South Korea, and Australia in Asia-pacific region. Many factors are contributing to the increase in consumption such as shifting to healthy lifestyle, expanding population, increasing disposable income, more accessibility, etc. Now-a-days, environmental sustainability is gaining more importance.

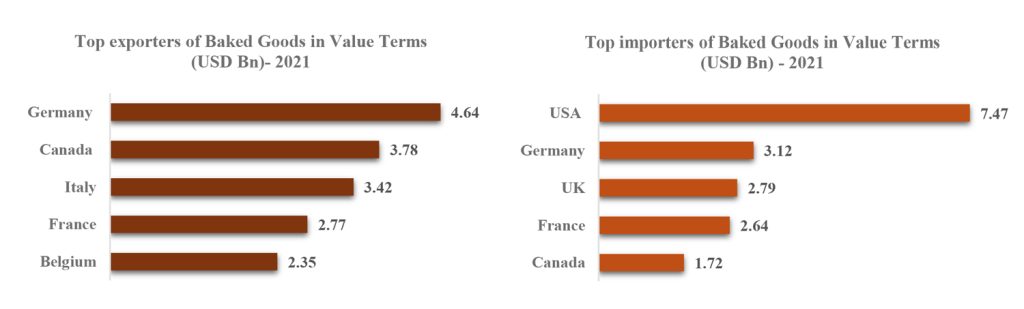

Between 2020 and 2021, exports of baked goods saw a notable 16% growth, rising from USD 37.5 billion to USD 43.5 billion. The European Union emerged as the largest exporter, led by Germany in 2021. Conversely, the United States held the top position for imports, totalling USD 7.47 billion in value. (OEC World Trade,2022 )

Source: OEC World Trade, 2022

Indian Bakery Market

Industry is witnessing significant growth because of changing consumer preferences, evolving lifestyles, and increasing disposable income, which is aided by R&D efforts of companies, government schemes and programs. There is a noticeable trend towards increasing demand for healthier options, premium and artisanal products.

The Indian bakery market size reached USD 11.3 billion in 2022. The Bakery Industry in India is expected to reach USD 21 billion by 2028, exhibiting a growth rate OF 10.8% during 2023-28 (MOFPI, 2023).

Volume consumption of baked goods in India, increased to 6.8 million metric tons in 2021 at a CAGR of 6.8% between 2016 and 2021. The market’s volume is expected to rise to 8.2 million metric tons by the end of 2026, representing a CAGR of 3.8% for the 2021-2026 period (MOFPI, 2023).

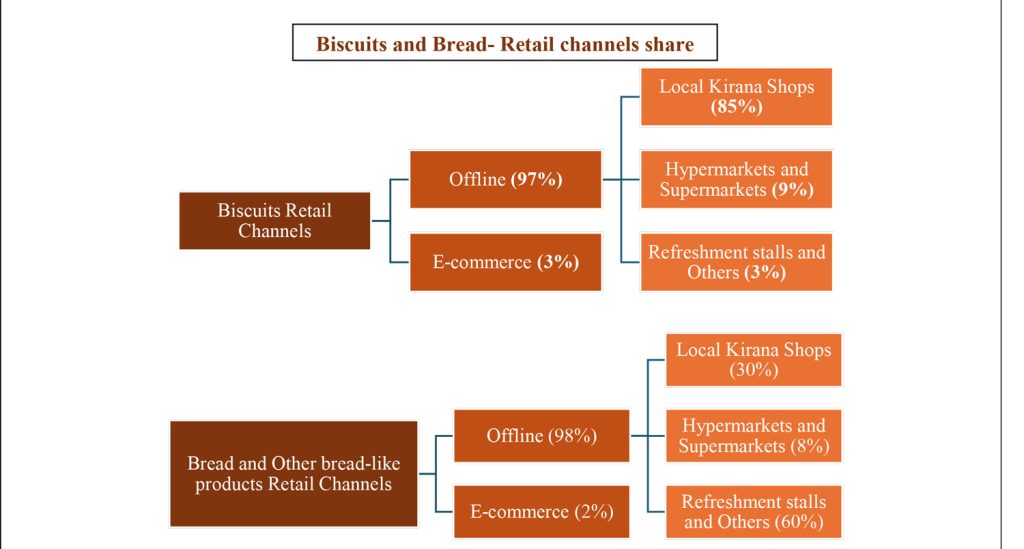

The bakery industry is divided into two categories: the organized sector, which includes 45,000 units registered with FSSAI and the unorganized sector, which includes small-scale businesses. The organised sector in India makes up 60% of the industry. Under the organised retail market, the distribution is dominated by offline channels (97-98%) with local Kirana shops and refreshment stalls having the highest share. E-Commerce has been increasing since the Covid-19 pandemic with major presence in Tier 1 cities. (Source: Euromonitor, 2023)

The companies are spending a lot in R&D and skill development to launch innovative products, it is expected that organised bakery sector will increase by 70% in 2030.

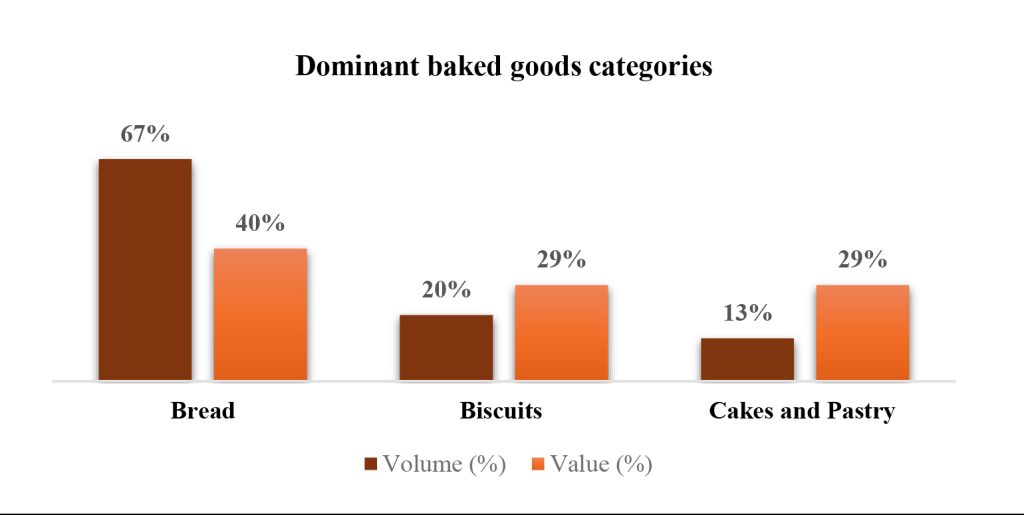

India Bakery Market Segmentation and Players

In baked goods, four major categories are : Biscuits, Bread, Cake, and Bakery pre- mixes. It is estimated that, in terms of volume, Bread commands a lion’s share at 50%, followed closely by Biscuits at 45%, while Cakes and Bakery pre-mixes trail at 4% and 1% respectively. However, when considering value, biscuits emerge as the frontrunner, claiming 71%, with Bread at 19%, Cakes at 8%, and Bakery pre-mixes at 2%. (Source: Euromonitor, 2023)

Despite the market’s fragmentation, large consumer packaged goods manufacturers such as Britannia, ITC, and Parle dominate, collectively capturing approximately 65% of the biscuit market share. Within the bread and bread-like products category, it is estimated that artisanal bakeries seize a notable 40% market share, while Britannia commands 15%, local bakeries secure 25%, and other retail packaged players claim the remaining 20%. (Source: Euromonitor, 2023)

Trends and Drivers

The latest trends and drivers shaping India’s bakery industry across each category include-

- Rising Health Consciousness:

Consumers seek bakery products that blend nutrition with taste as health consciousness is increasing. This trend fosters the growth of health and wellness portfolios within bakeries, reflecting a shift towards mindful eating habits. With consumers prioritizing their well-being, bakeries are capitalizing on this demand by providing healthier alternatives while ensuring deliciousness remains uncompromised. According to WHO, sugar consumption in India has decreased by 2.6 million tonnes between 2020-21 and 2021-22. Amidst rising awareness of sugar’s health impacts, consumers seek bakery items with reduced sugar or alternative sweeteners.Bakeries are responding by offering-

