July has been momentous for vaccines: multiple vaccines received regulatory approval or crossed significant development milestones. Merck’s Vaxneuvance (15-valent Pneumococcal Conjugate Vaccine or PCV) received green light by US FDA, followed by GlaxoSmithKline (GSK) receiving approval for Shingrix (Recombinant Zoster Vaccine, Adjuvanted).

Vaxneuvance, a 15-valent pneumococcal conjugate vaccine (PCV) developed by Merck was approved by FDA, after being granted priority review, for prevention of invasive Pneumococcal disease, caused by Streptococcus pneumoniae in individuals 18 years and older. Approval has been backed by results demonstrating safety, tolerability and immunogenicity from seven clinical studies, including phase 2 and 3 trials. The data also demonstrates Vaxneuvance’s superior immune response compared to current market leader, the 13-valent pneumococcal conjugate vaccine (PCV13) from Pfizer, Prevnar 13. Prevnar 13/ Prevenar 13 is the key revenue driver for the Pfizer’s vaccine portfolio, fetching USD 5.8 billion in 2020 and has historically competed with GSK’s Synflorix, 10-valent pneumococcal polysaccharide conjugate vaccine and Merck’s Pneumovax 23. Merck’s Vaxneuvance could supplant conjugate vaccine market leader Pfizer’s position through superior immune protection and could potentially shake up the current PCV vaccine landscape dominated by Pfizer.

The future pipeline across companies looks solid and as of July 2021, Pfizer’s pneumococcal vaccine pipeline entails 3 programs, 2 focused towards pediatric population, one is being studied under Phase 3 clinical trials and other one in Phase 2, third pneumococcal vaccine candidate for adult population entered registration phase in EU. As of May 2021, Merck’s pipeline contains 2 pneumococcal vaccine candidates, V116 for adult cohort, currently in Phase 2 trial and V114, under review in US and EU. Affinivax Inc and Astellas had joined forces in 2017, to develop and commercialize ASP3772, 24 valent pneumococcal vaccine candidate under investigation, which was granted FDA Breakthrough Therapy Designation based on Phase 2 data, released in July 2021.

Harbinger of impending competition with pediatric extension being sought by multiple companies, Pfizer’s Prevnar 13 could be up for intense competition in the near-to-mid-term. Currently, PCV market has been concentrated by pediatric use, being a part of the recommended immunization schedule for infants in several regulated markets and Streptococcus pneumonia infection being largest cause of death among children below five. Pipeline candidates are progressing fast: Merck released immunogenicity and safety endpoints from the pediatric Phase 3 trial of V114, and plans on initiating the submission of supplemental licensure application for pediatric extension by end of current year.

The wave is not leaving LMICs untouched, Serum Institute of India launched Pneumosil, 10 valent PCV, first indigenously developed PCV vaccine in collaboration with PATH and BMGF, and is now the only WHO pre-qualified PCV vaccine from India for procurement by UN agencies and GAVI, accelerating access for global PCV markets. Other Indian vaccine companies are also anticipated to ride on the wave with their dense pipeline, Biological E’s PCV vaccine candidate is currently in Phase 3 clinical trials; Aurobindo Pharma is developing PCV vaccine under a joint venture with Tergene biotech, and the candidate has completed phase 1 and phase 2 clinical studies, phase 3 is planned to begin in early 2021 and to be launched in FY2022. Panacea Biotec, is currently working towards developing 13/15 valent pneumococcal vaccine, historically having developed 10-valent PCV, Nucovac. The pipeline of pediatric vaccines indicate towards an impending shake up of the otherwise dominated market composition and a more distributed market share for PCV vaccines could be on horizon.

Another significant development was GSK bagging expanded use approval from US FDA for Shingrix, in immunocompromised adults of 18 years and older. Shringrix is used for prevention of shingles (herpes zoster) and is a recombinant sub-unit adjuvanted vaccine. The vaccine was first approved by FDA in 2017 for immunization of adults aged 50 years and older and had swiftly eaten away at the share of Merck’s live vaccine Zostavax. GSK’s recombinant vaccine triggered a shift in the market banking on longer duration of protective immunity and higher efficacy – 97.2% vs 51% of Zostavax. In 2020, GSK reported having fetched nearly USD 2.5 billion through Shringrix, and as a key revenue driver, contributed nearly 30% to the vaccine turnover of the company. Merck witnessed a steep decline in sales of Zostavax within the first year of Shingrix launch – from USD 668 million of Zostavax sales in 2017 to 32% of that in 2018 and was eventually discontinued in the US market in July 2020. Introduction of recombinant product however, expanded the overall shingles vaccine market, from sales threshold of USD 668 million of Zostavax in 2017 (prior to Shingrix introduction) to USD 2.5 billion sales of Shingrix in 2020.

