Controlled release fertilizer driven sustainable agriculture systems

Fertilizers releasing nutrients in a controlled manner to improve nutrient uptake by a crop are called controlled release fertilizers (CRFs). CRFs are promising solutions for improving the nutrient supply, enhancing crop quality, and yield, and reducing application costs, plant toxicity and environment pollution. Conventional methods of releasing fertilizers not only lead to ~50% fertilizer wastage through seepage to the soil and water but also increases labour costs. CRFs is easier to use and it considerably delays or extends its availability for use after application and uptake by plants. CRFs have the potential to address two key aspects of plant nutrient supply by matching nutrient supply as per plant requirements and ensuring nutrient availability. The CRF products today can considerably shrink total fertilizer use (primarily nitrogen) by 20 – 50%, leaching by ~55%, denitrification and volatilization by up to ~40% each. Majority of the CRF products are related to nitrogen fertilizers, to prevent atmospheric loss of N and resulting environmental emissions. Single application of CRF before sowing can satisfy crop nutrient requirements throughout the season. In addition to cost savings on application and labour, CRF application systems are independent of irrigation systems and need of sophisticated equipment for application.

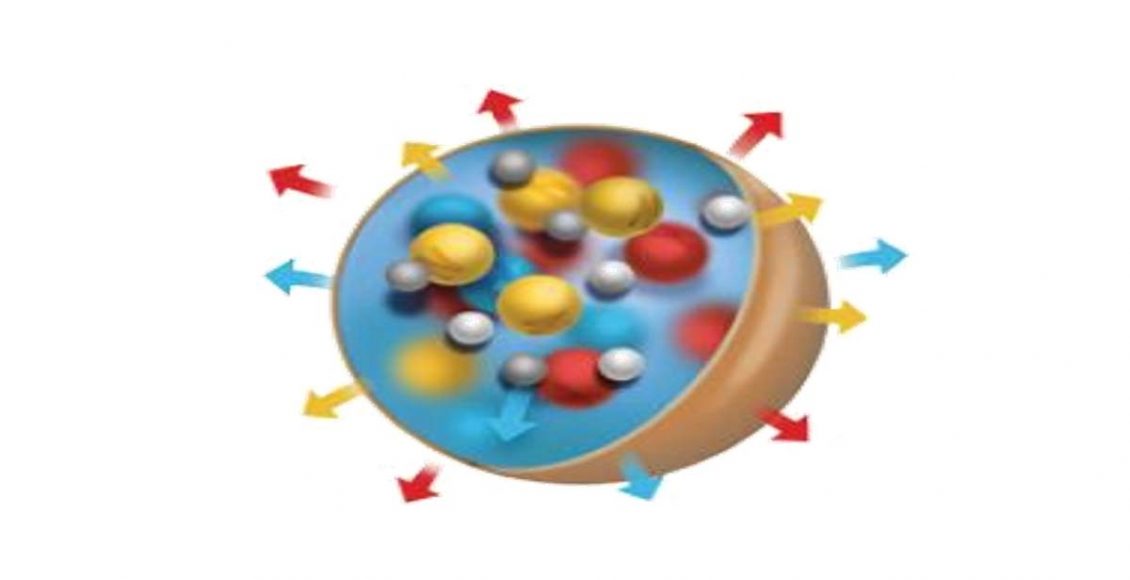

CRFs are granular fertilizers, coated with materials that controls water penetration and enables gradual availability of nutrients to plants. The release process includes water diffusion, nutrient dissolution, and nutrient release. The factors affecting the efficient release process of the nutrients depends on the thickness of the coating, shape, and size of the fertilizer, soil, and air temperature. Fully coated CRF are the most efficient ones in enhancing nitrogen use efficiency (NUE), reducing nutrient losses and environmental pollution.

