MOO-ving Forward: Trends, Challenges, and Way Forward for the Indian Dairy Industry

In India, milk holds a special place beyond just a regular food item. It carries profound cultural and historical importance in the lives of the Indian population. The Indian Dairy industry is also a vital part of the country’s economy and a pivotal contributor to the agriculture sector and rural development. The Government initiative Operation Flood (1970-96) contributed significantly, which eventually led to White Revolution. From being a country of acute milk shortage to the world’s largest milk producer, the Indian Dairy industry has come a long way. The Indian Dairy market stood at USD 130 Billion in 2021 and is expected to reach USD 300 Billion by 2027, driven by both volume and value terms (1).

![]() Production, Consumption, and Export of Indian Dairy Products

Production, Consumption, and Export of Indian Dairy Products

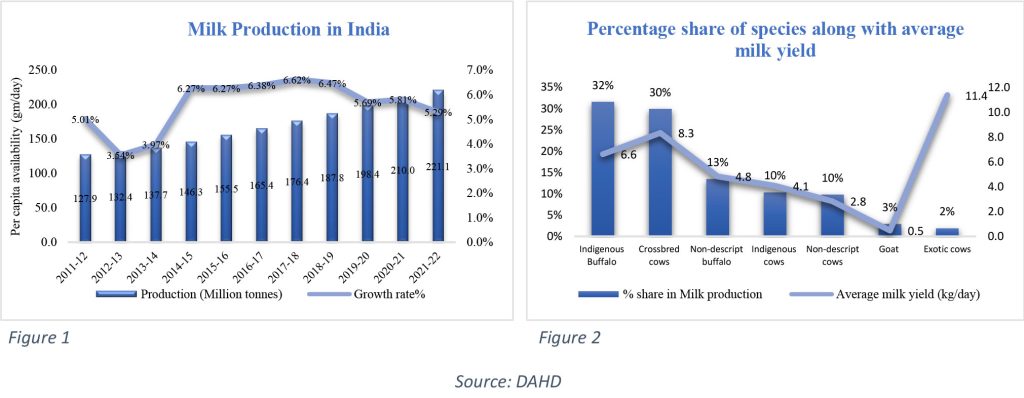

India is the largest milk producer, contributing to a 24% share in global milk production with 221.06 million tonnes of production as of 2021-2022 (2), which has increased by 73% from 2011-12 (Figure 1). The Milk productivity in India is low due to poor quality feed & fodder availability, improper infrastructure, poor healthcare, and disease management. The top 5 milk-producing states, Rajasthan (15%), Uttar Pradesh (15%), Madhya Pradesh (9%), Gujarat (8%), and Andhra Pradesh (7%), contribute to more than 50% of the total milk production in India (3). The dairy farm sector is highly fragmented in India, and two cattle per farm constitute 97% of the entire dairy farms in India. One hundred or more cattle per farm are very few (0.03%) (4).

Consumption of milk is very high in India. Milk and dairy products are considered as a substantial source of protein, calcium, and other essential nutrients, making them an important part of the Indian diet, especially for vegetarians. Most of the milk produced is consumed fresh, and only 35 percent is processed. In the unorganized sector, much of that is converted into traditional products like cheese, ghee, cottage butter, khoya, curd, malai, etc. In three decades (the 1980s, 1990s, and 2000s), the daily milk consumption in the country rose from a low of 107 grams per person in 1970 to 444 grams per person in 2021-22 (5). Five states alone account for over half of the country’s dairy products consumption: Uttar Pradesh (19 percent), Rajasthan (9 percent), Gujarat (8 percent), Maharashtra (7 percent), and Bihar (7 percent) (6). India has experienced a significant change in the previous five to ten years towards consuming value-added goods, including cheese, yogurt, UHT (ultra-heat treatment), milk, flavored milk, and whey. India’s growing organized retail sector is driving the sales of value-added products with 15-20 percent annual growth. About 35–40% of India’s dairy market comprises value-added products, and the remaining 65% comprises commodity products. Additionally, ghee, which accounts for a market share of roughly 15–18% in the dairy industry, is the most extensive product category within the value-added segment (7).

Consumption of milk is very high in India. Milk and dairy products are considered as a substantial source of protein, calcium, and other essential nutrients, making them an important part of the Indian diet, especially for vegetarians. Most of the milk produced is consumed fresh, and only 35 percent is processed. In the unorganized sector, much of that is converted into traditional products like cheese, ghee, cottage butter, khoya, curd, malai, etc. In three decades (the 1980s, 1990s, and 2000s), the daily milk consumption in the country rose from a low of 107 grams per person in 1970 to 444 grams per person in 2021-22 (5). Five states alone account for over half of the country’s dairy products consumption: Uttar Pradesh (19 percent), Rajasthan (9 percent), Gujarat (8 percent), Maharashtra (7 percent), and Bihar (7 percent) (6). India has experienced a significant change in the previous five to ten years towards consuming value-added goods, including cheese, yogurt, UHT (ultra-heat treatment), milk, flavored milk, and whey. India’s growing organized retail sector is driving the sales of value-added products with 15-20 percent annual growth. About 35–40% of India’s dairy market comprises value-added products, and the remaining 65% comprises commodity products. Additionally, ghee, which accounts for a market share of roughly 15–18% in the dairy industry, is the most extensive product category within the value-added segment (7).

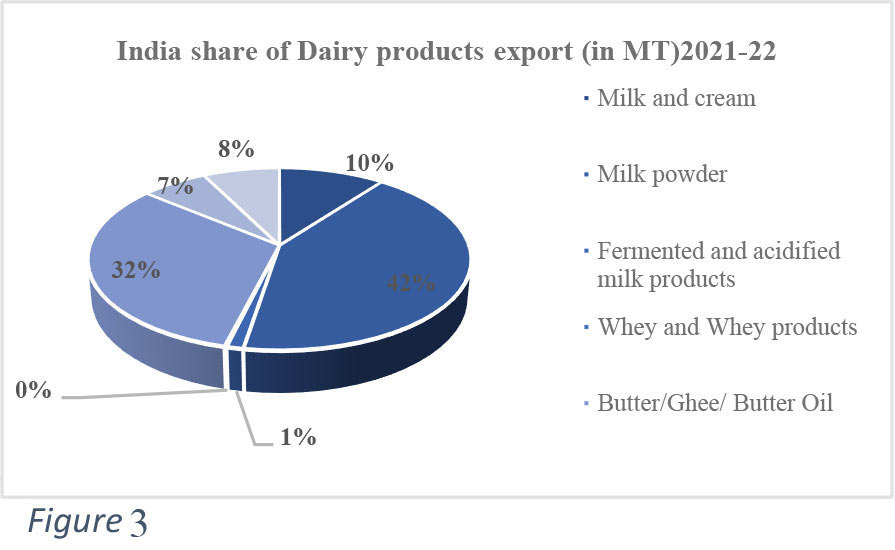

Despite being the top producer, India’s share of milk and  dairy products in global dairy export is less than 1% as compared to other exporters such as Germany (14.4%), New Zealand (12.9%), Belgium (7.6%), Netherlands (6.69%) and France (6.65%) (4). India faces tough competition with other global players regarding sanitary standards and certification difficulties, particularly in developed markets. India’s export markets are predominately in the SAARC countries. Major products exported by India are shown in Figure 3.

dairy products in global dairy export is less than 1% as compared to other exporters such as Germany (14.4%), New Zealand (12.9%), Belgium (7.6%), Netherlands (6.69%) and France (6.65%) (4). India faces tough competition with other global players regarding sanitary standards and certification difficulties, particularly in developed markets. India’s export markets are predominately in the SAARC countries. Major products exported by India are shown in Figure 3.

![]() Challenges Faced by the Indian Dairy Industry

Challenges Faced by the Indian Dairy Industry

The Indian dairy sector faces many challenges, such as:

Low productivity: India’s productivity per animal is very low. The significant reasons are limited availability and affordability of quality feed and fodder, traditional feeding practices, lack of veterinary, limited supply of quality animals, and ineffective cattle and buffalo breeding programs (8).

Production Inefficiency: Inadequate farm management, Inadequate access to finances, lack of affordable technology, and access to information led to low production efficiency in India.

Safety and Quality issues: India faces quality issues due to contaminated water, milk adulteration, use of pesticides, mycotoxins, heavy metals, and veterinary drugs.

![]() Trends in the Indian Dairy Industry

Trends in the Indian Dairy Industry

Consumer preferences are changing nowadays. After Covid-19, consumers have become more health-conscious and are inclined towards a healthy lifestyle. These preferences drive the dairy industry, creating an opportunity for innovative products. Some of the significant changes in consumer preferences dairy industry are:

- Health concerns

- Consumer awareness

- More focus on animal well-being

- Sustainable sourcing

- Veganism

- Convenience

All these preferences have elicited dairy players to innovate heavily in their products and offerings. Some of the primary focus areas of dairy players based on specific parameters are:

New Product Launch: There are several new product launches in the Indian dairy industry based on the source of milk and Nutrition.

New Product Launch: There are several new product launches in the Indian dairy industry based on the source of milk and Nutrition.

a. Source of Milk:

- Camel, Goat, and Yak Milk: The demand for camel, Goat, and Yak milk in India has increased recently. The reasons are – more nutritional benefits, easily digestible, and therapeutic use. These types of milk are comparatively costly, but still, the demand is rising, and that’s why in recent years, some companies have started ventures to cater to this growing demand. Brands like Aadvik are into selling camel and goat milk products only.

- A2 Milk and dairy products: A2 milk is in demand nowadays because of its A2 variant of Beta casein protein. Many ventures are getting into selling only A2 milk products, such as Vita Farms has Gir cows at the farms and sells 100% natural farm fresh A2 milk.

- Plant-based and Animal-free Milk Products: The demand for plant-based milk products is increasing in India due to increasing consumer health awareness, a vegan lifestyle, increased environmental concern, etc. Brands and Startups like Only Earth, Pilk, Sofit, Drupe, etc., are selling different kinds of plant-based milk, such as – Almonds, Soya, Oats, Coconut, and Millet milk.