A 2023 Mintel Research indicates that 79% of Indian consumers are motivated to consume sweet bakery products featuring novel flavours, and 30% are interested in flavour combinations. Driven by a desire for novelty, consumers are seeking unconventional flavour experiences, prompting bakeries to explore innovative ingredient combinations. From matcha-infused pastries to savoury-sweet creations and sourdough breads and cookies, diverse flavour offerings captivate adventurous palates. This trend encourages bakeries to push boundaries, embracing experimentation to cater to evolving tastes. By offering unique and unexpected flavour profiles, bakeries not only intrigue curious consumers but also differentiate themselves in a crowded market, fostering a sense of excitement and exploration.

A 2023 Mintel Research indicates that 79% of Indian consumers are motivated to consume sweet bakery products featuring novel flavours, and 30% are interested in flavour combinations. Driven by a desire for novelty, consumers are seeking unconventional flavour experiences, prompting bakeries to explore innovative ingredient combinations. From matcha-infused pastries to savoury-sweet creations and sourdough breads and cookies, diverse flavour offerings captivate adventurous palates. This trend encourages bakeries to push boundaries, embracing experimentation to cater to evolving tastes. By offering unique and unexpected flavour profiles, bakeries not only intrigue curious consumers but also differentiate themselves in a crowded market, fostering a sense of excitement and exploration.

- Single Serve/On-the-Go:

This trend highlights a fundamental paradigm shift in consumer behaviour, marked by an increasing emphasis on convenience, portability, and time efficiency. Several factors drive the increasing demand for single-serve bakery products. Urbanization and evolving lifestyles favour convenient options, while smaller households and busy routines fuel the need for portion-controlled choices. Additionally, e-commerce and digitalization broaden access, offering seamless ordering and delivery. These trends cater to health-conscious consumers and resonate across various demographics, making single-serve bakery items increasingly popular. In response to this demand, many biscuit manufacturers have introduced smaller Stock Keeping Units (SKUs) comprising 2-4 biscuits that can be eaten at once or have implemented individual packaging for each unit. This strategic approach enables consumers to access single biscuits or cookies without compromising the freshness of the remaining products. Bread being a low shelf-life product, manufacturers have also introduced smaller SKUs with 6-8 slices in resealable packaging, this has helped nuclear families and single-living customers to consume the packet within the shelf-life period. - Gifting:

There has been a significant rise in the demand for bakery pre-gift packages with premium packaging in the Urban areas. Though this trend is marked by seasonality, the price range is quite premium. Here, the focus is not on the taste, but on the presentation and packaging of the products. This trend emphasizes on the blend of gourmet flavours with traditional festive bakery. Premiumisation with health-benefit offerings is a major trend that can be seen in the future since consumers have become health-conscious and are willing to pay a premium for a healthy indulgence. This trend is also seen to be growing in the biscuit offerings for children, with cream-filled biscuits having real fruits, whole wheat and millet biscuits, and fortified biscuits. - Bakery pre-Mixes:

The pandemic has given birth to a lot of new trends, and home baking is one of them. Consumers have started baking cakes, breads, and biscuits at home, resulting in a growing demand for pre-mixes. Consumers prefer flavoured mixes, chocolate being the most preferred choice.

Conclusion

In conclusion, the bakery industry is undergoing a significant transformation driven by evolving consumer preferences, technology, and culture. Innovations in ingredients, flavors, and packaging are meeting the demand for healthier options and unique experiences. In India, the government supports innovation and entrepreneurship with schemes such as the Expansion of Food Processing and Preservation Capacities and PM Formalization of Micro Food Processing Enterprises and policy benefits foster growth. Embracing trends like health consciousness and flavor exploration can help bakeries stand out in the competitive market. With strategic development and a commitment to quality, the industry is poised to meet the ever-changing demands of discerning consumers, shaping a bright future.

Authors

Connect with Authors at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond