Packaging 2.0: The Transition Towards Sustainable Primary Packaging in Food Industry

Introduction

The global food packaging landscape is undergoing a defining transformation. Plastic reigned supreme for decades, celebrated for being cheap, lightweight, and adaptable. Yet, what once symbolized convenience has now become a symbol of concern, as its environmental toll grows, impossible to ignore.

In India, where the food and beverage packaging market is worth over USD 38 billion, the shift toward sustainability is no longer a distant ideal; it’s an immediate priority. India generates over 3.4 million tonnes of plastic waste annually, with food packaging as a major contributor. The question is no longer why we need sustainable alternatives, but how fast we can adopt them. From biopolymers and recycled materials to plant-based materials, a new wave of eco-friendly solutions is taking shape, each aiming to strike that elusive balance between performance, food safety, and circularity.

This article explores the evolving landscape of sustainable primary packaging materials — assessing their suitability across food categories, regulatory acceptance, and the pace of adoption among leading industry players driving India’s transition toward a more sustainable packaging ecosystem.

The Push Beyond Plastic

India’s food processing industry is a cornerstone of its economy, but its reliance on single-use plastics contributes significantly to environmental degradation. Plastic packaging pollutes landfills, rivers, and oceans with microplastics. Exploring sustainable packaging materials can address environmental, regulatory, and economic challenges. For instance, producing virgin plastics emits 4–6 kg CO2 per kg (1) adversely impacting the climate and India’s net-zero target by 2070, while sustainable materials like rPET, bagasse, PLA, seaweed, mycelium, etc., can reduce emissions by 20–50%.

Three strong forces are propelling the shift from plastic to sustainable materials:

- Regulatory pressure — India’s Plastic Waste Management (PWM) Rules and FSSAI Packaging Regulations in 2025 enforce stringent measures to reduce single-use plastics and promote sustainable alternatives. The PWM Rules ban many single-use plastic items and require producers, importers, and brand owners to meet recycling targets, register with the Central Pollution Control Board (CPCB), and label plastic packaging with recycled content information. From July 2025, all plastic packaging must include barcodes or QR codes for traceability and accountability.

- Corporate commitments —India’s Extended Producer Responsibility (EPR) regulations hold producers, importers, and brand owners accountable for the lifecycle of plastic packaging, requiring them to manage collection, recycling, and recycled content use. This compels FMCG brands to adopt sustainable packaging designs, reduce plastic waste, and support India’s circular economy goals while adhering to strict environmental and food safety standards

- Consumer awareness — Urban consumers, especially Gen Z and millennials, increasingly seek brands that offer “green” and safe packaging.

Classification of Sustainable Packaging Materials

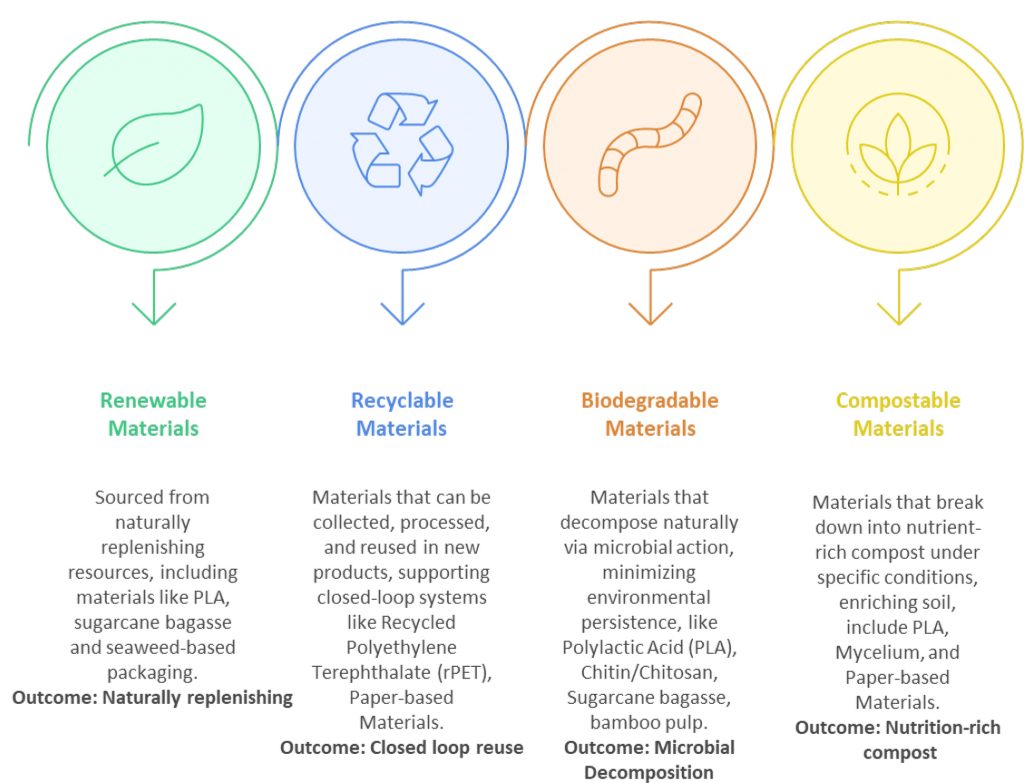

Sustainable packaging materials can be classified based on their sourcing, lifecycle, and end-of-life outcomes into:

Renewable and compostable bioplastics like PLA and PHA, and recycled materials like rPET, are gaining traction and are suitable for primary packaging of foods. Sustainable materials like bagasse, mycelium, and seaweed can serve as secondary packaging in the service and QSR sectors and are not covered here.

- Suitability for food contact material (primary packaging) across product categories

The suitability of packaging materials for food contact application is determined by the specific physicochemical & mechanical properties, and regulations; each tailored to fulfill food safety and performance requirements across diverse product categories. Regulatory compliance is universal, with standards varying across markets (EU, USA, India). A material is allowed for food contact/ primary packaging only after meeting the specific property and validating it through real-world trials and complying with standards.

The physicochemical & mechanical properties and their suitability for different food types and applications is indicated in below table:

| Property | Suitability & Relevance for Food Category | Specification | How It Meets Category Needs |

| Barrier

to migration |

Oils, meats, fatty/acidic foods, Bakery, snacks | Migration < 10 mg/dm² (EU/FDA) | Prevents harmful chemicals or metal migration into sensitive foods, crucial for maintaining long shelf life and safety. |

| Odor/Taste Neutrality | Dairy, beverages, snacks | Migration < 0.1–1 µg/kg for organoleptic substances | Ensures product tastes/aromas are uncompromised—especially critical in dairy and beverages. |

| Inertness

& Safety |

All categories (dry, wet, acidic, fatty) | Proven by simulant migration tests, stable at 40–100°C | Material chemistry must not react with content. |

| Mechanical Strength | Bulk goods, bottles, trays, boxes | Tensile strength > 20 MPa; Impact resistance > 5 J | Withstands stacking, shipping, and consumer handling—avoids rupture, spillage, and spoilage. |

| Flexibility/Rigidity | Pouches (snacks), rigid bottles (beverages) | Elongation at break > 100% (flexible); modulus > 1 GPa (rigid) | Conforms to product shape for flexible packs or protects contents (glass/rigid plastics) from mechanical stress. |

| Thermal Resistance | Ready-meals, frozen foods, dairy | –40°C to +120°C (must withstand process/storage temps) | Remains safe/stable under freezing, retorting, microwaving, or pasteurization; |

| Sealability | Pouches, trays, vacuum packs | Seal strength > 10 N/15mm (watertight/airtight) | Good seals prevent leaks and contamination, which is essential in ready-to-eat foods. |

- Suitability of sustainable alternatives to plastics for primary packaging

| Material | Nature | Property | Usage |

| Polylactic Acid (PLA) | PLA, derived from sugar-based fermentation, is one of the most widely adopted biodegradable polymers for primary food packaging due to its renewable origin, structural integrity, food-contact safety, and compostability. Its biodegradability under industrial composting (<180 days) makes it an eco-conscious replacement for short shelf-life and disposable applications. | A rigid and transparent bio-based polymer with good tensile strength and moderate barrier properties to oxygen (50–100 cc/m²·day) and moisture (100–170 g/m²). Has limited heat resistance, so it is not preferred for hot-fill/microwaveable packaging. | It is ideal for rigid containers and films used in bakery products, snacks, fresh produce, and cold food packages. At a high melting point of 180 °C, PLA offers high optical purity with thermal resistance, and at a low melting point of 155 °C, it is suitable for cold applications |

| Polyhydroxyalkanoates (PHA) | . Produced via microbial fermentation of renewable resources, it is a flexible, tough, and naturally biodegradable polymer exhibiting better heat resistance and elasticity than PLA | Has Good oxygen barrier property (20–30 cc/m²·day) and good moisture control properties (30–70 g/m²·day)

|

PHA films and wraps are suitable for fresh foods, bakery items, and snack packaging where flexibility, transparency, and compostability are desired. PHA can be blended with PLA or other biopolymers to improve mechanical strength and barrier properties |

| Polybutylene Adipate Terephthalate (PBAT) | A fully biodegradable, flexible polymer aliphatic–aliphatic-aromatic, soft, and highly flexible. | Has excellent ductility, toughness with moderate barrier properties to oxygen and moisture. | PBAT blends well with PLA and PHA to enhance flexibility and toughness. It performs well in compostable flexible packaging applications for bakery, fresh produce, and snack food, but is unsuitable for rigid containers and high-temperature uses |

| Recycled PET (rPET) | Recycled PET (rPET) is one of the food industry’s most established sustainable primary packaging materials. Derived from post-consumer PET bottles | Has high rigidity, outstanding mechanical strength, and superior barrier properties to oxygen (0.09–0.12 cc·mm/m²·day) and moisture (3.5–5 g/m²·day), comparable to virgin PET. | It is widely used in beverage bottles, trays, and lidding films for fresh, frozen, and prepared foods that require a long shelf life |

Indian Industry Initiatives towards Sustainable Primary Packaging Material–

The food industry is increasingly adopting sustainable packaging materials like PLA and rPET, primarily due to growing environmental concerns, regulatory pressures, and shifting consumer preferences, providing life cycle benefits.

Balrampur Chini Mills Limited (BCML) is setting up the country’s first fully integrated 100% bio-based PLA biopolymer manufacturing facility with a production capacity of 80,000 tonnes annually, expected to come into operation by the end of 2026. The plant aims to produce food-grade packaging products.

Praj Industries has also established a demonstration plant for biopolymers, including PLA. Their integrated biorefinery approach supports downstream PLA-based food packaging film and trays, aiming to supply FMCG and food processing sectors seeking compostable alternatives.

The adoption of rPET in food packaging has accelerated following regulatory approval by the Food Safety and Standards Authority of India (FSSAI) in March 2025, permitting its use in packaging, storing, and transporting food products under strict safety norms. Companies like UFlex have launched FSSAI-compliant single-pellet rPET resins blending recycled and virgin PET to meet the 30% recycled content mandate for PET bottles by FY26.

Additionally, major beverage companies like Coca-Cola and PepsiCo have increased their use of food-grade rPET bottles. PepsiCo India recently launched the country’s first soda bottle, which was made entirely from 100% recycled PET, for its Pepsi Black product. Similarly, Coca-Cola India introduced rPET bottles for its carbonated beverages and intends to use at least 50% recycled plastic by 2030, demonstrating how Indian industry stakeholders are actively integrating rPET into their supply chains to meet sustainability goals, regulatory mandates, and consumer preferences.Nestlé India has also undertaken major sustainable packaging efforts, aims for 100% recyclable or reusable packaging and has piloted the use of recycled PET in select products.

Besides this Bio composites, made from natural fibers combined with polymers, are increasingly explored for sustainable food packaging due to their renewable sourcing, biodegradability, and potential barrier properties.

Sustainable primary packaging materials redefine how the food industry approaches safety, performance, and environmental responsibility. With innovations spanning biopolymers, recycled plastics, and composites, the focus has shifted from single-use convenience to circularity and renewability. Polylactic Acid (PLA) is rapidly emerging as the most commercially adaptable and cost-effective biopolymer, outpacing PHA and PBAT in adoption due to its regulatory acceptance, processing versatility, and scalability. Meanwhile, recycled PET (rPET) has already achieved strong industry integration, driven by FSSAI approvals and major FMCG adoption, positioning it as a key enabler of India’s circular packaging economy. Together, PLA and rPET are set to define the next phase of sustainable primary packaging transformation in India’s food industry.

References:

- Econ.Sust.3, 475–510 (2023). https://doi.org/10.1007/s43615-022-00192-8

Author

Connect with Authors at: E-mail foodbiz@sathguru.com

Grow Beyond

Grow Beyond