Technological advancements in the coating materials over the last decade has improved the efficiency of the release process and created more economical products. Primarily bioinhibitors, sulphur and biocomposite based coatings have been used for efficient controlled release systems. Innovations are being made in the nutrient release pattern depending on the changing requirement of crops. Developments through polymer-based coatings/formulations for CRF is a green solution that enable to predict average release rate under ambient temperature and moisture condition. These not only help to alter nitrogen release dynamics but also reduce nitrogen losses caused by volatilization and leaching. Recent trends in the development of CRF include a combination of more than a single method (e.g.: sulphur + polymer). However, the key limitations for CRF’s include lack of flexibility, locked in rate and storage limitations.

Recent advancements in CRF products coated with nanomaterials have proven that these have potential to further boost NUE (as compared to other regular coatings) by improving solubility and dispersion of insoluble nutrients into soil and release nutrients as per plant requirements. The use of nanoparticles in CRF products can further enhance absorption of photosynthetically active radiation, reduce soil absorption and fixation, lower wastage of nutrients and thus increase bioavailability. Researchers and industry players are still working on standardizing formulations of nanomaterials and evaluating efficiency through large scale field and greenhouse evaluations before the industry adopts such products widely. However, the prospect of nano material based CRFs for sustainable cropping and its adequate adoption would depend on effective regulations, novel formulations, and associated risk management (nano toxicity).

With the growing demand of shifting to sustainable agricultural practices, the CRF market is increasing rapidly and is expected to grow at a CAGR of 6.37% globally and reach USD 3.86 billion in 2026 from USD 2.3 billion in 2017. The increased occurrence of nutrient deficient crop diseases is further expected to boost the demand for CRF’s. The increasing investment in research activities and technological advancements through development of affordable and/or low-cost polymer coating for manufacturing encapsulated or coated CRFs is further driving the growth in the industry. The industry has a fragmented landscape of players with large number of companies operating in the developing economies. Nutrien, Yara International, Eurochem Agro Gmbh, Haifa Group, Kingenta International and HIF Tech Marketing Sdn Bhd., among others are the key players in CRF market. Regionally dominant players like SQM, ICL and Pursell are driving innovation standards by development of cost-effective solutions. The industry lately has been witnessing several strategic partnerships between key players such as Kingenta, Haifa Chemicals and Agrium engaged in M&A activities to expand their portfolio. Kingenta acquired 2 speciality fertilizer companies like Ekompany and COMPO GmbH for increased research activities on efficiency enhanced fertilizer. Turf, ornamental, and plantation crops is the leading application segment for CRFs globally.

The key challenges related to wide scale adoption of CRFs is the price gap between CRF and conventional fertilizer products. This has hindered extensive usage of CRF in horticultural and agricultural crops. Large scale production constraints, non-availability in local markets and farmer’s limited understanding about CRFs have further hindered popularization of the segment. Sometimes slower release of nutrients to meet requirements, poor performance owing to improper soil and temperature conditions and presence of harmful chemical in coating material have further stalled wider adoption of these products.

CRFs are yet to make any considerable footprint in Indian fertilizer markets. Even though CRFs are available in the form of coated and encapsulated products, condensation products of aldehydes and urea, slow-release products and N-stabilizers, no major players are dealing with them for use in regular cropping systems of local markets. Local suppliers import CRFs from global giants and market locally primarily for use in ornamental, fruits, and plantation crops. Increasing demand of high efficiency fertilizers suitable for meeting the nutrient requirements and enhancing nutrient uptake are expected to be the key growth drivers for the market. Several studies have indicated that NUE with CRFs in rice fields to be 50 – 100% higher than conventional urea (fertilizer savings of up to 30%) and similar results for vegetable crops.

Leading players are now aiming at building strong supply base and strategic partnerships in large agricultural economies like India, China and Malaysia to boost sales of CRF products. The adoption of CRF products in developing countries have been limited due to lack of major players promoting the product, higher prices, lack of efficient regulatory guidelines for CRF and associated subsidies. However, the growth of CRF products in developing economies is expected to be driven by encouraging government support for boosting adoption of variety of fertilizers to enhance production and ensure food and environmental safety.

Author:

Grow Beyond

Grow Beyond