Animal-free milk cultures animal cells in a laboratory without traditional animal farming. This technology offers an alternative to conventionally produced milk, addressing animal welfare, environmental impact, and sustainability concerns. “Zero cow factory” is the first company in India to manufacture animal-free milk protein and dairy products using bioengineering microbes and Precision Fermentation.

b. Nutrition :

- High Protein, Low-Fat milk and dairy products: As consumers become more health conscious, they want healthy dairy products, high in protein and low in fat. Established dairy players and new ventures are taking this as an opportunity and working towards more product innovation to attract customers. Epigamia is well-established in the Indian market in high-protein, low-fat yogurts.

- Fortification: When milk is processed, it loses vitamins A and D. According to a recent survey of NNMB (National Nutrition Monitoring Bureau) and experts of ICMR, Indians have a high burden of Vitamins A and D deficiencies, and that’s why fortification of milk with these vitamins is needed. Brands like Nestle, Nandini, Mother Dairy, and Britannia sell fortified milk.

- Probiotics: Probiotics are friendly microorganisms that enhance the aroma, texture, and flavor, along with the nutritional value of dairy products. They help in improving the immune system of the body. Major players in this category are Amul, Nestle, Mother Dairy, and Yakult.

Organic Milk: As more consumers prefer organic products, the market for organic milk is expanding. Farmers are adopting organic farming practices and investing in organic milk production. Startups use all measures to be an Organic milk-selling brand, such as no artificial insemination, no use of fertilizers and pesticides for fodder, and no hormone injection.

Organic Milk: As more consumers prefer organic products, the market for organic milk is expanding. Farmers are adopting organic farming practices and investing in organic milk production. Startups use all measures to be an Organic milk-selling brand, such as no artificial insemination, no use of fertilizers and pesticides for fodder, and no hormone injection. Clean Label: As customers demand antibiotics, hormones, and lactose-free milk due to health concerns, demand for clean-labeled dairy products is increasing. Indian population has a significant prevalence of lactose intolerance, providing opportunities for dairy companies to launch lactose-free milk products. Several players are selling lactose-free, antibiotic, and hormone-free milk at a premium.

Clean Label: As customers demand antibiotics, hormones, and lactose-free milk due to health concerns, demand for clean-labeled dairy products is increasing. Indian population has a significant prevalence of lactose intolerance, providing opportunities for dairy companies to launch lactose-free milk products. Several players are selling lactose-free, antibiotic, and hormone-free milk at a premium.-

Traceability: Milk producers and brands in India are increasingly becoming transparent by providing information on their product labels. Dairy companies are implementing traceability systems to allow consumers to track the milk’s journey from farm to shelf.

Traceability: Milk producers and brands in India are increasingly becoming transparent by providing information on their product labels. Dairy companies are implementing traceability systems to allow consumers to track the milk’s journey from farm to shelf.  Packaging: Consumers increasingly prioritize sustainability and seek to make eco-friendly choices. Most brands focus on becoming environmentally sustainable by promoting recycling. Several players are working towards it in the Dairy sector by using recyclable glass bottles and recollecting PET bottles used for supplying milk.

Packaging: Consumers increasingly prioritize sustainability and seek to make eco-friendly choices. Most brands focus on becoming environmentally sustainable by promoting recycling. Several players are working towards it in the Dairy sector by using recyclable glass bottles and recollecting PET bottles used for supplying milk.

Way Forward for Indian Dairy:

India has enormous potential in the dairy sector for more production, innovation, and export. To enhance milk production, India must improve the productivity of animals by focusing more on their health by giving them proper feed and fodder. The Government is taking many steps to improve the genetics of animals to improve productivity and lessen the risk of diseases. The availability and accessibility of credit financing for small dairy farmers must be improved so that they can upgrade farm management procedures and infrastructure. Improvement in technology, digitization, and cold chain management is also required across the value chain. Due to increased consumer awareness and demand for safer and novel products, Dairy companies can focus on innovation and launch value-added products. To increase export, India must create an exportable surplus; for this, the Government must increase production and encourage players to export more dairy products. India must identify more international market opportunities along with the products in emerging categories. India should create awareness and brand traditional Indian dairy products such as Ghee.

References:

- https://www.taas.in/documents/pub-activity-54.pdf

- https://www.ibef.org/news/india-ranks-first-contributes-24-of-global-milk-production-govt-to-ls

- https://www.nddb.coop/information/stats/milkprodstate

- https://www.nddb.coop/sites/default/files/pdfs/baseline/16_Roadmap_&_strategies_to_promote_dairy_products.pdf

- https://pib.gov.in/FeaturesDeatils.aspx?NoteId=151137&ModuleId%20=%202

- https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Dairy%20and%20Products%20Annual_New%20Delhi_India_10-15-2021.pdf

- https://www.careratings.com/upload/NewsFiles/SplAnalysis/Indian%20Dairy%20%20Dairy%20Products%20Industry%20-%20June%202020.pdf

- https://www.fao.org/3/i0588e/I0588E05.htm

Author

Connect with Authors at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond