Adapting to the Appetite Shift: Food Industry Strategies Amid the Rise of GLP-1 Drugs

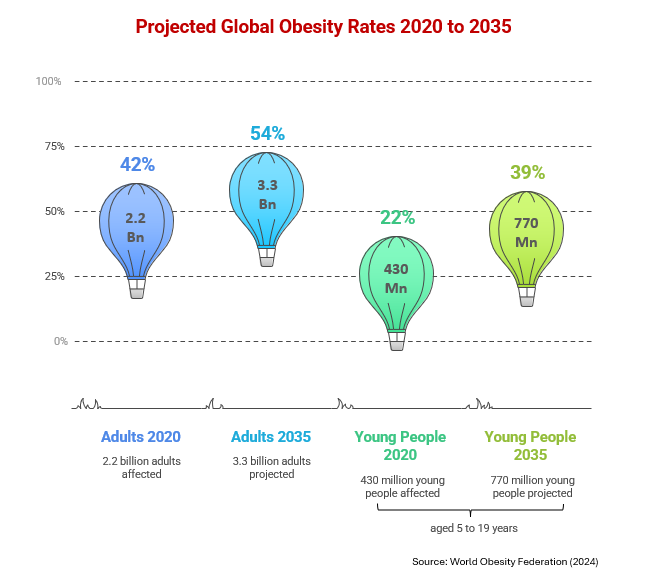

According to the World Obesity Federation (2024), estimates for global levels of obesity (high BMI) suggest that nearly 3.3 billion adults may be affected by 2035, compared with 2.2 billion in 2020. This reflects an increase from 42% of adults in 2020 to over 54% by 2035. For young people aged 5 to 19 years, the figure rises from 22% experiencing high BMI (430 million) to over 39% (770 million) by 2035. This alarming growth in obesity prevalence is intensifying the global demand for weight loss management solutions—ranging from lifestyle interventions and nutritional support to pharmaceutical therapies.

According to the World Obesity Federation (2024), estimates for global levels of obesity (high BMI) suggest that nearly 3.3 billion adults may be affected by 2035, compared with 2.2 billion in 2020. This reflects an increase from 42% of adults in 2020 to over 54% by 2035. For young people aged 5 to 19 years, the figure rises from 22% experiencing high BMI (430 million) to over 39% (770 million) by 2035. This alarming growth in obesity prevalence is intensifying the global demand for weight loss management solutions—ranging from lifestyle interventions and nutritional support to pharmaceutical therapies.

The rising use of GLP-1 drugs like Ozempic, Mounjaro, and Wegovy and the likes across the world —mainly prescribed for type 2 diabetes but widely used for weight loss—is reshaping eating habits and the food industry. These medications reduce appetite and change how people think about food, leading to lower demand for indulgent or unhealthy items.

According to consumer behaviour data from Circana, GLP-1 users are shifting their spending toward healthier groceries such as vegetables, eggs, and nuts, while cutting back on spicy foods, fatty meats, and sugary drinks—items they’re advised to avoid. This trend creates clear opportunities for food and beverage companies to update their product lines to support these changing preferences.

GLP-1 drugs often cause digestive tract side effects, highlighting the need for gut-friendly products that also support weight management. Companies like Unilever are responding by investing in plant-based foods. Unilever aims to earn €1.5 billion ($1.61B) annually from such products and plans to double the number of items containing vegetables and fruits. In an interview in the early 2024, Unilever’s health director, Julie Willems, pointed out that plant-based diets are typically lower in calories and saturated fats, higher in fiber, and can help prevent diseases like type 2 diabetes and heart conditions.

Beyond the drug users, GLP-1—a natural hormone that helps control blood sugar and appetite—is gaining attention. This creates space for products and ingredients that naturally boost GLP-1 levels, offering a nutrition-first approach to weight management. As a result, foods that support GLP-1 naturally are moving into the spotlight—giving brands a chance to align with this growing health-focused demand. Certain nutrients and exercise can naturally enhance GLP-1 secretion in the body. Soluble fiber when fermented into short-chain fatty acids in the colon, promotes GLP-1 release. Unsaturated long-chain fats—like those in olive oil, flaxseed oil (ALA), and fish (DHA)—are more effective at boosting GLP-1 than saturated fats. Additionally, amino acids from protein digestion may trigger GLP-1 receptors, contributing to the protein’s satiating effect.

Strategic Responses from Food & Health Supplement Companies to the GLP-1 Wave

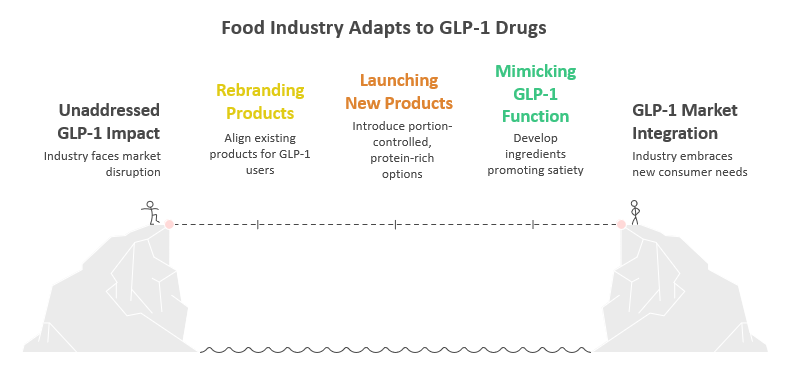

Although still in the early stages, a few key approaches are gaining momentum among food and health supplement companies to manage the buzz of GLP-1 drugs and their impact on the industry:

Approach#1: Rebranding existing products as supportive options for GLP-1 users—this includes gut health solutions to ease gastrointestinal discomfort and supplements designed to fill nutritional gaps that may result from lower food consumption.