The current approval expands eligible pool to include immunocompromised adults 18 years or older. As in the case of adults older than 50, this population cohort is also susceptible to shingles and its associated complications. Immunogenicity and safety was assessed in clinical studies including cohort of patients having undergone autologous hematopoietic stem cell transplants, treatments for hematological malignancies, patients with HIV, solid tumors and renal transplants. In 2020, the vaccine had received European Commission’s nod for prevention of shingles and post-herpetic neuralgia (PHN). The product has been approved in other geographies, including Canada, China, Japan, Australia etc. The expanded coverage approval from FDA supports GSK’s focus on growth in the vaccines segment and maintaining leadership in the shingles vaccine.

While the Shingles vaccine is primarily focused on geriatric and immunocompromised population in high income countries, the other vaccine candidate to make a leap this year has high relevance for several endemic low and middle income countries. Takeda had earlier this year announced commencing regulatory submission for Dengue vaccine candidate in EU and other dengue-endemic countries. European Medicine Agency has accepted filing for TAK-003, dengue vaccine candidate for individuals aged 4 to 60 years. Takeda’s tetravalent dengue vaccine candidate is a live attenuated dengue serotype 2 virus. The company will be filling for regulatory submissions in Argentina, Brazil, Colombia, Indonesia, Malaysia, Mexico, Singapore, Sri Lanka and Thailand in 2021. This vaccine is supported by safety and efficacy data from Phase 3 Tetravalent Immunization against Dengue Efficacy Study (TIDES), which was undertaken for 36 months. This is eagerly awaited given the significant need for prevention of dengue in several endemic countries and the current void in prevention arsenal beyond traditional vector control approaches. Sanofi’s Dengvaxia had been approved by Philippines FDA in 2015, based on studies indicating good safety profile in Asian countries, among children, following which the country government commenced public school immunization program. However, post approval concerns regarding administration in dengue-naïve population were raised and a setback was in order as in 2017, Sanofi confirmed that post-approval long-term data indicated that the vaccine could make future dengue episodes more severe in recipients never previously infected with dengue. Dengvaxia received US FDA approval in 2019, for use in children ages 9 to 16 years with history of previous infection or living in dengue endemic regions.

Pandemic has acted as a catalyst in development of mRNA vaccines with the global recognition of breakthrough impact of mRNA COVID-19 vaccines. At the heel of this success, in July 2021, BioNTech announced plans to develop the first mRNA vaccine for Malaria, indicating initiation of clinical trials by end of 2022. BioNTech is evaluating multiple vaccine candidates for Malaria targets, including circumsporozoite protein (CSP), to develop safe and effective mRNA vaccine providing immunity for prevention of Malaria. The effort is an extension of company’s COVID-19 vaccine efforts, which was co-developed with Pfizer. Akin to dengue, malaria is another highly endemic vector borne disease where an effective vaccine is long awaited. Development of vaccine against malaria was a quest undertaken by GSK, for more than 30 years, in 2015 EMA presented positive opinion on the vaccine candidate. However, efficacy data from Phase 3 trial conducted in 2011 showed mediocre efficacy of only 50% in children aged 5-17 months, for up to a year. A Phase 2 study conducted in 2016, investigated efficacy over 7 year period and reported dismal results: in 5th year of vaccination, the vaccinated cohort was less protected as compared to the cohort having received placebo. Malaria Vaccine Implementation Program, an ongoing large scale program by WHO, will be vaccinating 360,000 children per year from 2019 to 2023 with GSK’s vaccine and will be studying safety and reduction in mortality. In addition to addressing the unmet need in malaria vaccines, BioNTech has also committed to addressing the void in the vaccine manufacturing capacity in the African continent. BioNTech is exploring opportunities to set up African mRNA manufacturing facilities leveraging partners or by self. This is being explored in collaboration with the WHO and the African CDC. The project will fall under ‘eradicateMalaria’ initiative, being led by non-profit public benefit foundation, the kENUP Foundation.

The COVID-19 pandemic has been a global reminder of the need to strengthen and intensify our vaccine development and preparedness globally. The month’s developments emphasize pharma companies’ continued focus on vaccines and bring a stray of much needed hope during the ongoing pandemic.

COVID-19 vaccination is critical to power economic recovery globally and avert severity of the rightfully feared third wave. While it is encouraging to note that developed nations such as USA, UK, Canada, Germany, France etc. have been able to vaccinate close to half of their populations, majority of low and middle income countries (LMICs) continue to pursue all possible avenues for much needed supply of vaccines. The glaring divide in access to vaccines sets back global hope of end to the pandemic. The unmet demand for COVID-19 vaccines has fueled greater momentum towards emerging market focused partnerships and capacity creation for expanded access to COVID-19 vaccines and therapeutics:

COVID-19 vaccination is critical to power economic recovery globally and avert severity of the rightfully feared third wave. While it is encouraging to note that developed nations such as USA, UK, Canada, Germany, France etc. have been able to vaccinate close to half of their populations, majority of low and middle income countries (LMICs) continue to pursue all possible avenues for much needed supply of vaccines. The glaring divide in access to vaccines sets back global hope of end to the pandemic. The unmet demand for COVID-19 vaccines has fueled greater momentum towards emerging market focused partnerships and capacity creation for expanded access to COVID-19 vaccines and therapeutics:

India-based pharmaceutical firm Cipla was granted the import license for restricted emergency use of Moderna’s mRNA vaccine. The vaccine is being donated from Moderna to India as part of WHO and GAVI’s COVAX initiative and the import and supply will be facilitated via Cipla. An accelerated authorization was granted to the vaccine since it has been granted an Emergency Use Authorization (EUA) by the US FDA and WHO. In May 2021, Dr. Reddy’s also launched Sputnik-V vaccine under a collaboration with the Russia Direct Investment Fund (RDIF) to import and supply 250 million doses of the vaccine to India. RDIF has also partnered with multiple other companies in India – including Serum Institute of India, Hetero Biopharma, Gland Pharma, Panacea Biotec, Shilpa Medicare, Stelis Biopharma, Morepen Labs and Virchow Biotech to contract-manufacture about a billion doses of Sputnik V in India. At a time when India is ramping up vaccination campaigns across the country and the potential threat of a third wave lingering, manufacturing partnerships that can fill the supply gap in a short time-frame become critical. India’s Aurobindo Pharma had announced a partnership with US based Vaxxinity (earlier named COVAXX) for UB-612, a peptide based COVID-19 vaccine. Aurobindo Pharma has exclusive rights to develop and market the vaccine in India and to certain UNICEF markets and non-exclusive rights for certain other emerging markets. In late June, Aurobindo obtained regulatory approval in India to commence a Phase II/III trial in the country for UB-612.

South Africa has also been scaling-up vaccine manufacturing, more specifically fill-finish of vaccines which is the final step in vaccine manufacturing. Recently, Pfizer and BioNTech announced collaboration with Biovac, South-African bio-pharmaceutical company to perform fill-finish of its vaccine for supply within the African Union. As part of the agreement, Biovac will obtain the vaccine product from Europe and perform the final fill-finish at its newly modified plant in South Africa. The company expects to begin manufacturing by the second half of 2022 and gradually increase production to a peak 100 million doses per year by early 2023. Being an mRNA vaccine, the Pfizer-BioNTech COVID-19 Vaccine would require sophisticated manufacturing technology and expertise, not feasible to be established at a new location such as South Africa in a short time-frame. Like vaccine manufacturing, vaccine fill-finish capacity is also limited worldwide and competes with other biological products. Thus, creating regional fill-finish capacities that can act as distribution nodes to nearby locations can help enhance regional operational capacity that is critical in the context of current supply void.

In an effort to support availability and access of vaccines in the African Union, the International Finance Corporation (IFC), the French Development institution Proparco, DEG – the German development finance institution, and the U.S. International Development Finance Corporation (DFC) have announced a joint funding of USD 708 million to Aspen Pharmaceuticals to expand the production of J&J’s vaccine in its Gqeberha plant in Africa. Aspen and J&J entered into an agreement in November 2020, to perform formulation and fill-finish of its vaccine for distribution in the African Union. Aspen was importing the active ingredient for the vaccine formulation from Emergent Biosolutions, Baltimore USA but due to reports of contamination, a lot of 2 million doses had to be discarded. Aspen will now import the active ingredient for the vaccine from Europe and perform formulation and fill-finish at its plant.

Beyond vaccines, industry is also focused on improving availability of monoclonal antibody treatments for COVID-19 in emerging markets. To this end, India-based Biocon Biologics has partnered with US-based Adagio Therapeutics for an exclusive license to manufacture and commercialize an antibody treatment in India and select other emerging markets. ADG20 has exhibited neutralizing activity against SARS-CoV-2 and all known variants and has shown to provide rapid and durable protection up to 1 year. It is currently being evaluated in two separate Phase 2/3 global clinical trials – the STAMP trial is evaluating ADG20 as a treatment for non-hospitalized COVID-19 patients and the EVADE trial as a preventive aid for COVID-19. As part of the agreement, Biocon will have access to the clinical data generated to support the regulatory submissions and seek approval or emergency authorization in India and other select emerging markets.

The delta variant continues to drive the next wave of surge in cases across global regions. Vaccination remains the strongest source of hope for us to ride out of the pandemic. In the context of the glaring access gaps, manufacturing partnerships and capacity creation initiatives will remain importunate for both for vaccine and therapeutics. While the pathway to widespread LMIC access within calendar year 2020 still remains hazy, we remain optimistic given the global momentum and energized efforts across stakeholders to bridge the access gap.

The pandemic has been a stark reminder of the continued threat of communicable diseases and need for greater depth in anti-infective drug discovery investments. This remains true in the context of looming treat of anti-microbial resistance as well as high level of unmet need across several neglected infectious disease. The progressively declining appetite for anti-infective investments by venture capital funds as well as industry has been a cause of continued concern. In this context, July has brought a whiff of relief with significant regulatory milestones.

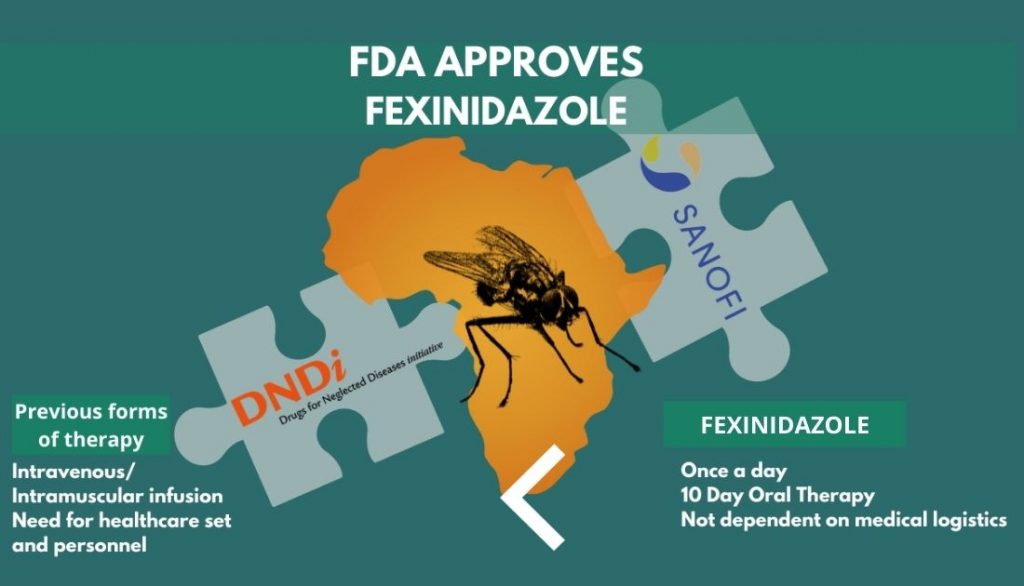

Fexinidazole for sleeping sickness: Addressing a critical clinical unmet need, the US FDA awarded a tropical disease priority review voucher (PRV) alongside the approval of Sanofi’s fexinidazole for the treatment of sleeping sickness. Sleeping sickness is a parasitic disease, also called African trypanosomiasis, caused by the Trypanosoma brucei bug and transmitted by the tse-tse fly. Sleeping sickness, endemic to the Sub- Saharan Region in Africa, leaves 65 million people at-risk of the infection which can be fatal if left untreated. This approval is a key milestone since it has a high unmet need in tropical regions and also it is the first compound whose development was steered by Drugs for Neglected Diseases initiative (DNDi) with a corporate partner, right from its discovery into clinical development.

Fexinidazole is also the first oral 10-day treatment for sleeping sickness, highly useful in regions with poor medical logistics, increasing the accessibility of treatment manifold. It works for both the first stage of the disease, as well as the second stage when the parasites have crossed the blood-brain barrier. The second stage often causing patients to suffer from neuropsychiatric symptoms. Prior to approval of fexinidazole, sleeping sickness was treated through intramuscular or intravenous injections of pentamidine or eflornithine, respectively, these treatment methods require a medical health infrastructure and personnel which is generally tough to find in remote regions of the endemic regions. The current FDA approval was preceded by the drug’s EMA approval in 2018.

Fexinidazole is also the first oral 10-day treatment for sleeping sickness, highly useful in regions with poor medical logistics, increasing the accessibility of treatment manifold. It works for both the first stage of the disease, as well as the second stage when the parasites have crossed the blood-brain barrier. The second stage often causing patients to suffer from neuropsychiatric symptoms. Prior to approval of fexinidazole, sleeping sickness was treated through intramuscular or intravenous injections of pentamidine or eflornithine, respectively, these treatment methods require a medical health infrastructure and personnel which is generally tough to find in remote regions of the endemic regions. The current FDA approval was preceded by the drug’s EMA approval in 2018.

The quest for a new drug to treat African trypanosomiasis began in 2005, through the collaboration of DNDi and the Swiss Tropical and Public Health Institute, Fexinidazole previously shelved by Hoechst (now Sanofi) in the 1980s, was rediscovered through an extensive mining exercise. Post the completion of preclinical trials, DNDi and Sanofi, in 2009, embarked on the path to develop, manufacture and distribute fexinidazole together with the initiation of Phase I clinical trials. By 2012 clinical trials for Phase II/III commenced in Democratic Republic of Congo and the Central African Republic. Fexinidazole, in 2018 was recommended by CHMP, EMA’s human medicines committee. Philanthropic funding for the USD 62.5 million campaign was supported by seven European countries and the Bill and Melinda Gates Foundation.

WHO and Sanofi have been partners since 2001, to aid in screening, control and treatment of sleeping sickness. In 2020, they renewed their partnership to eliminate the disease by 2030 and Sanofi committed to provide free access of the drug to WHO. The Switzerland-based non-profit organisation, Drugs for Neglected Diseases initiative (DNDi), conducted the pivotal clinical in partnership with the National Sleeping Sickness Programs of the Democratic Republic of Congo, Central African Republic, and Sanofi, involving 749 patients.

The approval also earned DNDi a Priority Review Voucher (PRV). The FDA Tropical Disease PRV Program was established in 2007 and incentivizes development of new drugs for neglected tropical diseases including sleeping sickness. The PRV can be used by the holder for a priority review by the FDA within 6 months. There have been several precedents of PRVs being bought by pharma companies and value realized by sellers has scaled USD 100 million in several cases. Sanofi and DNDi will share any benefits or monetization proceeds from the PRV to enable continued investments in innovation for sleeping sickness and other neglected diseases. The FDA approval milestone and Sanofi – DNDi’s commitment to share the proceeds of the PRV are testimony to impact of incentivization programs for neglected diseases.

Another significant development in the neglected diseases was the launch of Hepatitis C PACT (Partnership for Control and Treatment), a public health partnership between Drugs for Neglected Diseases initiative (DNDi), Médecins Sans Frontières (MSF), Foundation for Innovative New Diagnostics (FIND), the global alliance for diagnostics, and the Treatment Action Group, to tackle disparities in access of diagnostics and treatment for Hepatitis C in low-and-middle income countries (LMICs).

Paediatric extension for Dalvance: Another milestone approval by the FDA was expansion of Dalvance to paediatric patients aged as young as new-borns. This label expansion makes Dalvance the first single-dose 30-minute intravenous administered therapy for acute bacterial skin and skin structure infections (ABSSSI) by susceptible Gram-positive bacteria in children, including infections caused by methicillin-resistant Staphylococcus aureus (MRSA). The paediatric approval comes after 7 years of Dalvance’s approval for adults. It sets Dalvance competitively ahead of Mellinta’s Kimyrsa, recently approved in March, an updated version of the 3-hour infusion drug, Orbactiv. Though Kimyrsa, reduced the infusion time from three to one hour, Dalvance’s 30-minute infusion time and paediatric approval gives it competitive edge in the highly underserved market for antibiotics for resistant critical care infections.

The approvals provide hope that cross-stakeholder collaboration can continue to spur innovation, funding and finally new drug access of unmet clinical needs in anti-infectives. Incentive mechanisms such as the PRC emphasize potential for creative incentives to trigger deeper industry engagement in rare diseases and anti-infectives. Together, we hope all these levers translate to wider industry and investor appetite as well as commercial value realization for anti-infectives.

Grow Beyond

Grow Beyond