Several major players have swiftly adapted their current product portfolios to align with the nutritional needs of GLP-1 users. Herbalife Nutrition took a similar path by bundling its existing nutritional supplements into GLP-1 nutrition companion combos, launched in early 2024, to address potential micronutrient gaps during reduced food intake. Nestlé’s GLP-1 Nutrition platform, launched in June 2024, curates existing nutritional products to support users experiencing appetite suppression and digestive changes. Conagra Brands, starting January 2025, began labeling its 26 Healthy Choice® frozen meals with an ‘On Track’ badge—highlighting higher protein and fiber content and indicating they are ‘GLP-1 Friendly’, allowing consumers to make informed choices within familiar product lines.

Approach#2: Launching new offerings such as portion-controlled, protein-rich snacks and functional foods that cater to GLP-1 users or those transitioning off the drugs while trying to maintain weight loss. These products also aim to address muscle loss often linked to prolonged medication use.

Nestlé has moved beyond rebranding by introducing new product lines designed to meet the emerging functional needs of this consumer base. In late 2024, the company introduced BOOST® Pre-Meal Hunger Support Nutritional Drink, featuring whey protein and promotes body’s natural GLP-1 response. In April 2025, the brand also announced Boost Advanced, leveraging patented whey protein microgel technology to deliver high-quality protein in a ready-to-drink format, with added nutrients supporting muscle preservation, digestive health, and energy metabolism. Additionally, Nestlé’s new Vital Pursuit, a frozen food line targeting GLP-1 users, addresses portion control and nutrient density in convenient meal formats.

Approach#3: Tapping into growing demand for ingredients that mimics the functionality of GLP-1 drugs, which are believed to promote satiety—either by enhancing GLP-1 production or through other pathways. However, some companies may be stretching the scientific claims in their marketing, which could lead to regulatory scrutiny.

Ingredient innovators and food-tech startups are rapidly responding with targeted functional compounds. Nexira’s Carolean, a clean-label, ingredient derived from cactus and carob, supports GLP-1 secretion by achieving peak viscosity within 15 minutes—delivering satiety through delayed gastric emptying and sustained digestive benefits. Hofseth BioCare’s (from The Netherlands) ProGo, a protein hydrolysate from Atlantic salmon, uses a proprietary enzymatic process to produce small peptides that activate GLP-1 receptors. Early studies suggest metabolic advantages, including fat mass reduction and improved blood glucose control. On the other end, NotCo, a Chilean startup backed by Kraft Heinz, announced a botanical powdered GLP-1 booster designed for integration into meals or processed foods. While the full appetite-suppressing effects are still being validated, this innovation signals growing interest in meal-embedded satiety solutions.

Intellectual Property and Clinical Research Trends:

Recent global patent trends reflect the growing interest in GLP-1 across the food space, particularly in boosting GLP-1 secretion, appetite regulation, and diabetes control. Of the nearly 180 food-related GLP-1 patent families filed in last 20 years (since FDA approval of the first GLP-1 drug), around 40% have been published in just the past four years. While pharmaceutical companies are exploring broader applications in food and supplements, most filings focus on formulations using probiotics and amino acid complexes (peptides and polypeptides) to stimulate GLP-1 secretion and receptor activation. A significant share of patents comes from universities and research institutes—especially in South Korea, China, and the US—indicating licensing potential for FMCG players.

From the food industry players, Nestle is protecting innovations in infant nutrition using oligosaccharide complexes and Human Milk Oligosaccharides (HMOs) to enhance GLP-1 secretion and address childhood obesity. Meanwhile, Japan’s Suntory is developing emulsified GLP-1 secretagogues for food and beverages, including combinations with natural sweeteners like stevia and mogroside. Ingredient suppliers such as DuPont, DSM-Firmenich, and Tate & Lyle are also active in this space, working on compositions with polypeptides, enzymes, and protein hydrolysates to support gut health and GLP-1 activity.

The number of clinical trials that are being performed in this area is also drastically increasing. While, the major focus is on the impact of GLP-1 compositions on appetite control, eating patterns, and its glycaemic responses from the premier universities and pharmaceutical companies, there were very few F&B ingredient companies like Roquette Frères and DSM, who were trying to validate the impact of their existing products such as pea proteins and beta-glucans in conjunction with GLP-1 compositions. This leaves an opportunity for the food manufacturers and ingredients suppliers to collaborate with the universities to strengthen their knowledge and enhance their claims on the packaging to make the most of this transition from the consumers.

Recently, U.S. based popular nutrition supplement brand GNC conducted a first-of-its-kind nutritional analysis of GLP-1 users, revealing widespread deficiencies in essential nutrients and protein intake. These findings are shaping evidence-based supplement development and clinical nutrition guidance tailored to the unique needs of this population.

Conclusion:

Conclusion:

The rising influence of GLP-1 drugs is transforming consumer expectations, food choices, and health goals—driving a new wave of innovation across the food and nutrition industry. As appetite control and metabolic health become mainstream concerns, companies must act decisively to reformulate offerings, validate health claims, and align with evolving dietary behaviours focusing on nutrition-first approach to tackle these shifts. Strategic investments in science-backed ingredients, targeted product development, and collaborative research will be critical for brands seeking to stay relevant in this shifting landscape and capture the growing demand for GLP-1-aligned solutions.

Authors

Connect with Authors at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond